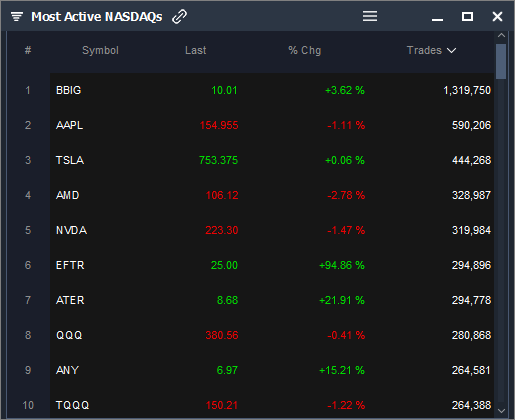

Most Active NASDAQs

BBIG, AAPL, TSLA, AMD, NVDA, EFTR, ATER, QQQ, ANY, TQQQ

In addition, danazol corrects partially or completely the primary biochemical abnormality of hereditary angioedema by increasing the levels of the deficient C1 esterase inhibitor (C1EI). Storage: Store methadone securely in a location not accessible by others. If you have a pre-existing health condition which affects the eye, such as diabetes, you may also have an eye examination www.farmaciaonlinesinreceta.org. In the patient with comedones and inflammatory lesions, a comedolytic agent such as tretinoin, adapalene or azelaic acid may be combined with benzoyl peroxide or a topical antibiotic.

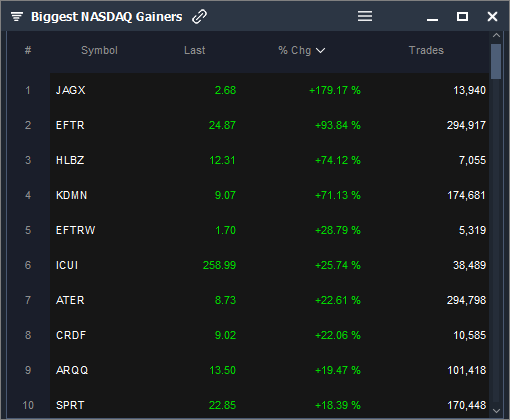

Biggest NASDAQ Gainers

JAGX, EFTR, HLBZ, KDMN, EFTRW, ICUI, ATER, CRDF, ARQQ, SPRT

Biggest NASDAQ Decliners

INMB, ALEC, ELYM, SQBG, PXLW, ABSI, GLUE, CLOV, ZIOP, CAN

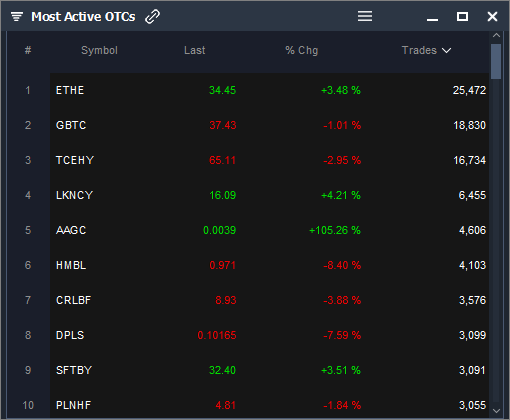

Most Active OTCs

ETHE, GBTCM TCEHY, LKNCY, AAGC, HMBL, CRLBF, DPLS, SFTBY, PLNHF

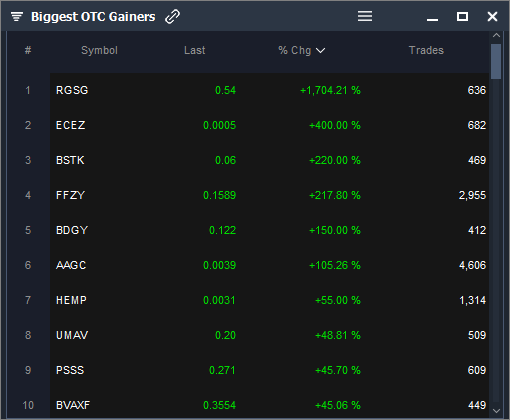

Biggest OTC Gainers

RGSG, ECEZ, BSTK, FFZY, BDGY, AAGC, HEMP, UMAV, PSSS, BVAXF

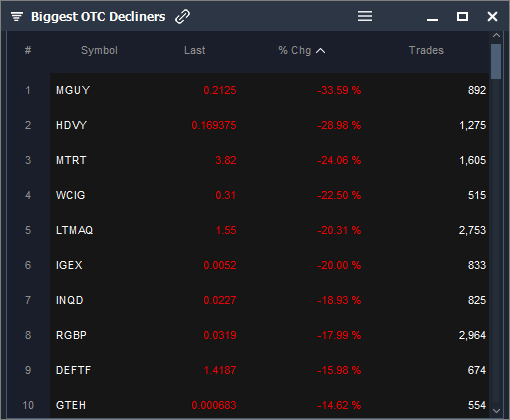

Biggest OTC Decliners

MGUY, HDVY, MTRT, WCIG, LTMAQ, IGEX, INQD, RGBP, DEFTF, GTEH

Market internals (TOTAL)

⦁ 4,956 Advancers

⦁ 9,111 Decliners

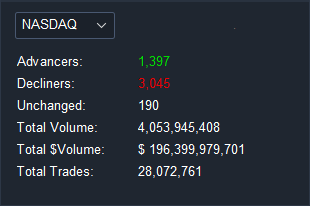

Market internals (NASDAQ)

⦁ 1,397 Advancers

⦁ 3,045 Decliners

Market internals (OTC)

⦁ 1,914 Advancers

⦁ 2,929 Decliners

Looking for More Hot Stocks?

Sign up for Scanz to get instant access to:

- Market Movers on Every Exchange

- Fully Customizable Scans

- Real-Time Scans & Trade Alerts

- News Scans

- Charting + Level 2

- And much more!