After you’ve put in the work to identify a potential trade, you still need to wait for a signal to trigger your position. But, it simply isn’t possible to watch a stock at all hours of the trading day, let alone to watch multiple stocks so closely.

That’s where the Scanz Notifications module comes in. With this tool, you can create custom alerts that will let you know when a specific stock reaches a specific price or trading volume. That way, you can focus on developing new trade ideas or researching other companies, without worrying that you’ll miss the big move you’ve been waiting for.

To help you put the Scanz Notifications module to work, we’ll cover six useful ways you can create stock alerts.

Notifications Depend on Your Research

For all of the notifications we’ll cover, it’s important that you’ve put in some research into a specific stock first. You should have a strong idea of where a stock’s support and resistance levels are, what its average trading volume is, and what price movements you’d like to see to trigger opening or closing a position. Whenever using the Notifications module, it’s a good idea to have a chart open for the stock you’re creating an alert for so that the relevant data is readily accessible.

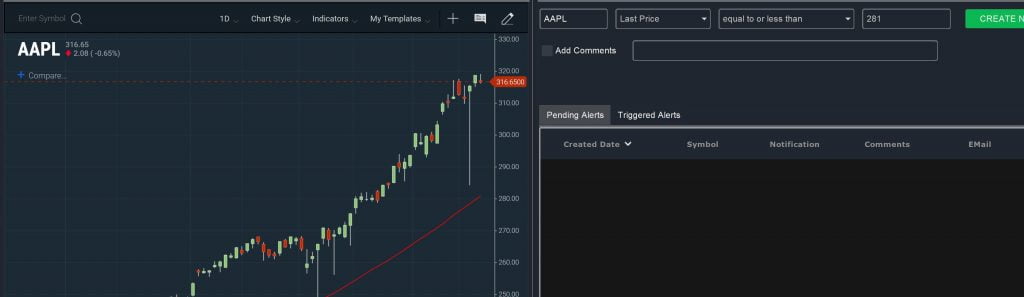

1. Crossing a Moving Average

Moving averages often represent levels of support or resistance. When a stock’s price crosses its moving average, it may represent the beginning of a larger movement. This is especially true for stocks that have shorter-term moving averages stacked on top of (bullish) or beneath (bearish) longer-term moving averages.

Given that moving averages are easily identifiable on a technical chart, they’re perfect targets for setting price alerts. You can get the moving average for a particular stock from its chart or from the Easy Scanner or Pro Scanner modules. If the price is below the moving average of interest, your notification should trigger if the Last Price is equal to or greater than the current moving average. If the price is above the moving average, set the notification to trigger when the Last Price is equal to or less than the moving average.

Keep in mind that moving averages change over time, especially if you’re trading on timescales greater than a week. So, you may need to refresh these notifications once a week or so to keep the moving averages current.

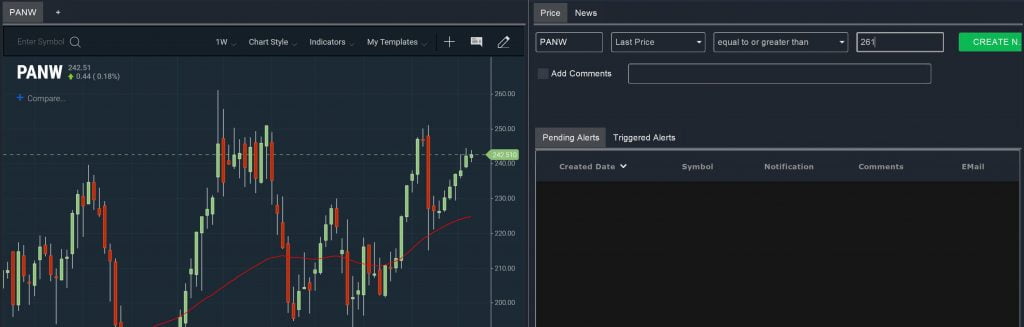

2. New 52-Week High or Low

Additional support or resistance levels that can be useful in identifying potentially large price movements are the 52-week high and low for a stock. If a stock rises above its 52-week high or falls below its 52-week low, it may be a bullish or bearish sign. Alternatively, this may be the beginning of a reversal.

No matter what the outcome, it’s a good idea to monitor when a stock you’re interested in is hitting new 52-week highs or lows. You’ll use the Last Price to create your notification, triggering an alert when it is equal to or greater than the 52-week high or equal to or less than the 52-week low.

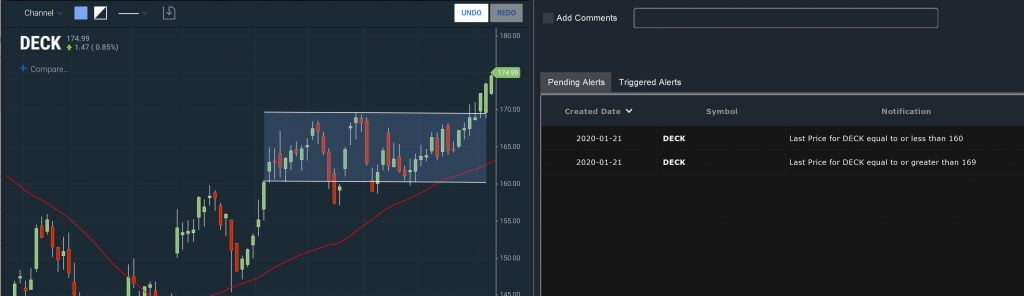

3. Reaching a Target Price Level

More generally, you can set notifications to keep an eye on technical patterns that you’ve identified in a chart. For example, if you identify a stock that is moving inside a channel, you can create alerts that will notify you when the price breaks above or below the channel boundaries. This can be very useful for slow-developing patterns that precede large price movements.

Alternatively, you can set price notifications to alert you when a stock that you have an open position on has reached its price target. This is a good alternative to setting a limit order in cases where you may want to reevaluate your price target before selling.

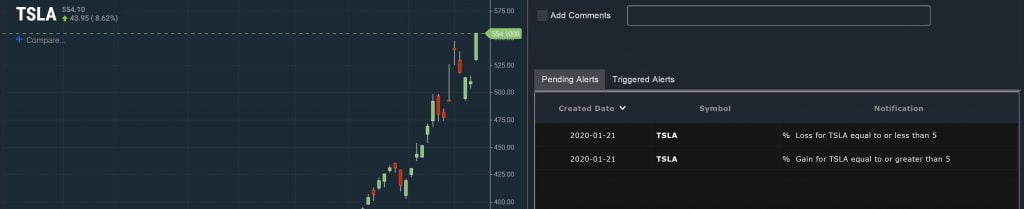

4. Large Intraday Swings

You can also use the Notifications module to be alerted when a stock you’re following experiences high intraday volatility. Large intraday price changes may be a sign of a changing trading pattern, a response to market news, or a sign of volatility to come.

It’s simple to spot these large intraday price swings by using the % Gain or % Loss parameters to create notifications. For example, you can receive an alert when the % Gain is equal to or greater than 5% or when the % Loss is equal to or less than 5%.

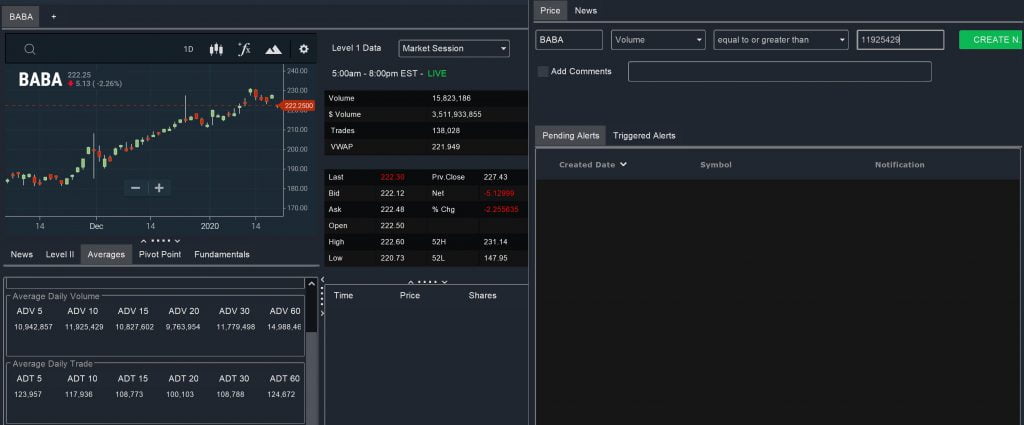

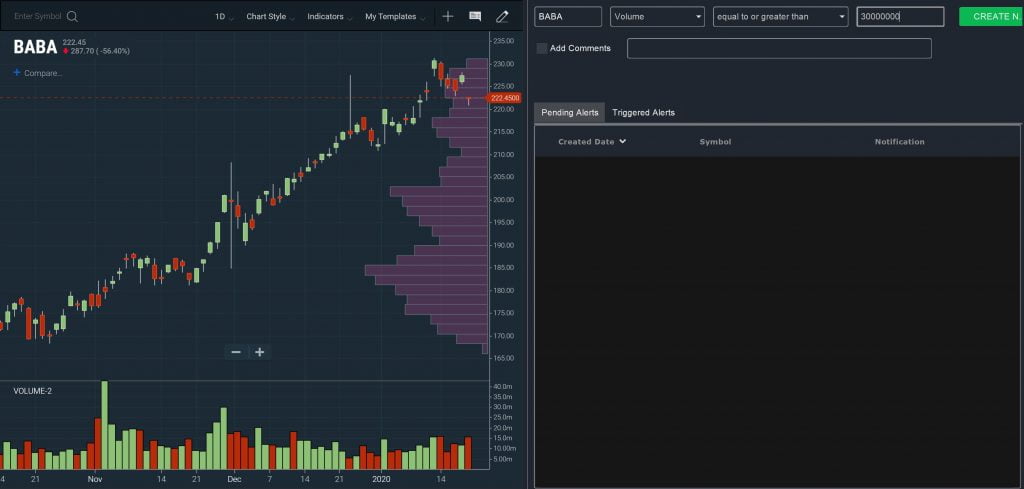

5. Higher than Average Volume

Unusually high trading volume can be a good sign that a stock is picking up momentum or that a big price movement is being supported by the market. When monitoring a stock’s volume with notifications, you have a few different parameters available – including number of daily trades and dollar-volume. Most of the time, though, you’ll want to stick with looking at total trading volume since you’re looking at a single stock rather than across the market.

In this case, you can use the average daily volume to guide your notification level. For example, you may create an alert that triggers when the current volume exceeds the 10-day average daily volume.

However, this is likely to trigger overly frequently – the volume should be greater than average nearly half the time. An alternative method for setting a volume alert is when the trading volume exceeds the highest volume seen over a set period, such as 10 days or one month.

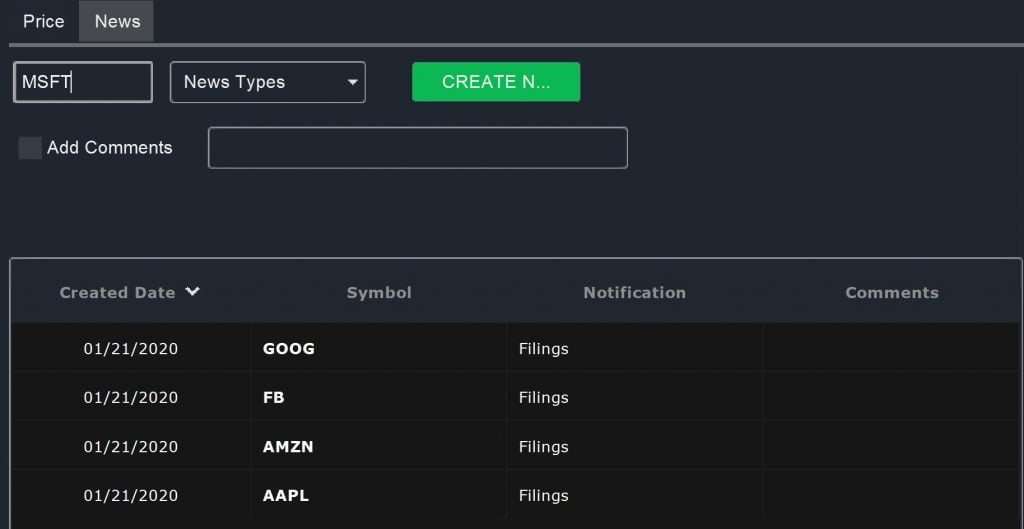

6. New Financial Filings

Financial filings, such as earnings reports and insider trading disclosures, are often the triggers for major moves in a stock’s price. You can make sure that you get news of these financial reports for a stock you’re watching as soon as they hit the market by setting up news alerts using the Notifications module.

Setting up these notifications is extremely simple – you just have to pick the company you’re interested in and create the alert. It’s fast and easy to do this for every stock in your watchlist to make sure that you’re never behind the market when it comes to financial releases.

Staying on Top of the Market with Notifications

With the Scanz Notifications module, it’s easy to make sure that actionable price movements and news are brought to your attention immediately. That way, you can open and close positions exactly when you need to without having to spend every day glued to a single chart. So, you’re free to spend your day finding new profitable trades and be confident that you’ll never miss a big move.