One of the most difficult and time-consuming parts of stock trading is finding stocks that are worth trading in the first place. There are thousands of stocks available, but only a small handful of them might offer an opportunity for profit at any given time.

That’s where a stock screener like Scanz can come in handy. In this guide, we’ll explain everything you need to know about stock screeners, from how they can help your trading to how to set up your first screen.

What is a Stock Screener?

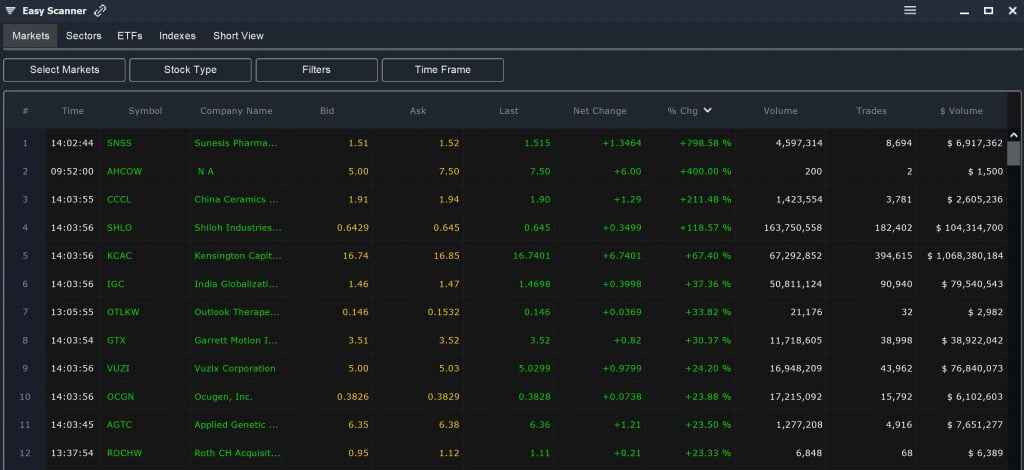

A stock screener is a tool for finding stocks based on a set of parameters that you define. Starting from a list of thousands of stocks, a screener can help you whittle down to a list of perhaps just dozens of stocks that fit your trading criteria. The more parameters you add to your screen, generally the smaller the number of stocks that will make it into your results list.

The beauty of stock screeners is that they are highly customizable and can be as simple or complex as you want. For example, a basic stock screen could simply narrow the list of all possible stocks down to just stocks that trade on, say, the New York Stock Exchange. Or you could design a screen that searches for only a small subset of stocks with highly specific fundamental and technical attributes.

The range of parameters that you can use to filter stocks with a stock screener is very wide. Screeners like Scanz allow you to sort stocks based on fundamental metrics like market capitalization, revenue, or debt. You can also filter stocks according to technical characteristics, such as whether the share price is above or below a moving average, whether the RSI indicator is above or below a specific threshold, or whether trading volume is greater than normal.

What is the Purpose of a Stock Screener?

The goal of a stock screener is to help you narrow and focus your search for stocks to trade. By using a stock screener, you can reduce the list of candidates for trading down to only those stocks that have a good chance of fitting into your trading strategy. You can spend your time researching this handful of trading candidates, rather than trying to quickly evaluate hundreds of stocks to trade.

Importantly, stock screeners can also be used for discovery. Without an organized way to find stocks that fit your trading strategy, many traders focus on the same small subset of companies day after day. A stock screener can help you quickly identify other stocks that meet your basic trading criteria and that could be potentially good candidates for trading.

How Can a Stock Screener Help Your Trading?

A stock screener can do wonders for your trading. To start, saving time on stock discovery can make your approach to trading much more efficient. Instead of sifting quickly through hundreds of charts in a single day, you can more carefully evaluate a small handful of charts that you already know meet the broad parameters of your trading strategy. This also reduces the chances that you might make a mistake or miss something important, since you know that all stocks you are evaluating have met some user-defined thresholds for trading.

In addition, the time you saved by using a screener can be used for other aspects of trading. For example, you might be able to place more trades throughout the day or dive deeper into researching a promising trade. Even getting to a trade sooner can make a huge difference in whether it is profitable. For example, if you are looking for breakout trading opportunities, it is critical that you find stock candidates for these trades before a breakout happens.

Setting Up a Stock Screener with Scanz

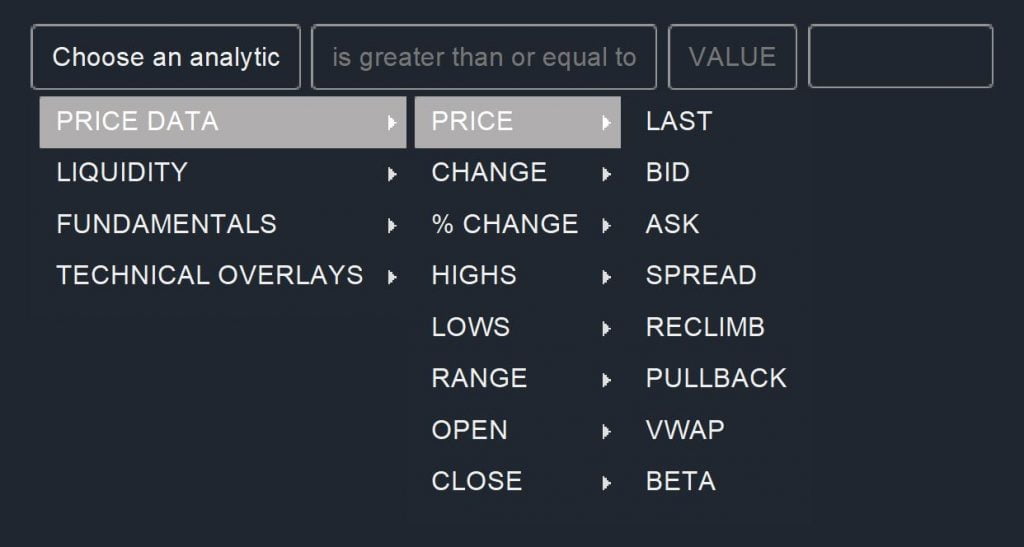

Let’s take a closer look at how to set up a new stock screener with Scanz. We’ll focus on the Pro Screener module, which enable you to create a fully custom stock screen to suit your trading strategy.

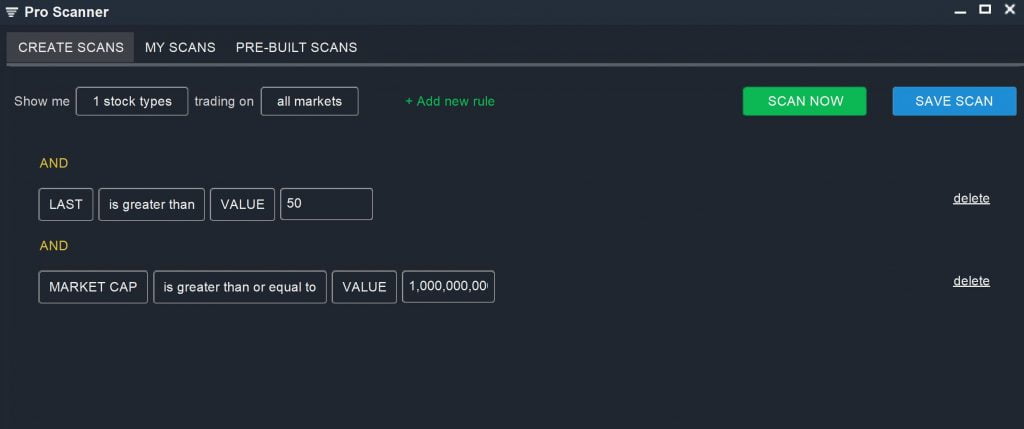

With the Pro Scanner, you can build filters one at a time. Each filter is linked with an ‘AND’ logical, meaning that only stocks that meet all the parameters you define will show up in your screener results.

To get started, decide what types of equities you are looking for. You can select any combination of regular securities, ETFs, preferred shares, foreign stocks, and more. Then choose whether you want to screen all US stocks, or only stocks that trade on specific exchanges like the NASDAQ or NYSE.

Now you can start adding filters to your stock screen. Choose from price data, volume data, fundamental metrics, and popular technical indicators. As an example, let’s filter based on stock price. We’ll choose ‘Price Data > Price > Last.’ If the goal is to find all stocks with a share price greater than $50, we’ll apply the ‘is greater than’ logical, choose ‘Value,’ and then enter ‘50.’

We can also add additional filters. For example, let’s say we want to limit the screen to stocks priced higher than $50 and that have a market capitalization of at least $1 billion. Click ‘+ Add New Rule’ to add another line to the screen, and then choose ‘Fundamentals > Share Structure > Market Cap.’ Choose the ‘is greater than or equal to’ logical, select ‘Value,’ and then enter ‘1,000,000,000.’

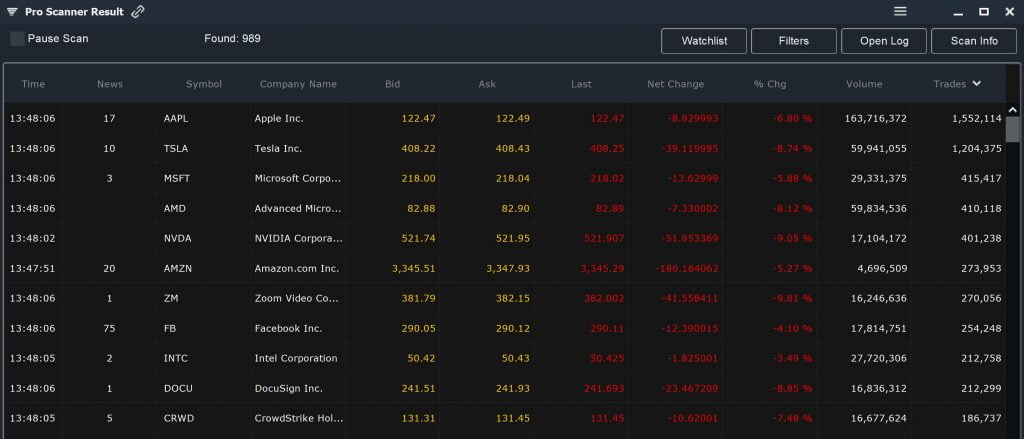

When your screener is ready, click ‘Scan Now.’ The results list will only contain stocks that have a share price greater than $50 and a market cap of $1 billion or more. Note that you can also save your stock screens so that you can use them again in the future or return to them to add additional parameters.

Tips for Building Stock Screeners

Stock screeners can be extremely powerful when used properly. However, screener results can also be misleading if your scan is not designed carefully. Here are four tips to help you get started with building stock screeners:

Tip #1: Keep It Simple

The most important thing to keep in mind when designing stock screeners is to keep your screen as simple as possible. Usually, less is more when it comes to building a stock screen. Simpler screeners are more flexible in changing market conditions and less prone to error. If you feel that you need a more complex screen, try starting with a simpler scan and adding parameters one at a time.

Tip #2: Focus on the Output

When building stock screens, it’s easy to get caught up in the parameters. But you should always keep an eye on the output that you’re trying to achieve. You could build a highly technical stock screen, but it’s of no use unless it produces an actionable list of stocks with potential trading opportunities.

Tip #3: Define Your Setups First

Another thing to keep in mind when approaching stock screeners is that you should define the setup you’re looking for before you create a screen. Think about what goes into your ideal trading setup and then build a screen that finds stocks that exhibit those conditions. Don’t start with a scan and then look for potential setups from the results.

Tip #4: Think about Your Timeframe

Stock screeners like Scanz allow you to modify the timeframe of your screen parameters. For example, you can screen stocks based on a 10-minute moving average or based on a 10-day moving average. Think about what timeframe is appropriate for your strategy and goals when setting up filters, and make sure that all of your parameters are operating on the same timeframe.

Start Building Your First Screener

A stock screener like Scanz can be an extremely useful tool for improving your trading. A well-built screener allows you to focus in on stocks that already meet many of the criteria of your trading strategy. As a result, stock screeners can save you time and help you trade more effectively.

Ready to start building your first stock screener? Check out some of our video guides and blog posts for some ideas and tutorials.