Successful trading is all about being at the right place at the right time. More specifically, it’s about trading the right stocks at the right times.

Active traders don’t get attached to hot stock picks; they follow the momentum in the stock market. Some stocks may only present a few trading opportunities throughout the entire year, meaning day traders are constantly refreshing their watch lists.

Day traders may be stalking a particular setup for months before it comes to fruition. If you’re taking a manual approach to this process, you’re wasting plenty of precious trading hours. Staring at a screen waiting for the perfect setup is inefficient and unnecessary. Today, we’re going to discuss how you can set trade alerts to save time and catch more trading opportunities.

What is a Trading Alert?

A trading alert provides you with a notification when a certain set of criteria has been triggered. In EquityFeed, you can set audio alerts, popup alerts, and email alerts.

These alerts can be set for a few different scenarios, including:

- Price changes (i.e. stock hits $X price)

- Percentage changes (i.e. stock is up over 10%)

- Volume changes (i.e stock volume is over 10 million)

- News (i.e. a company releases news or filings)

- And more!

Trade alerts help you stay on top of your trades without having to stare at a screen or flip through hundreds of stocks on a watch list.

Benefits of Trade Alerts

There are a few key benefits to setting trade alerts.

Avoid Missing out on a Trade

The first benefit is straightforward; trade alerts help you avoid missing out on a trade. If you’ve been waiting for months for stock $XYZ to break out above $120, the last thing you want to do is miss the move because the stock fell of your radar. If you set an alert, you can ensure you’ll be ready to take action when the stock starts to break out.

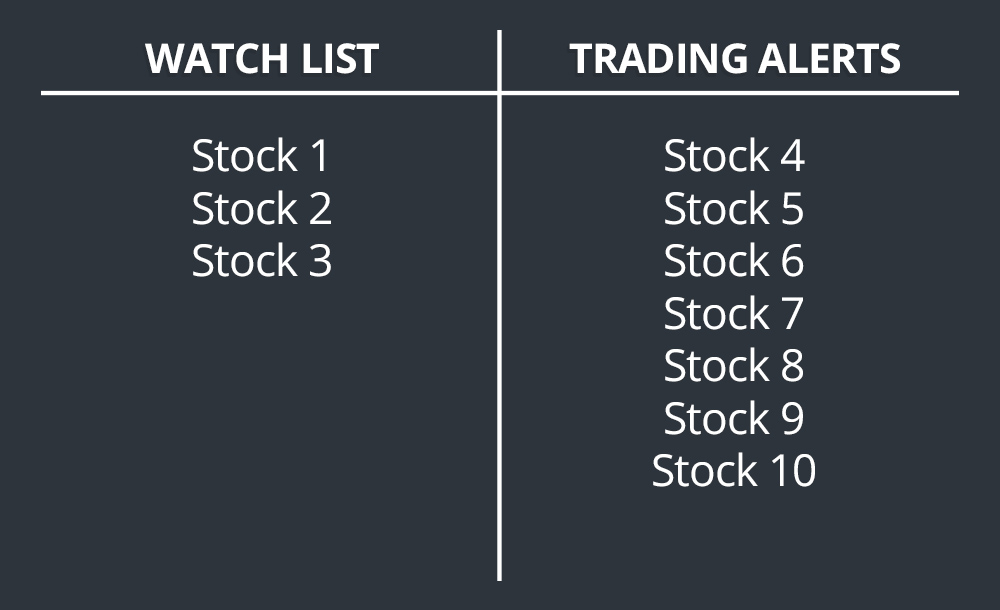

Create Smaller Watch Lists

Successful traders know that “less is more.” If you focus on less stocks, you can give each stock more of your attention, which may lead to more favorable trade outcomes. That said, many new traders get carried away with FOMO (fear of missing out) and create long watch lists. They don’t want to miss a move, so they make sure they are watching as many stocks as possible.

As mentioned above, this approach is counterintuitive to your success as a trader. You’re better off keeping your watch lists simple and setting trading alerts for the other setups.

For example, assume stock $XYZ is trading at $110 and you’ve been watching it for the past two weeks, waiting for it to break above its 52-week high at $125. You’d be better off setting a price alert and shifting your focus to better short-term opportunities.

Track More Setups

Trading alerts can also help you track more setups overall. We’re all human and our attention is limited. We can only focus on so many stocks at one time. If you’ve been trading for a while, you’ve undoubtedly missed out on an opportunity because a stock fell of your radar.

With trading alerts, you can stay on top of all of your setups. Just load up your alerts, and let the platform do the rest of the work for you.

Stay Up to Date on Company News

It’s important for traders to stay up to date on news that may affect the stocks they are trading. If you have a position in a stock (or it’s on your watch list), you’ll want to know if the company reports any significant updates. It can be tedious to scroll through news stories from hundreds of different stocks. Trade alerts can simplify the process.

Simply set up news and/or filings alerts for any ticker and you’ll never miss an update again.

Setting Trade Alerts in EquityFeed

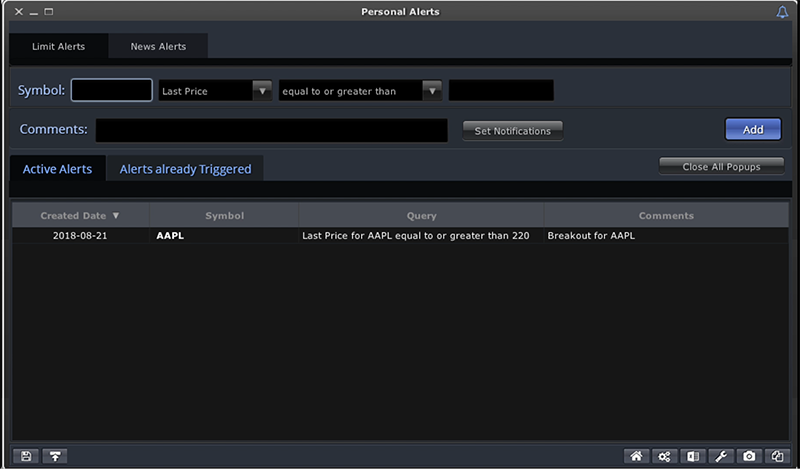

Setting trade alerts in EquityFeed is simple.

Start by navigating to the Personal Alerts tool.

You’ll find sections for both Trade Alerts and News Alerts.

Setting Up a Trade Alert

- Enter a ticker

- Choose which type of alert you’d like to set

- Add any additional comments

- Choose your notification type

- Add to your alerts list

Setting Up a News Alert

- Enter a ticker

- Choose which type of news your interested in

- Add any additional comments

- Choose your notification type

- Add to your alerts list