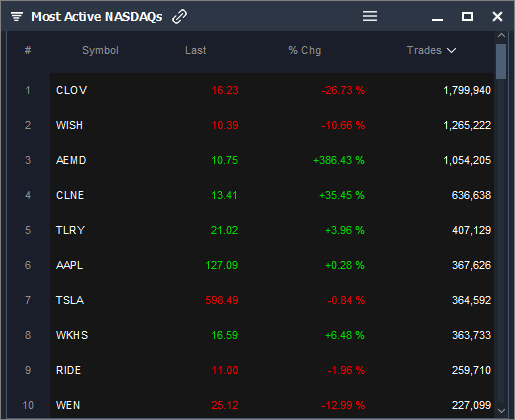

Most Active NASDAQs

CLOV, WISH, AEMD, CLNE, TLRY, AAPL, TSLA, WKHS, RIDE, WEN

The studies assessed the safety and effectiveness of AllerNaze™ in treating the symptoms (runny nose, nasal itching, sneezing, and nasal congestion) in patients with allergic rhinitis. It is important that you keep a written list of all prescription and over-the-counter (over-the-counter) medications you are taking, as well as any products such as vitamins, minerals, or other dietary supplements. Amoxicillin is most commonly taken orally farmacia en linea. Five hundred twenty-nine patients were assigned to each group.

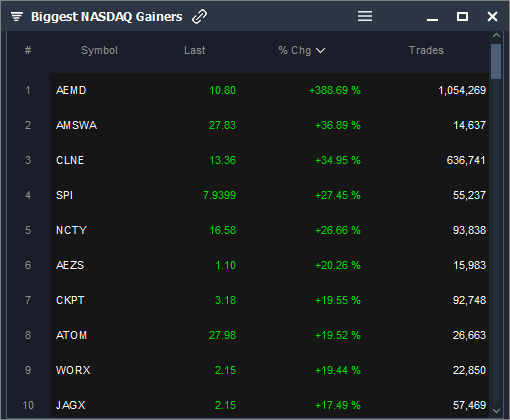

Biggest NASDAQ Gainers

AEMD, AMSWA, CLNE, SPI, NCTY, AEZS, CKPT, ATOM, WORX, JAGX

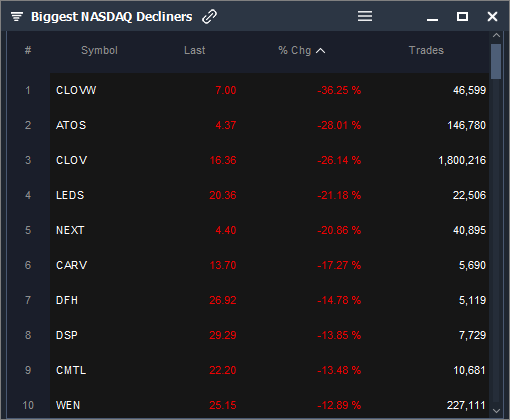

Biggest NASDAQ Decliners

CLOVW, ATOS, CLOV, LEDS, NEXT, CARV, DFH, DSP, CMTL, WEN

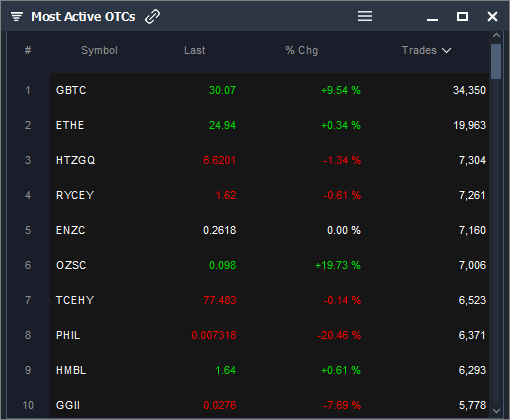

Most Active OTCs

GBTC, ETHE, HTZGQ, RYCEY, ENZC, OZSC, TCEHY, PHIL, HMBL, GGII

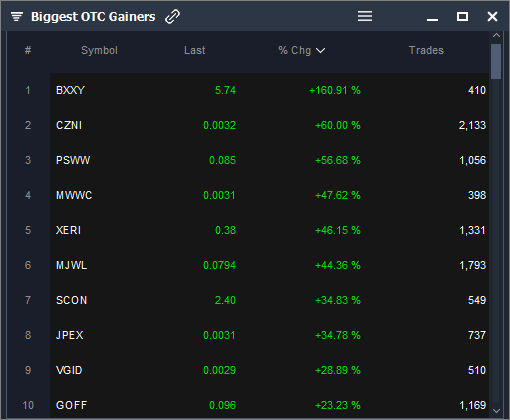

Biggest OTC Gainers

BXXXY, CZNI, PSWW, MWWC, XERI, MJWL, SCON, JPEX, VGID, GOFF

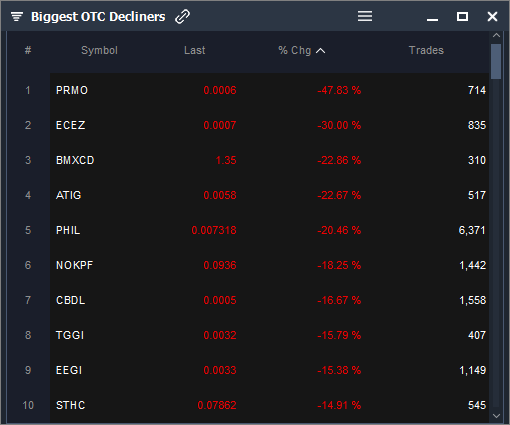

Biggest OTC Decliners

PRMO, ECEZ, BMXCD, ATIG, PHIL, NOKPF, CBDL, TGGI, EEGI, STHC

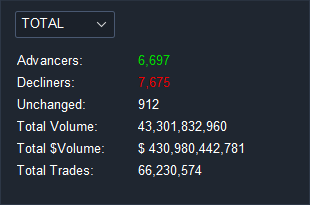

Market internals (TOTAL)

⦁ 6,697 Advancers

⦁ 7,675 Decliners

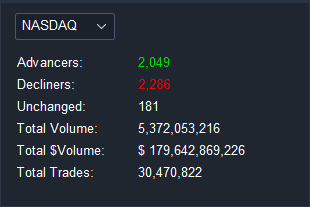

Market internals (NASDAQ)

⦁ 2,049 Advancers

⦁ 2,286 Decliners

Market internals (OTC)

⦁ 2,671 Advancers

⦁ 2,673 Decliners