Penny stocks present an overlooked and potentially extremely lucrative opportunity for day traders. While these types of stocks present their own set of hazards, such as low liquidity and often murky company fundamentals, cautious traders who know what to look for can find success in trading penny stocks.

In this guide, we’ll explain everything you need to know about trading penny stocks and show you how to set up actionable penny stock scanners with Scanz.

What is a Penny Stock?

Broadly speaking, penny stocks are any stocks that trade for less than $5 per share on over-the-counter (OTC) markets. These stocks are usually issued by small companies trying to raise money from public investors, in the same way that larger companies issue stocks on the major exchanges. But, beware that many companies issuing penny stocks have very little cash on hand and may or may not have an established market.

What Should Penny Stock Traders Look Out For?

Trading penny stocks is significantly riskier than trading stocks on major exchanges. SEC regulations are much looser since most penny stocks are traded on a quotation system rather than an exchange. In fact, one of the two largest penny stock listing services, Pink Sheets, doesn’t enforce any requirements around market cap, share price, or other safety factors on the stocks it lists.

That means that you need to be extremely cautious to vet the companies you’re trading. Unlike stocks trading on major exchanges, there’s no guarantee that you’ll be able to access detailed or verifiable fundamental data for companies trading as penny stocks. It’s essential to do your due diligence to decide whether a company is real or a scam, and whether its growth potential justifies the current share price. Keep in mind that rumors and bits of news can create huge price movements in the penny stock market in a way that they wouldn’t be able to on major exchanges.

Liquidity is also a concern when trading penny stocks. Since there are so many companies listed and relatively few traders buying and selling penny stocks, it can be hard to buy or sell shares at the quoted price. In practice, that means you’ll need to use limit orders almost anytime you buy or sell.

On top of that, low liquidity results in high volatility. Low prices and low float mean that individual investors can move the price of a penny stock significantly without a huge amount of capital. Even small amounts of legitimate trading activity can lead to major price swings that you wouldn’t normally see on major exchanges. This volatility is a large part of the attraction of penny stocks, since it offers significant opportunities for profit, but it’s also a major risk factor.

What Makes a Good Penny Stock Scanner?

The first step in creating a penny stock scanner is to figure out what your strategy is. Are you looking for penny stocks that have hit rock bottom and are ready for a bounce? Or are you looking to get into a stock that’s rising on momentum to execute a swing trade? Many of the same chart patterns that apply to large-cap stocks apply to penny stocks, although you need to be cognizant of how low liquidity and high volatility can change the timescales and explosiveness of these patterns. Think about your timeline, too – penny stocks can be traded on an intraday basis, but they can also be bought and sold over multiple days or weeks.

Once you’ve narrowed down a scan to look only for a specific type of setup, you can home in on the best prospects. Trading volume is more important than ever when you’re trading penny stocks, since you need enough liquidity in the stock to be able to smoothly enter and exit a position. So, a volume filter is always a good idea.

Depending on your strategy, you may also want to look at price volatility. Most traders will ideally want to see some sort of pattern or trend in the stock’s price, rather than simply wild swings. It’s also important to make sure that the stock also hasn’t already exhausted the volatility that your strategy depends on.

Finally, a good stock scanner needs to be timely. Penny stock prices can change quickly in response to news or even individual trades because of their low liquidity. Real-time price information is absolutely essential. A news scanner can help you cut through the noise and figure out why specific penny stocks are moving and whether the current price is overbought or still has room to run.

Creating Penny Stock Scanners in Scanz

Scanz offers three ways to scan for penny stocks: using the Easy Scanner, using the Pro Scanner, and using the News Scanner. We’ll take a look at all three to see what they offer and how you can use them to find trading opportunities.

Easy Scanner

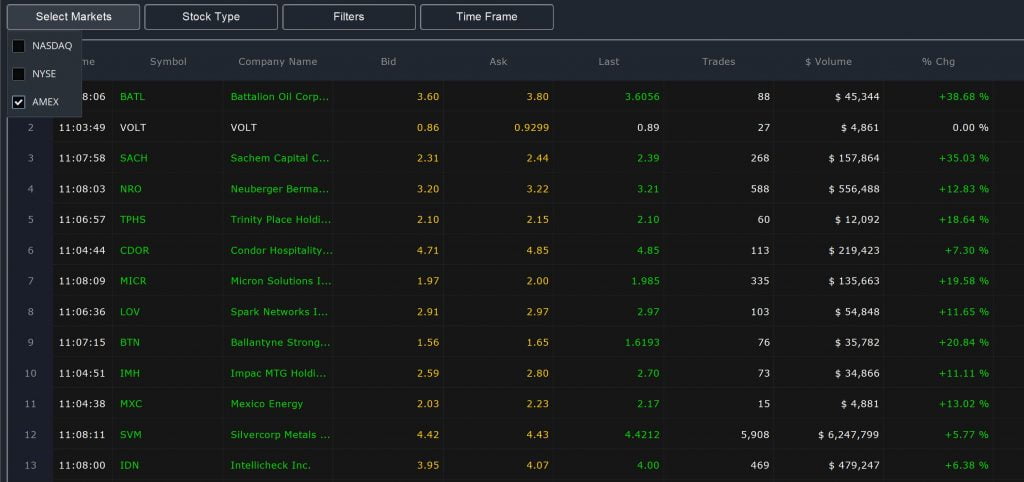

The Scanz Easy Scanner allows you to quickly see the penny stocks that are getting the most trading volume. That’s important, since these are the stocks that offer the liquidity you need to enter and exit trades – not to mention they’ll generally be less volatile than low-liquidity stocks.

To set up the Easy Scanner to look for penny stocks, first select only the AMEX market and then use the filter settings to set a maximum share price of $5. Then sort by Trades or $Volume – either of these are better options that Volume, since they reflect the actual number or trades being placed or money changing hands rather than just the number of shares traded (which could come from a few large transactions).

If you want to further narrow your scan, you can change the share price filter, sort stocks by % Change and set a minimum volume filter, or set a minimum % Change filter. Keep in mind that the Easy Scanner also allows you to slice penny stocks by sector, which can be a great way to act on sector-wide news.

Pro Scanner

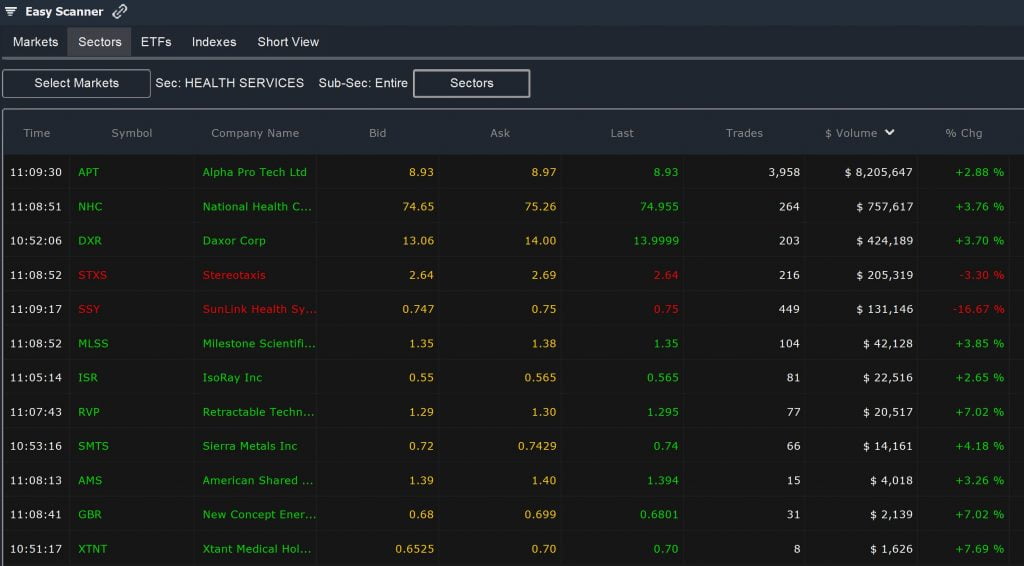

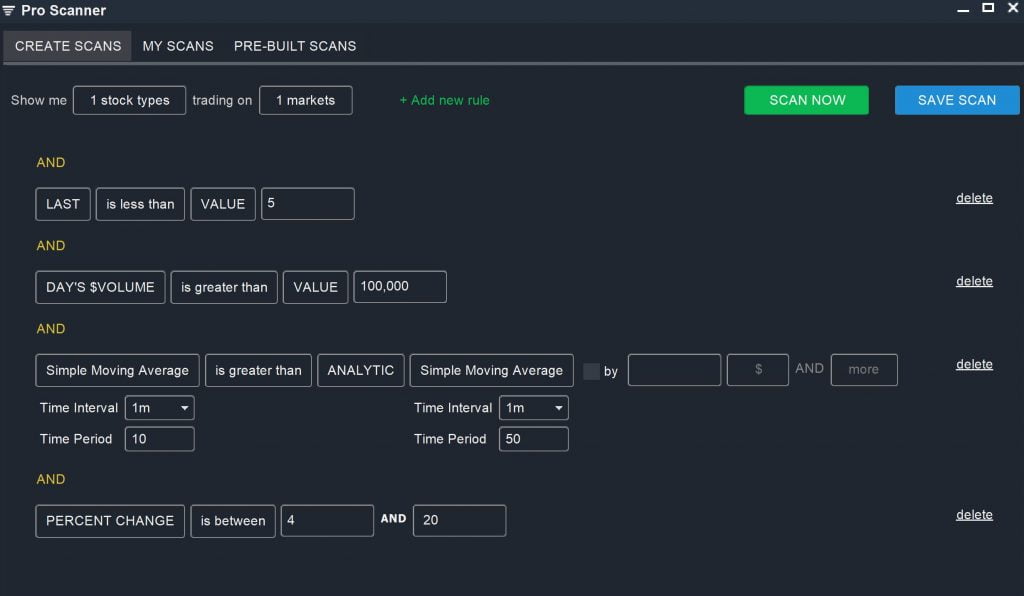

The Pro Scanner allows you to create advanced scans that look for a combination of fundamental parameters and technical setups. Many of the same scanning strategies that apply to exchange-traded stocks can also be used on penny stocks, but remember that adding a volume filter to your scan will be extremely important.

Some basic filters you can use to build a penny stock scanner are the Markets and Last Price parameters. You’ll want to set Markets to AMEX only and create a filter that limits Last Price to less than $5. Use the $Volume or Trades filter to set a minimum trading volume or to look only for stocks that are trading above their average daily volume.

From there, your options are virtually unlimited. The % Change filter can be a good place to start to find stocks that are moving on the day – and to exclude stocks that have already made such large moves that they’re likely exhausted. You can also use moving averages to spot stocks that are prospective breakouts or that are about to trigger a moving average cross.

Putting all that together, let’s look at a basic bullish scan that focuses squarely on the “safest” penny stocks in terms of liquidity and volatility:

LAST is less than VALUE 5

AND

DAY’S $VOLUME is greater than VALUE 100,000

AND

Simple Moving Average (1m, 10) is greater than ANALYTIC Simple Moving Average (1m, 50)

AND

PERCENT CHANGE is between 4 AND 20

News Scanner

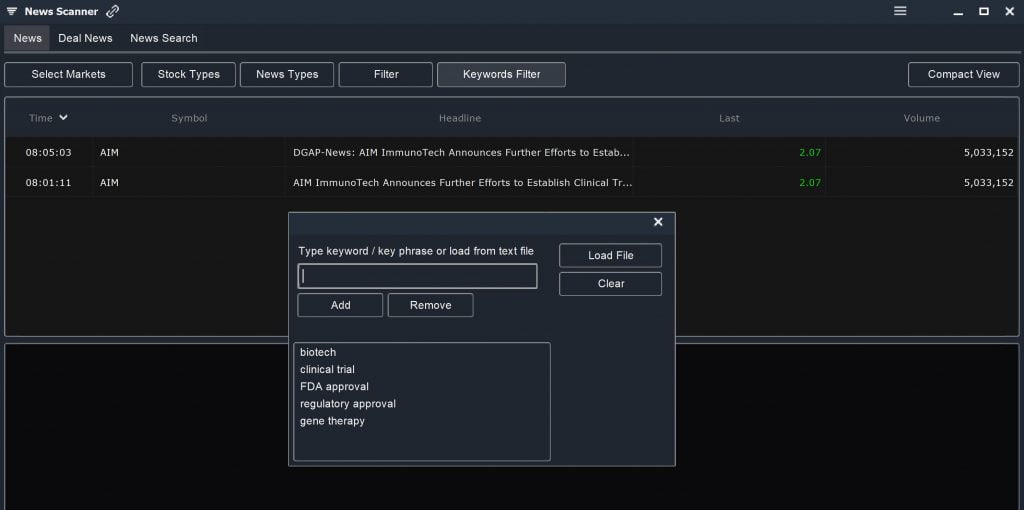

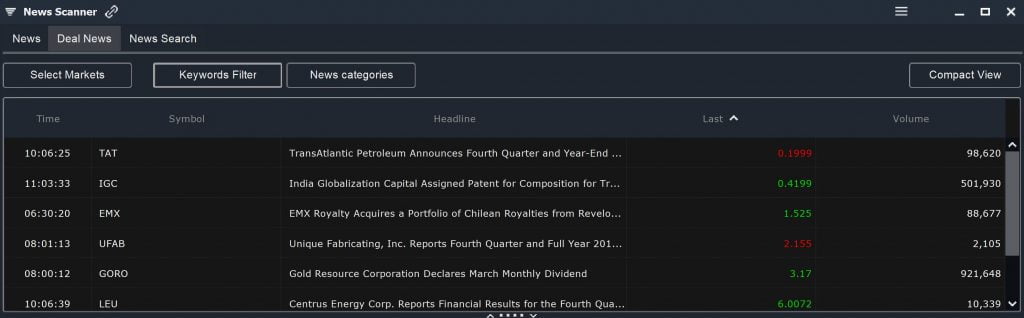

The News Scanner is a great way to keep abreast of news that could impact the price of penny stocks. The filter parameters in this scanner work similarly to the Easy Scanner – you’ll start out by selecting just the AMEX market and placing a cap of $5 on the Current Price filter.

From there, you can enter your own keywords to narrow your search. This is a great way to look for news around specific sectors or specific companies on your watchlist. Alternatively, you can use keywords that target products, trends, or even major companies that may be competitors to discover new penny stocks to trade.

Don’t forget to check the Deal News tab, either. You can’t filter this according to stock price, but you can sort the news according to Last share price to quickly find penny stock news. Deal rumors can trigger massive jumps in share prices, but be careful since not every M&A rumor turns out to be true.

Conclusion

Trading penny stocks can be risky, but for aggressive traders these small-cap companies offer potentially large profits. Part of the trick to trading penny stocks is to find the companies that are reputable, have enough liquidity to enable smooth trading, and are poised for big price movements. With the Easy, Pro, and News scanners in Scanz, you can more easily spot penny stock trading opportunities and build a strategy for success.