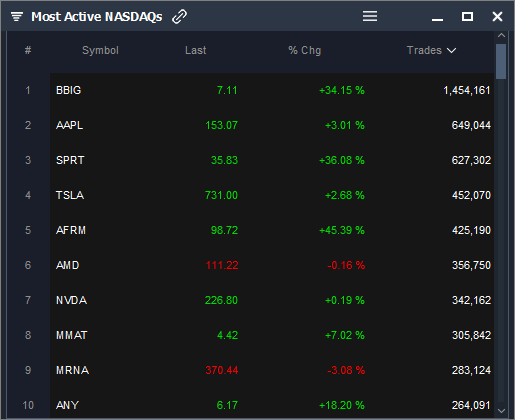

Most Active NASDAQs

BBIG, AAPL, SPRT, TSLA, AFRM, AMD, NVDA, MMAT, MRNA, ANY

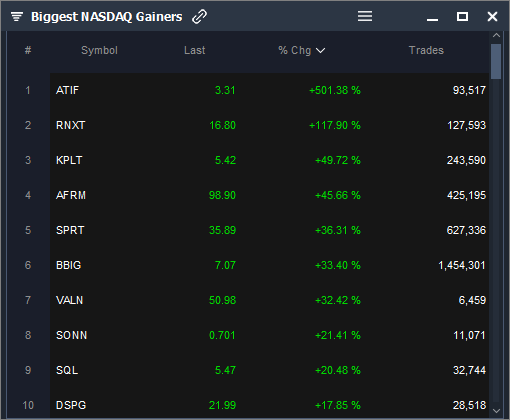

Biggest NASDAQ Gainers

ATIF, RNXT, KPLT, AFRM, SPRT, BBIG, VALN, SONN, SQL, DSPG

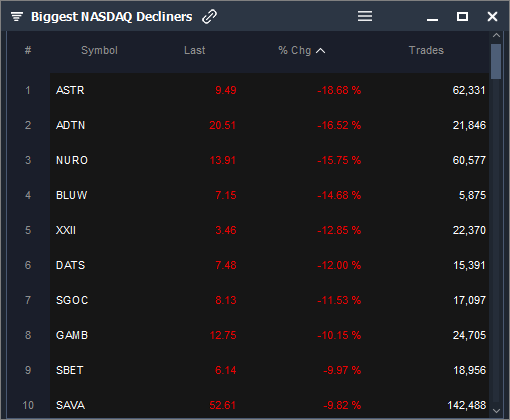

Biggest NASDAQ Decliners

ASTR, ADTN, NURO, BLUW, XXII, DATS, SGOC, GAMB, SBET, SAVA

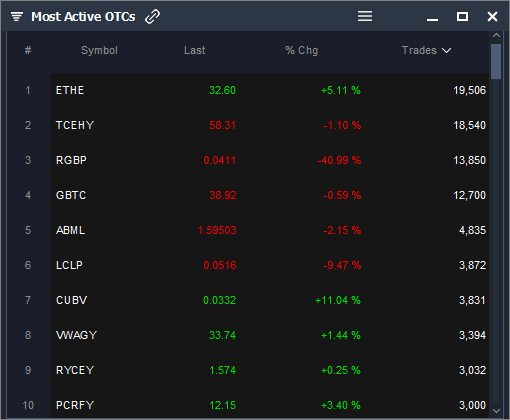

Most Active OTCs

ETHE, TCEHY, RGBP, GBTC, ABML, LCLP, CUBV, VWAGY, RYCEY, PCRFY

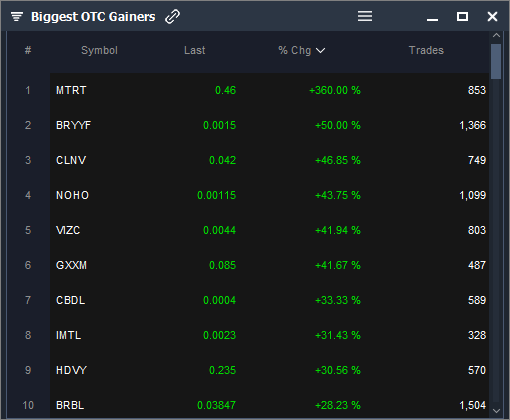

Biggest OTC Gainers

MTRT, BRYYF, CLNV, NOHO, VIZC, GXXM, CBDL, IMTL, HDVY, BRBL

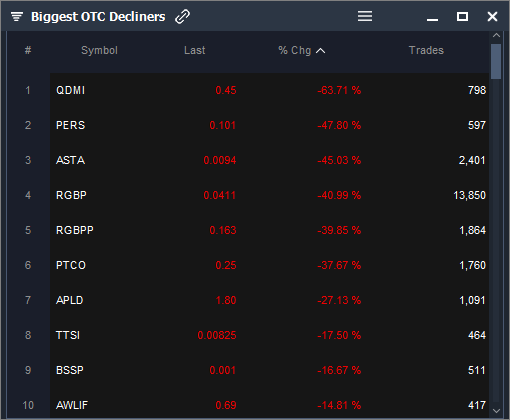

Biggest OTC Decliners

QDMI, PERS, ASTA, RGBP, RGBPP, PTCO, APLD, TTSI, BSSP, AWLIF

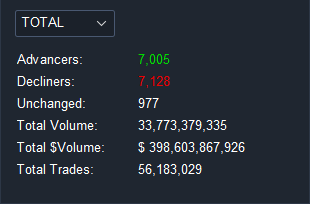

Market internals (TOTAL)

⦁ 7,005 Advancers

⦁ 7,128 Decliners

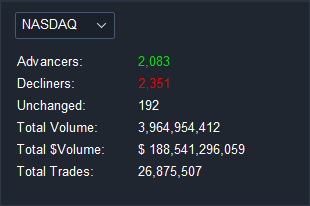

Market internals (NASDAQ)

⦁ 2,083 Advancers

⦁ 2,351 Decliners

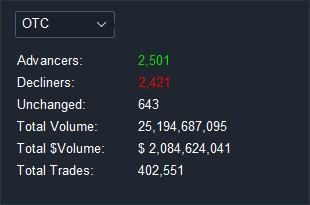

Market internals (OTC)

⦁ 2,501 Advancers

⦁ 2,421 Decliners

Looking for More Hot Stocks?

Sign up for Scanz to get instant access to:

- Market Movers on Every Exchange

- Fully Customizable Scans

- Real-Time Scans & Trade Alerts

- News Scans

- Charting + Level 2

- And much more!