Learning new concepts about trading approaches and the stock market is critical to your success as a trader.

One such approach is trading low-float stocks. Low float stocks are a type of stock with a limited number of shares available for trading, which tends to cause more volatility in the price and create big potential opportunities for traders.

Although this sounds enticing initially, it’s essential to understand the risks associated with these stocks before you begin trading.

In this blog post, we’ll explain what you need to know about low-float stocks, their inherent risks and benefits, and some examples of low-float stocks available on the market.

What Is a Low Float Stock?

Before we delve into the definition of low-float stocks, let’s first identify what a “float” is. A float is the number of shares a trader can buy or sell in the open market.

For example, a stock with “a 3,000,000 float” means three million shares are actually circulating publicly and available to purchase and trade. A stock’s float excludes any shares owned by the company, its officers and directors, or significant investors.

Low-float stocks are those companies with limited floats available in the market, usually between 10 million and 20 million. Due to the fewer shares, there is less supply for these stocks and higher sensitivity for price movements.

What Are the Risks and Benefits of Low Float Stocks?

Like all stocks, low-float stocks have their own inherent risks and benefits. Understanding these risks and benefits helps traders make sound trading decisions.

Here are some of the inherent risks and advantages of low-float stocks:

The Risks of a Low Float Stock

As repeatedly mentioned, low-float stocks are volatile and riskier than most stocks. The restricted float makes predicting the stock’s price movements extremely challenging as trading volume is higher and more susceptible to market fluctuations.

Moreover, low-float stocks can be manipulated by more prominent traders or a group of traders who may control a large portion of the available share count. This could cause sharp swings in the stock price if the buyers or sellers dump numerous shares in the market.

The Benefits of a Low Float Stock

The volatility of a low-float stock can present some advantages to traders. Low-float stocks are often seen as a quick way to make money due to their high volatility, which can quickly create huge gains or losses. This makes it ideal for day traders who want to capitalize on rapid price movements by holding the stock only for a few days.

Moreover, if significant news about a low-float company hits the mainstream media, the stock’s price can quickly soar as traders rush to buy shares before it goes up.

What Are Some Examples of Low Float Stocks?

Now that you know what a low-float stock is and why it’s appealing to many day traders, it’s time to know some of the popular low-float stocks in the current market. As mentioned, stocks are considered low-float if they only have around 10 to 20 million shares.

Here are some of the popular low-float stocks available in the market today:

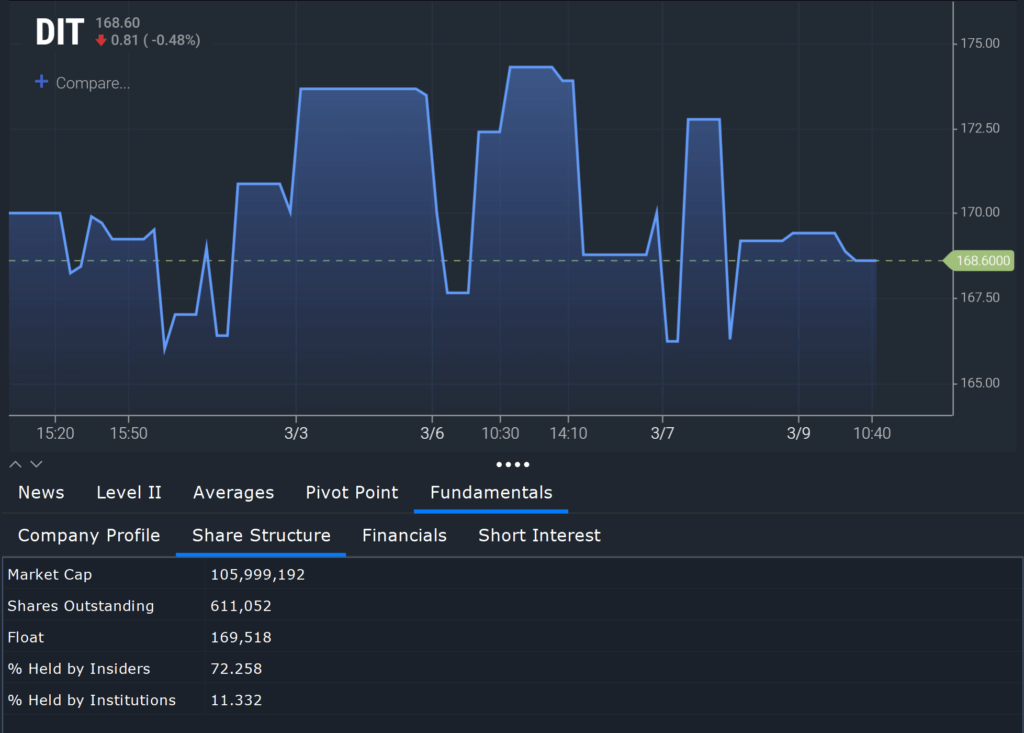

AMCON Distributing Co.

The AMCON Distributing Company is a renowned wholesale distributor throughout the United States. This distributing company is known to distribute over 17,000 products. The company’s products in circulation range from cigarettes and beer to health, beauty, and even frozen products.

As of this writing, AMCON Distributing Company has a public float of around 169,518. Around 0.91% of their overall float is shorted or acquired by institutional traders.

J.W. Mays Inc.

J.W. Mays Inc. is a known real estate firm based in New York. Historically, the company started as a women’s clothing store with nine locations spread throughout New York.

However, the company faced numerous financial setbacks and eventually shifted its focus to commercial real estate. The company owner leases their current properties to retail, restaurant, and other commercial owners.

As of writing, J.W. Mays Inc. has a public float of 518,479 shares, and around 0.55% of its overall float is distributed to institutional traders and internal investors.

HTG Molecular Diagnostics Inc.

HTG Molecular Diagnostics Inc. is an Arizona-based medical equipment provider specializing in RNA platform technologies. The company is renowned for providing comprehensive and accurate medical analysis and its innovative products, such as the Gene Transcription Profiling Panels.

As of this writing, HTG Molecular Diagnostics Inc. has a public float of around 877,495 shares, and approximately 14.41% of its overall float is shorted to internal investors.

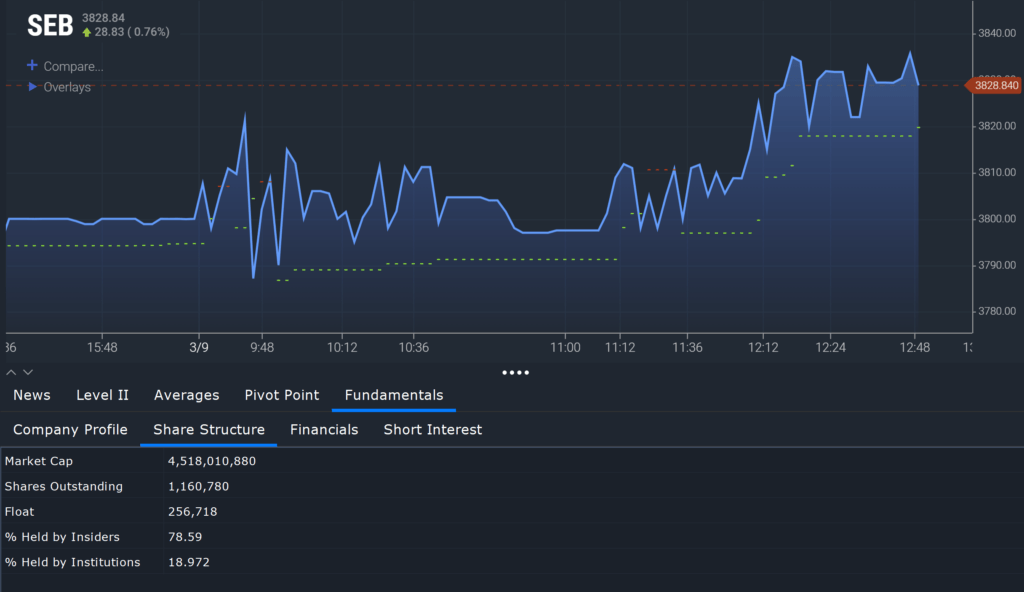

Seaboard Corp.

The Seaboard Corporation is a well-known multinational agricultural and transportation company based in the United States.

The company is renowned for producing and distributing pork and providing ocean transportation. Seaboard Corp. is known for sugar and grain production, electricity generation, and commodity merchandising in the international market.

As of this writing, Seaboard Corporation has released a public float of around 256,718 shares, the second highest on this list. The company also provided about 0.56% of its total float to its institutional traders.

Finding Hidden Opportunities With Scanz Pro Scanner

Many people easily dismiss low-float stocks due to the risks associated with them, but if you know how to assess the current market conditions and look for opportunities properly, low-float stocks can be a great way to make money quickly.

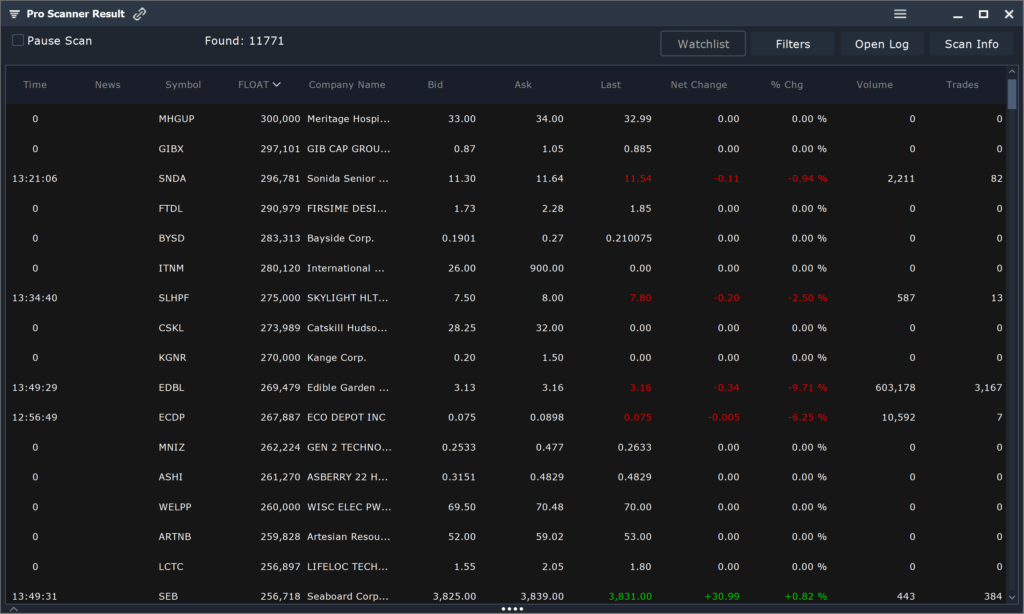

With Scanz Pro Scanner, you can effortlessly search for these hidden gems in the stock market. This platform allows you to find low float stocks with ease. The Scanz Pro Scanner features multiple filters to help you narrow your search using the most critical metrics.

You can conveniently customize the scan criteria to look for the low-float stocks that match your trading strategies. This way, you can be sure you are investing in the right stocks and not wasting time searching through a long list of options.

The Scanz Pro Scanner contains numerous features that make trading stocks less daunting and more rewarding. Take our seven-day 100% free trial and see how it can simplify and maximize your trading experience.