SEC filings can be an important source of information about companies’ financial health, insider trading, and more. These filings are often studied by traders because of the insights they offer, and unexpected news contained within SEC filings can cause sudden moves in stock prices.

With Scanz, you can easily monitor SEC filings to deeply investigate a company or to stay ahead of breaking market news. Let’s take a look at several different methods for analyzing SEC filings with Scanz.

Find All Filings for a Specific Company

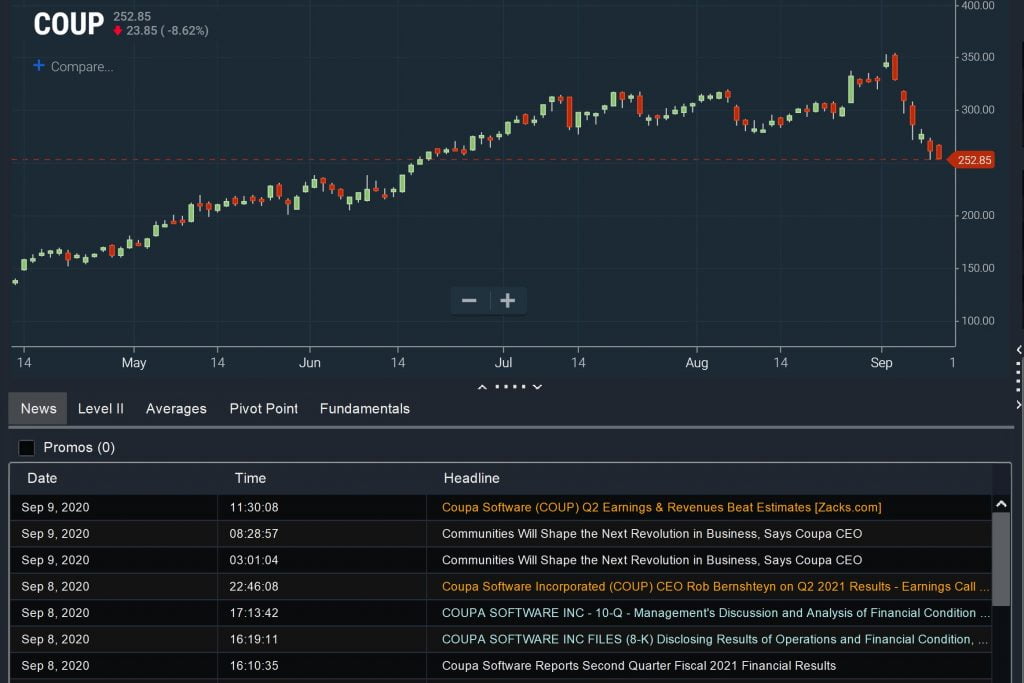

When evaluating a specific company to trade, it can be helpful to quickly browse all recent SEC filings for that company. Scanz makes this easy to do using the Montage window.

To get started, choose a stock from your scan results or select Montage from the home menu and search for a ticker symbol. SEC filings appear along with other company-related headlines under the News tab. Typically, SEC filings are easy to spot because the headlines appear in all-caps white text.

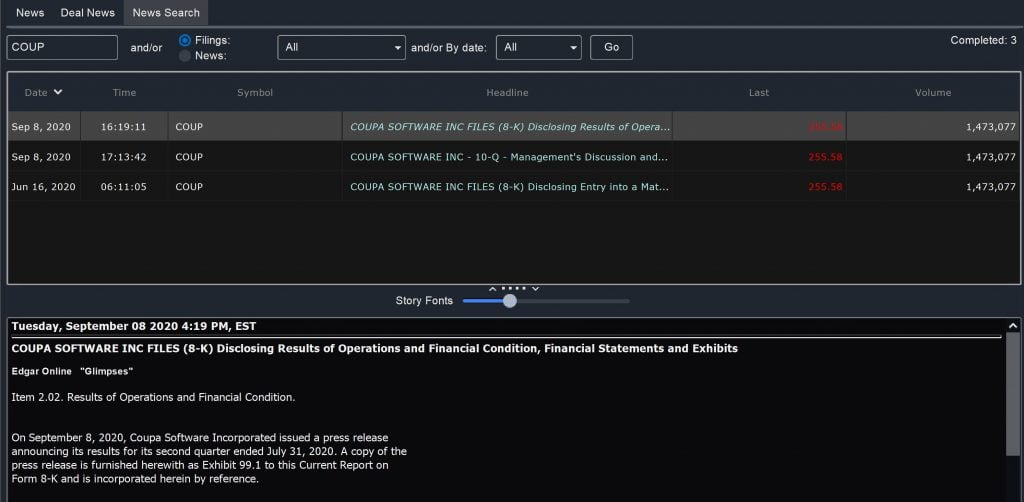

Alternatively, you can search for SEC filings using the News Scanner. Under the News Search tab, enter the ticker symbol of interest and check the Filings option. You can search all filings for the past three months, or limit your search to specific SEC forms or a shorter timeframe depending on your preference.

Create Real-time SEC Filings Scans

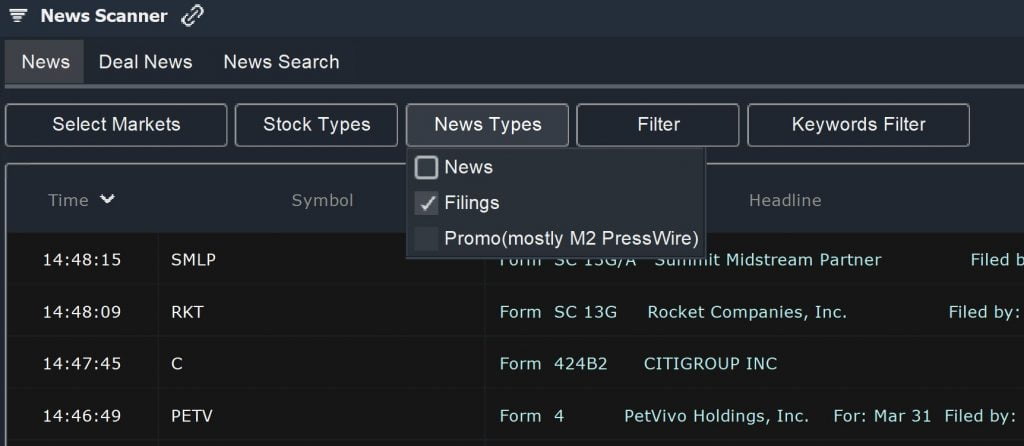

Scanz also enables you to create real-time scans for SEC filings using the News Scanner module. To set up a scan for SEC filings, use the scanner’s News tab and select Filings only under the News Types menu.

You can set broad boundaries on your scan by choosing specific exchanges and types of securities to include. Under the Filter tab, you’ll find many more options for tailoring your scan. The Market Cap parameter is a good option for finding companies in a specific size range that you want to trade. In addition, you can use % Change or Current Volume to scan specifically for companies that are reacting strongly to a new SEC filing.

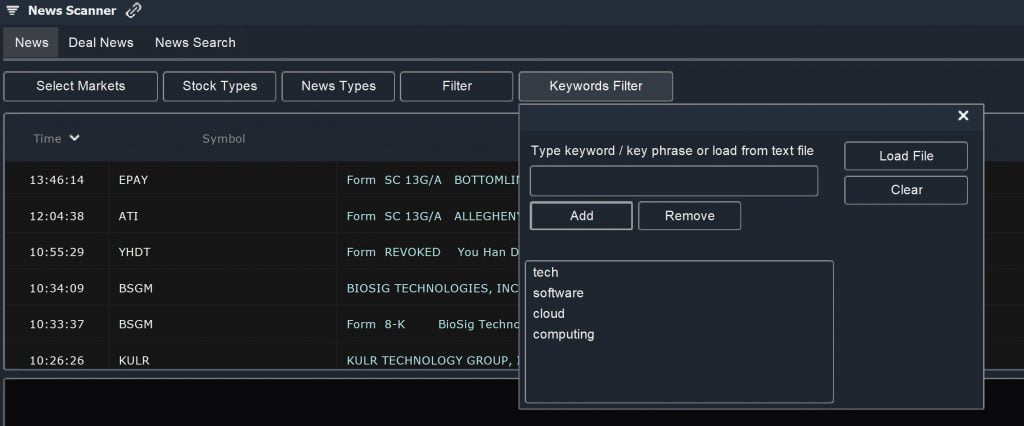

The Keywords Filter tool gives you even more control over your scan. You can include specific companies in your search by listing their names and ticker symbols as keywords. You can also target sector-specific keywords. For example, to find SEC filings for tech stocks, you might include keywords such as ‘tech,’ ‘computing,’ and ‘cloud.’ If you create SEC filings or news scans frequently, you can also create text lists of keywords and import them to Scanz for faster scanner setup.

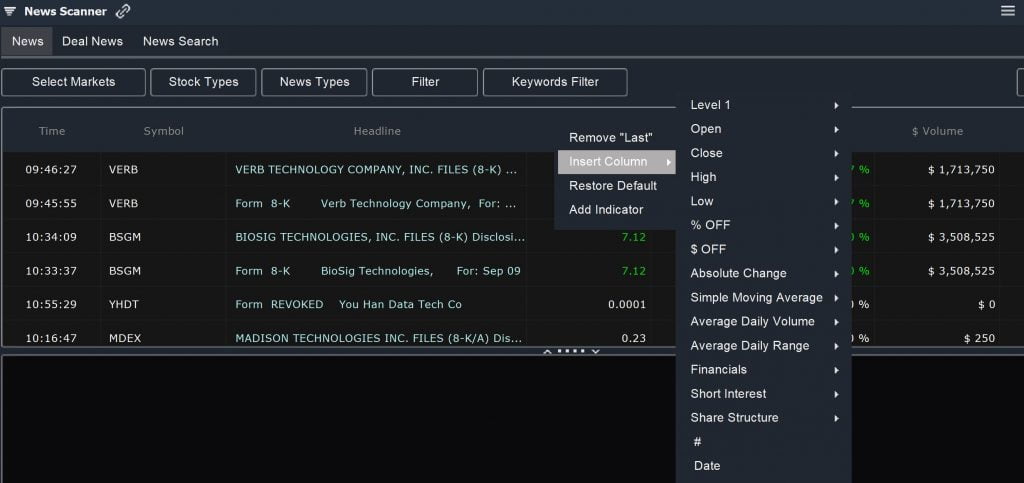

Once your SEC filings scan is set up, results will appear automatically in the scanner window. By default, results are listed chronologically. However, you can right-click to add columns for price change, trading volume, volatility, and much more and sort your results according to these attributes. This is a useful way to quickly identify stocks that are responding strongly to a just-released SEC filing.

Create SEC Filings Alerts

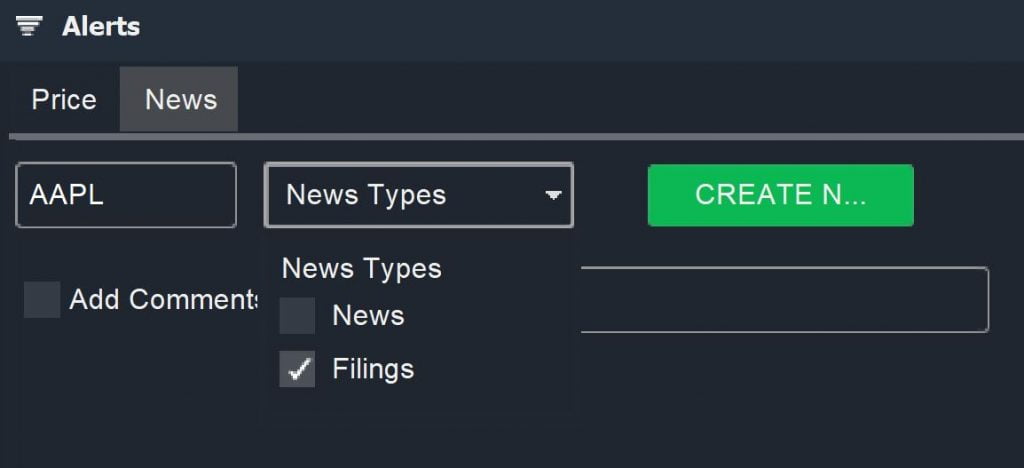

Scanz makes it easy to stay on top of new SEC filings for companies in your watchlists using alerts. To create SEC Filings alerts, open the Alerts module and select the News tab. Enter a ticker symbol and, under News Types, choose Filings. Then simply click Create New Alert, and Scanz will notify you anytime that company files a new form with the SEC.

Conclusion

SEC filings can provide important information about a company’s financial prospects. These filings are often read by traders as soon as they are released and used to re-evaluate a company’s value. As a result, many companies see significant price action in response to new SEC filings.

With Scanz, it’s easy to stay on top of SEC filings. You can easily find recent filings for any company to aid your stock research or create a custom scan to watch for new filings in a specific market sector or among a subset of companies. Scanz also supports filings alerts, so you can be the first to know when a company on your watchlist releases new information through an SEC filing.