When investors talk about trading stocks, they are typically referring to the common stock that public companies issue. However, that’s not the only type of equity available for most companies on the stock market. Many companies also issue preferred stock, which offers a very different way of investing in a company.

In this guide, we’ll explain everything you need to know about preferred stock and show you how to scan for preferred stock using Scanz.

What is Preferred Stock?

Preferred stock offers partial ownership in a public company just like common stock. Preferred stock trades on the stock market right alongside common stock.

However, preferred stock operates in practice more like bonds than common shares. Preferred stock holders are offered guaranteed dividends that depend on interest rates as opposed to corporate performance. They also typically lack the voting power that is afforded to common stock holders.

There is a variety of financial and regulatory reasons for why companies issue preferred stock instead of simply issuing bonds. In some cases, it can help them raise money without taking on debt that might impact their credit rating. In other cases, preferred stock can enable companies to raise money without running up against regulations about how much debt they can take on.

Why Buy Preferred Stock?

One of the main reasons that investors might choose to buy preferred stock is that these shares entitle the shareholder to a fixed dividend. This dividend is guaranteed in perpetuity (or for a period of decades, depending on the specific shares) and does not need to be approved by a company’s board like dividends paid to common stock holders.

Typically, the dividend paid out to preferred shareholders is based on current interest rates rather than the company’s performance. This means that preferred stock typically rises and falls in value with interest rates rather than based on a company’s profits. So, changes in the price of preferred shares may not reflect swings in the price of common stocks.

Notably, some preferred stock issues are convertible to common stock at a fixed rate. For preferred stock with this property, price changes in the common stock can affect the price of preferred shares for a given company. Keep in mind that once preferred shares are converted to common shares, they cannot be converted back and lose any dividend privileges they may have had.

Another important benefit to preferred stock is that owners of these shares take priority over common share owners when it comes to payouts. If a company goes into bankruptcy, for example, preferred stock holders are ahead of common stock holders (but behind bond holders) in the line to collect on payments from liquidation sales.

The Downsides of Preferred Stock

There are some disadvantages to preferred stock that are worth keeping in mind. Since they don’t entitle shareholders to profit-based dividends, preferred stock typically doesn’t appreciate over the long term in the same way that common stock does. Preferred stock carries somewhat less risk than common stock, but also potentially lower rewards.

In addition, preferred stock generally does not confer voting rights. So, preferred stock holders don’t have a say in the direction a company takes or in the makeup of the board.

How to Scan for Preferred Stock in Scanz

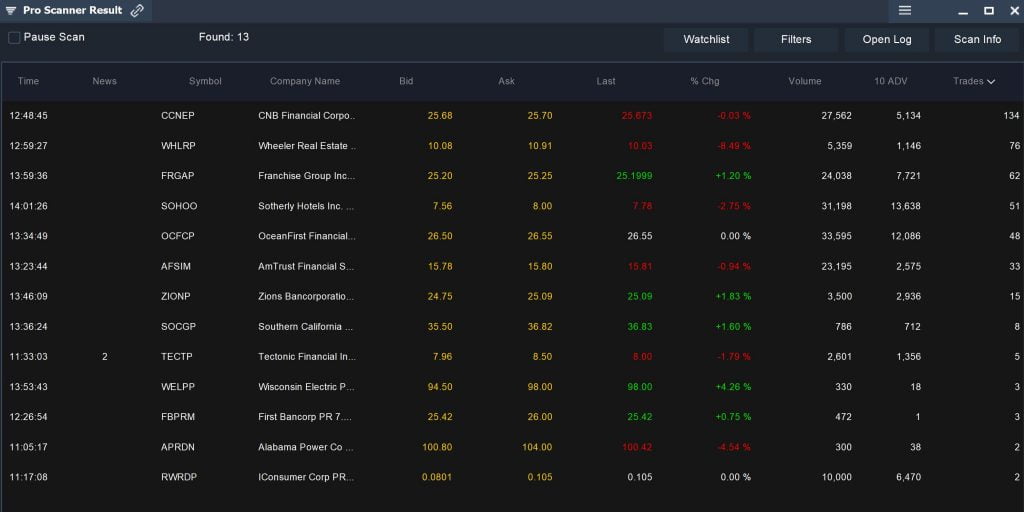

Scanning for preferred stock in Scanz is easy. In either the Easy Scanner or the Pro Scanner, simply select ‘Preferred Securities’ under the ‘Stock Type’ menu. From there, you can create a scan as you normally would or use one of your saved scans.

To give you an example, let’s scan for preferred stock that is experiencing a significant price change using the Easy Scanner. Select ‘Preferred Securities’ as the stock type and under the ‘Filters’ menu set % Change from 2% to 10%. You may also want to add a volume filter, since preferred stock typically trades at much lower volume than common stock even for popular companies.

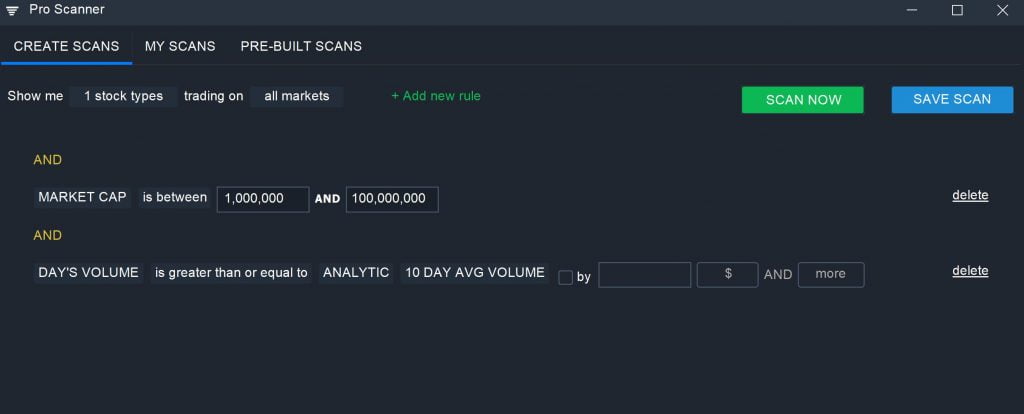

You can also use the Pro Scanner to find preferred stock. For example, you can look for preferred shares of small-cap companies that trading with above-average volume. To create this scan, set stock type to ‘Preferred Securities’ only and then use the following parameters:

MARKET CAP is between 1,000,000 AND 100,000,000

AND

DAY’S VOLUME is greater than or equal to ANALYTIC 10 DAY AVG VOLUME

Of course, your preferred stock screener can be as complex as you want. We recommend keeping it simple and focusing on parameters around company performance and trading volume.

Conclusion

Preferred stock offers a way to invest in public companies and secure a guaranteed dividend and priority shareholder status during periods of financial trouble. Buying preferred shares can be an alternative to purchasing bonds, although most preferred shares don’t offer the same potential upside from long-term growth in a company as common stock shares.

With Scanz, you can easily screen for preferred stock using either the Easy Scanner or Pro Scanner. Just select ‘Preferred Securities’ as the stock type for your scan and then build a screen as you would for any other type of stock investment.