Microcap stocks offer an exciting opportunity for traders looking for volatility. These small companies often move by significantly greater degrees each day than the large- and mega-cap stocks in the S&P 500.

Plus, microcap stocks offer an opportunity for discovery. Many of these companies are not household names and they can be frequently overlooked by institutional investors and analysts. As a result, there are plenty of bargains to be had in the microcap world.

Finding the right microcaps to trade is a key part of profiting from these volatile stocks. So, let’s take a look at some of the top microcap stock screeners you can create using Scanz.

What are Microcap Stocks?

Microcap stocks are shares of publicly traded companies that have a market capitalization between $50 million and $300 million. By comparison, the smallest company in the S&P 500 has a market cap of around $6 billion.

Microcap stocks may be traded on national exchanges like the New York Stock Exchange, but most of them are found on over-the-counter markets. There are vastly more microcap stocks than there are well-known blue-chip stocks, which makes using a screener critically important for trading this class of companies.

One thing to keep in mind when trading microcap stocks is that information can be hard to come by. These companies are rarely covered by analysts and don’t show up in market news headlines very frequently. In addition, companies that trade on over-the-counter markets aren’t required to file quarterly financial reports with the SEC. It’s important to dig deep into any microcap company before trading so that you understand its financial situation and business model.

Why Trade Microcaps?

The fact that microcaps often fly under the radar of institutional investors can actually be a good thing. There are often excellent value and growth stocks with small market capitalizations that Wall Street never looks at. As a result, opportunities to get in on the ground floor of a potentially high-growth company stick around for longer. You can also find microcap stocks that are picking up momentum, but that don’t rapidly become overpriced because of overwhelming news coverage and investor interest.

Generally speaking, microcap stocks tend to be more volatile than stocks with higher market capitalizations. That’s in part due to the fact that there is little institutional money in these stocks, which is usually slow to move. High volatility can be a boon for short-term trading, since it offers the possibility of quick price changes. Of course, volatility also brings risk – so you should have a strong stomach before trading microcaps.

Microcap Stock Screeners

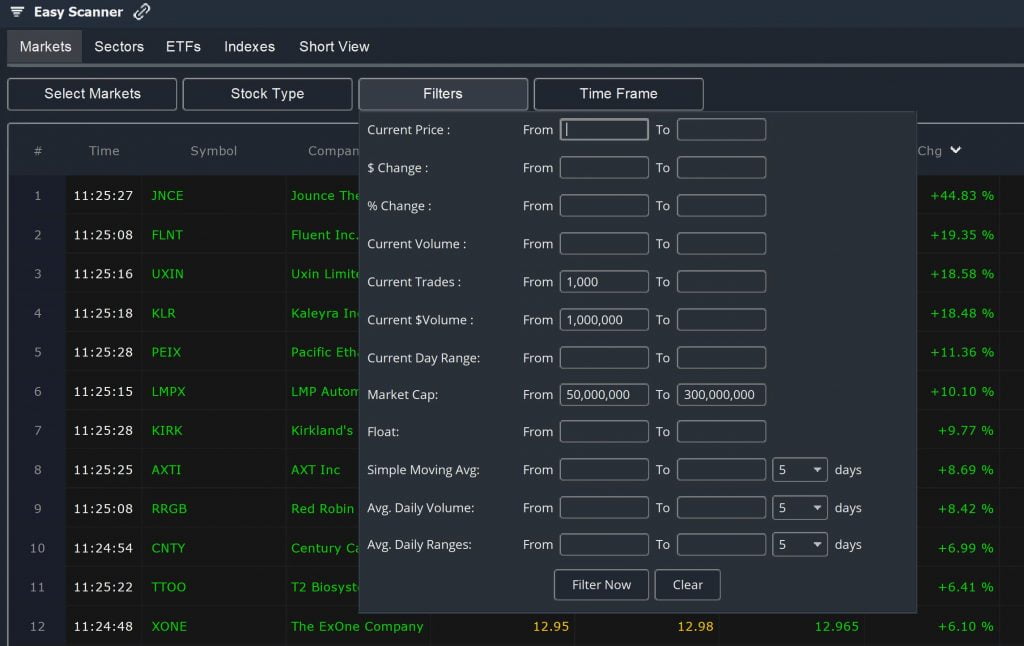

The easiest way to scan for microcap stocks is using the Easy Scanner within Scanz. Start out by filtering the scanner results to only show stocks with a market capitalization between $50 million and $300 million using the ‘Filters’ toolbar.

With that filter applied, you can use the sort functions within the Easy Scanner to find potential trading opportunities.

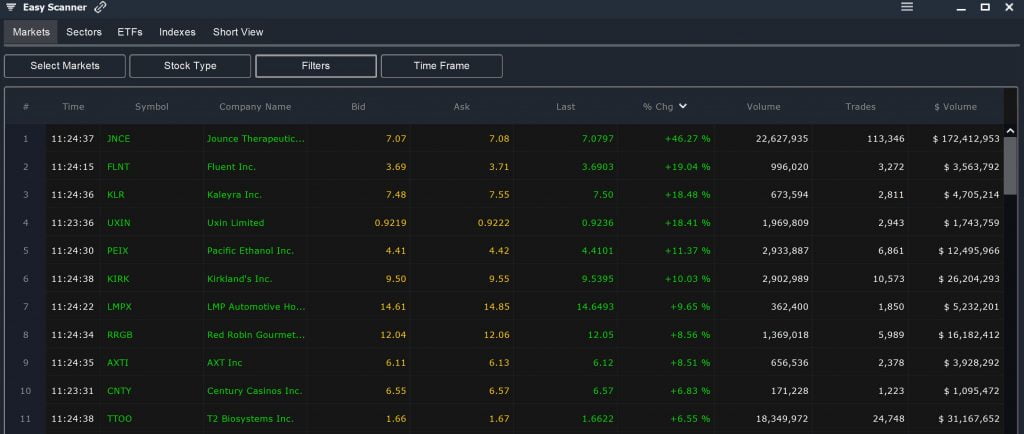

Top Movers

The best place to start with screening microcap stocks is to look for companies that have experienced the biggest gain or loss of the day. Just sort the screener results by % Change to see these top movers.

Note that you might want to filter out stocks with low trading volume for this screen. Many top moving microcap stocks, particularly those that trade on OTC markets, may only experience a few trades each day. Most traders will want to avoid stocks with such low liquidity. So, under ‘Filters,’ set ‘Current $ Volume’ to $1 million and up and ‘Current Trades’ to 1,000 and up.

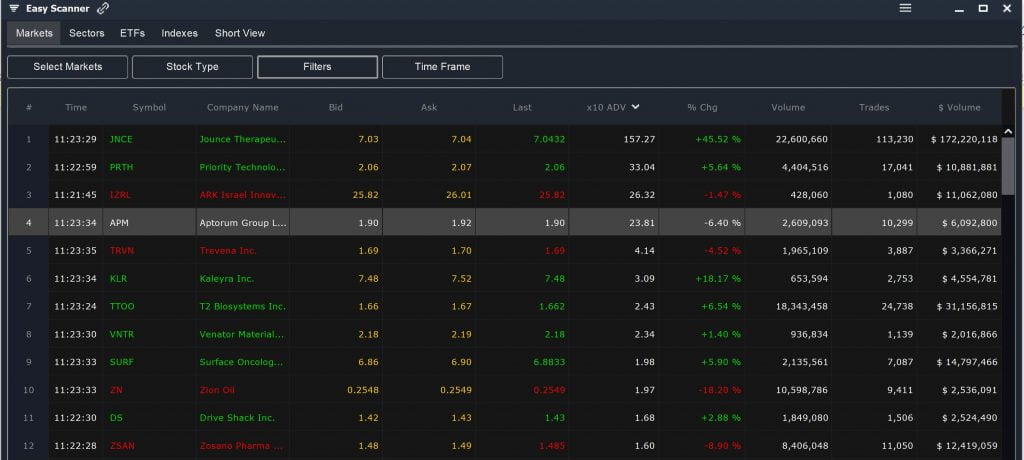

High Volume Microcap Stocks

You can also screen microcap stocks according to volume. This is a particularly powerful screen for microcaps, since unusually high volume is often an indicator of news around a stock or a signal of investor interest that could lead to greater volatility.

In the Easy Scanner, add a column for ‘Average Daily Volume > Multiple > x10 ADV’ and sort results by this column. Again, it is good idea to remove stocks with low volume by setting $ Volume and Trades minimums under the ‘Filters’ tab. You can then quickly view stocks that have gained or lost a significant percentage on the day while trading with significantly higher than usual volume.

Moving Average Momentum

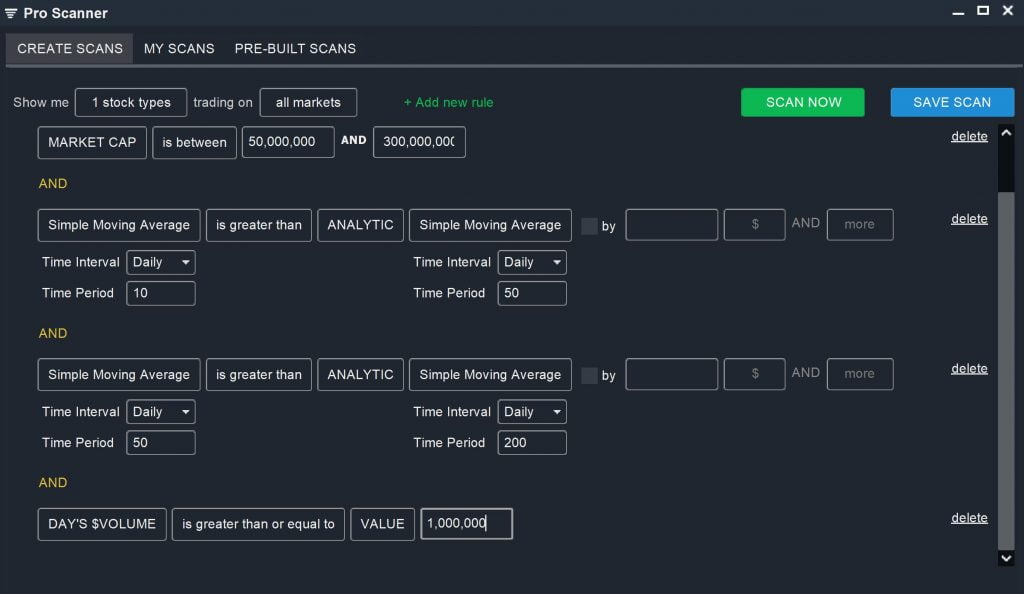

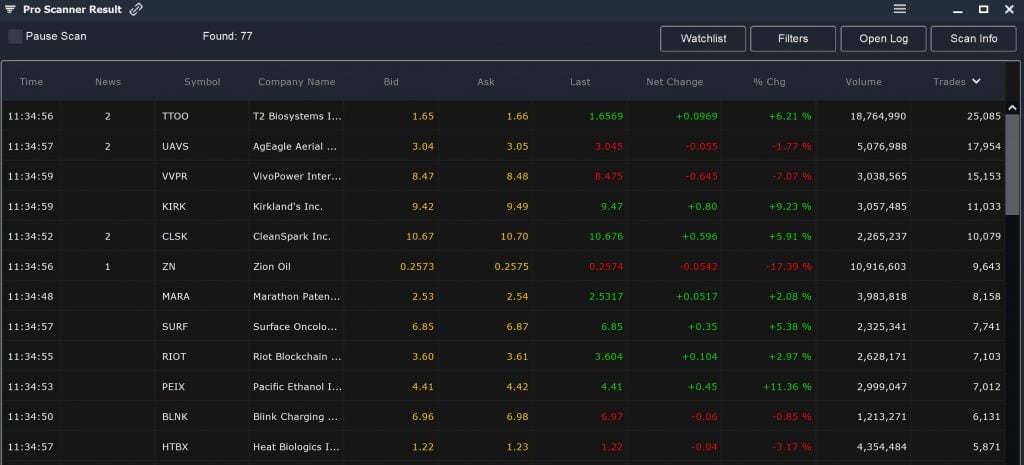

You can create more complex microcap stock screens using the Pro Scanner. As an example, let’s look for microcap stocks with positive, stacked moving averages. When short-term moving averages are stacked above long-term moving averages, it indicates that a stock has upward price momentum.

To create a moving average scan specifically focused on microcap stocks, we’ll need to include a filter for market cap. We’ll also add a volume filter to eliminate low-activity stocks.

MARKET CAP is between 50,000,000 AND 300,000,000

AND

Simple Moving Average (Daily, 10) is greater than ANALYTIC Simple Moving Average (Daily, 50)

AND

Simple Moving Average (Daily, 50) is greater than ANALYTIC Simple Moving Average (Daily, 200)

AND

DAY’S $ VOLUME is greater than or equal to VALUE 1,000,000

You can further customize this scan to look specifically for microcap stocks that have gained, say, 5% or more on the day or that are trading with above-average volume. As for Easy Scanner results, you can also sort the screen results according to % Change, $ Volume, or current volume relative to the average daily volume.

If you want even more penny stock scans, check out this video tutorial below:

Conclusion

Microcap stocks provide an opportunity for traders because they are relatively volatile and often overlooked by institutional investors. However, there are many companies with small market capitalizations that have strong business models and that can jump in price in reaction to company or market news or sudden investor interest. Just make sure that you keep an eye on volume when trading microcap stocks, as some stocks are much more liquid than others.