Staying one step ahead of the market is a major aspect of trading. To do that, it’s critical that you know about price changes, news, and other developments as soon as they happen.

With real-time stock alerts, you can easily monitor the market’s movements and be the first to know when things change. In this guide, we’ll explain what real-time stock alerts are, why they’re important, and how you can set them up using Scanz.

What is a “Real-time” Stock Alert?

A “real-time” stock alert is an alert that you get with no delay after a trigger occurs. This type of alert is nearly instantaneous and requires a fast, live market data stream.

As an example, say you set up an alert for a new 52-week high in Apple stock. With a real-time alert, you’ll be notified the second that Apple shares set a new high – not a few minutes later. So, you can respond to that price action as soon as it happens instead of trying to chase after the market.

The Importance of Real-time Stock Alerts

Real-time stock alerts are critical for fast-paced trading, especially in today’s market environment when there are so many people waiting to pounce on a new piece of news or price movement. With real-time alerts, you can be one of the first to know about a new development. That in turn confers a first-mover advantage that could be the difference between winning or losing on a trade.

More broadly, real-time stock alerts help you take charge of your trading. You can set up alerts and then leave them to do their job while you research trade ideas or investigate a stock in more detail. If there’s something you need to know about, the alerts will make sure you’re notified as soon as it happens. In effect, real-time alerts let you use technology to monitor the market for you while you pursue other trading opportunities.

Types of Real-time Stock Alerts

There are two different types of real-time stock alerts: stock-specific alerts and scan-based alerts.

Stock-specific Alerts

Stock-specific alerts are real-time alerts that you manually create for yourself. These alerts typically target a stock that you’re monitoring for trading opportunities. They can be triggered by news headlines, significant price changes, or technical indicators. You can have stock-specific alerts for many different stocks, as well as multiple different alerts for a single stock.

Scan-based Alerts

Scan-based alerts are based on a set of criteria like those that you would use to build scans. They’re not stock-specific, but rather scan the whole market or a subset of the market for new developments. Real-time scan-based alerts are especially useful for finding stocks to day trade since they can notify you when stocks meet the requirements of your trading strategy.

How to Get Real-time Alerts in Scanz

There are several different ways to get real-time alerts in Scanz, including using the Alerts module, the Breakout Scanner, and the Pro Scanner.

Alerts Module

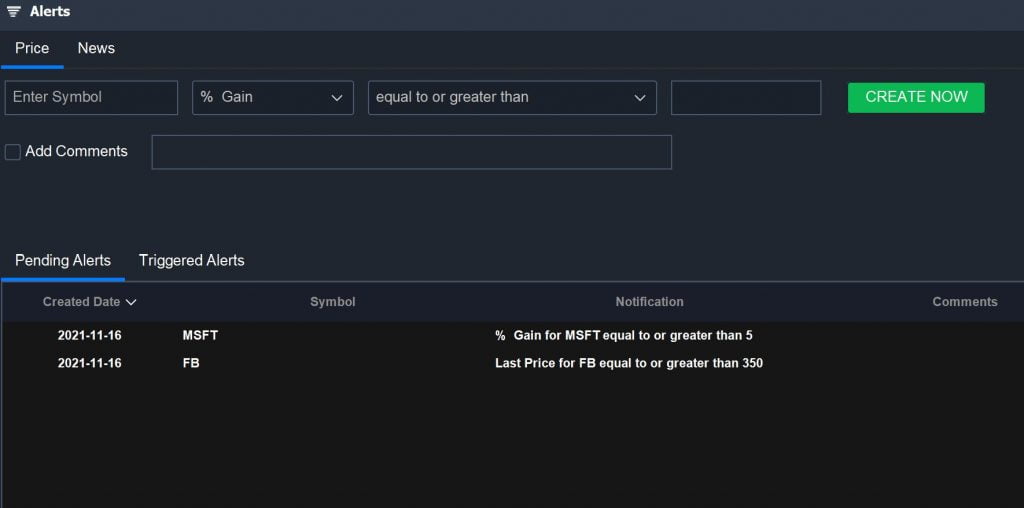

The Alerts module is the best place to go in Scanz for real-time stock-specific alerts. With the Alerts module, you can set up price-based, volume-based, and news-based alerts.

For price and volume alerts, simply enter the stock symbol you’re interested in monitoring and choose the indicator you want to use as your trigger. Scanz can issue notifications based on:

- Price (including bid or ask price)

- Volume (including share volume, dollar volume, and number of trades)

- Percent gain or loss

You can then set the threshold for your trigger. There’s no limit to how many alerts you can create for a single stock, and you can add comments to each alert so you know exactly what it’s for.

For real-time news alerts, you can choose to be notified of new headlines, SEC filings, or both. This is especially useful for following updates about a stock around earnings reports or other major announcements.

Breakout Scanner

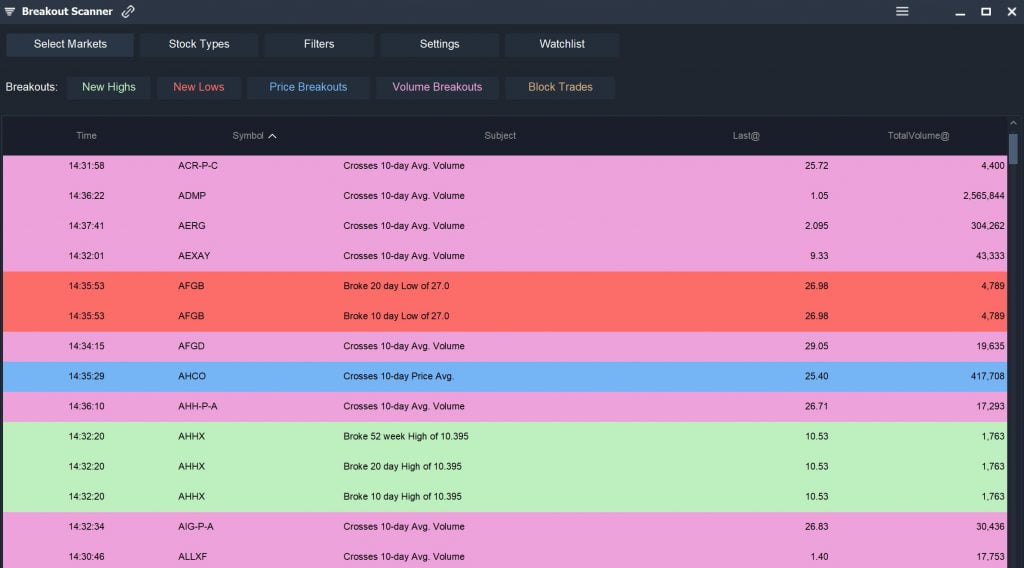

The Breakout Scanner offers streaming real-time alerts on autopilot. It offers an easy way to keep up with important price changes across the market and is a great option for day-to-day monitoring that’s not tied to a specific trading strategy.

To customize the Breakout Scanner, you can choose which markets to watch and set filters for price, volume, and percent change. You can also limit the Breakout Scanner to issuing real-time alerts for one or more of your custom watchlists in Scanz.

The Breakout Scanner can issue alerts for new highs and lows, price breakouts, volume breakouts, and block trades. You can customize the timeframe for any of these triggers as well as monitor breakouts over multiple timeframes.

Pro Scanner

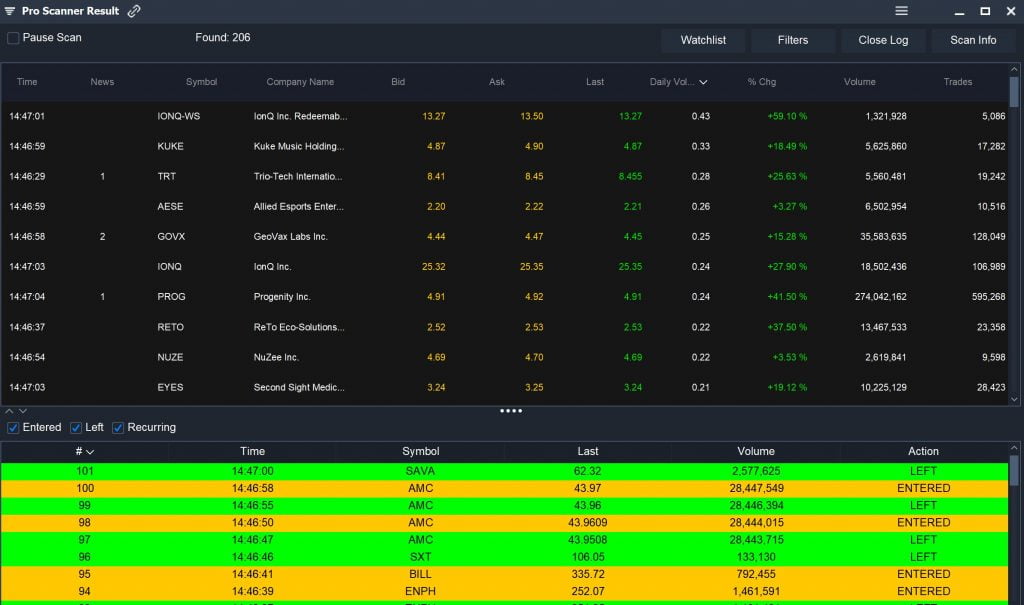

The Pro Scanner enables you to create fully custom real-time alerts. It’s best used to find stocks that align with the requirements of a specific trading strategy. Notably, you can use your existing scans as the basis for real-time alerts.

By default, the Pro Scanner displays all stocks that meet your scan criteria on a given trading day. However, you can get a stream of real-time scan results by opening the scan log. The log will add results in real-time as they meet your scan criteria, as well as notify you when stocks that had met your scan results earlier no longer do.

Conclusion

Real-time stock alerts are an essential tool for every trader. They help you stay one step ahead of the market and enable you to monitor important price action and news as it happens. With Scanz, you can easily get real-time stock alerts using the Alerts module, the Breakout Scanner, and the Pro Scanner.