Day traders regularly use watchlists to keep an eye on stocks that could present trading opportunities. But staying on top of a large watchlist or multiple different watchlists for different strategies can quickly become difficult.

With Scanz, you can create real-time watchlist scanners to ensure you never miss a chance to trade. Today, we’ll explain how a watchlist scanner can improve your trading and show you how to set up real-time watchlist scanners in Scanz.

Why Use a Watchlist Scanner

Watchlists are designed to help you stay on top of potential trading opportunities. However, it’s easy to run into trouble trying to manage multiple watchlists, each with dozens of stocks, every trading day. Even if you are able to stay on top of your watchlists successfully, having to constantly keep an eye on them detracts from your ability to focus on the trades at hand.

Using a watchlist scanner can enable you to stay on top of your watchlists without having to monitor them all day long. With a watchlist scanner, you can quickly see when a setup you’ve been waiting for is unfolding and get an alert when it happens.

You can also use watchlist scanners to narrow down a general use watchlist to a selection of stocks that are experiencing high volatility or high volume during the current trading day. If you have multiple different watchlists for different trading strategies, you can even use scanners to identify which individual watchlist is most active on a given day.

Creating a Watchlist Scanner in Scanz

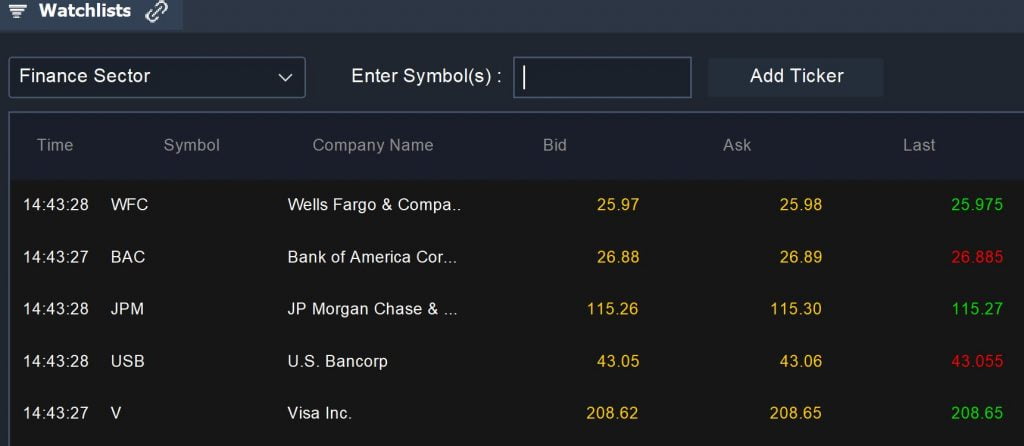

The first step to creating a watchlist scanner with Scanz is to create a set of watchlists. You can do that easily using the Watchlists module. Just give your watchlist a name and add the ticker symbols you want included. You can create as many custom watchlists as you need.

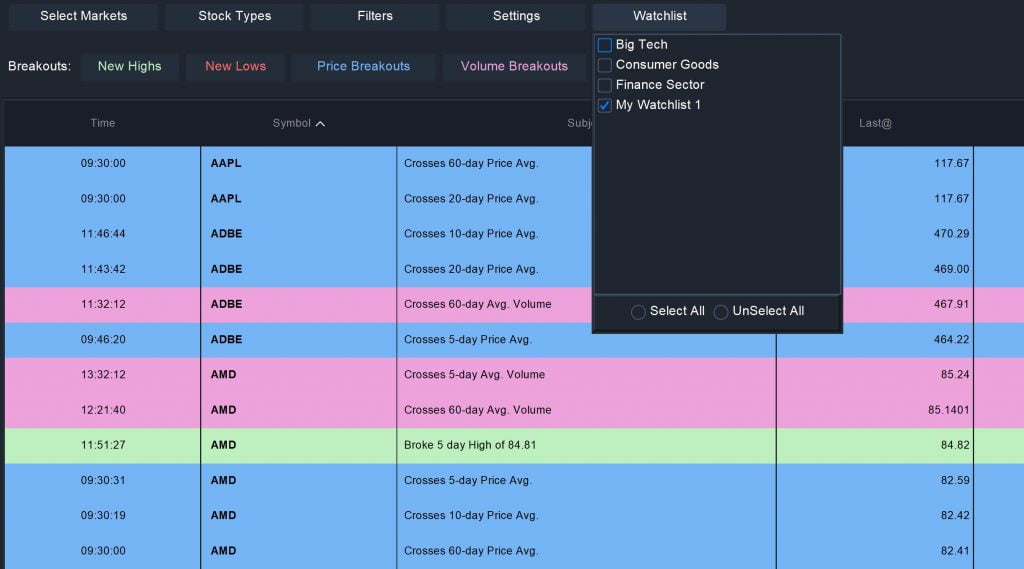

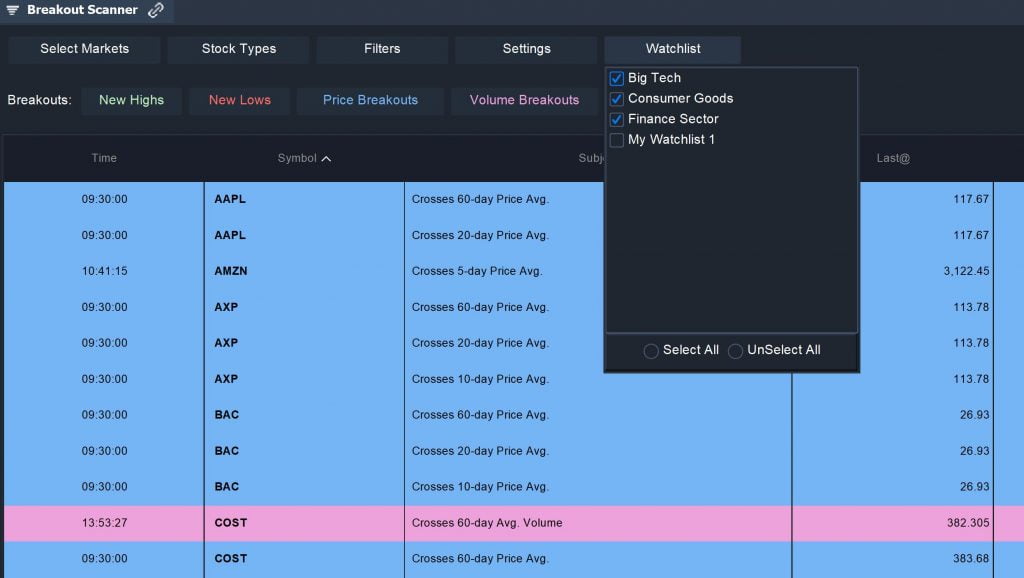

Then open the Breakouts Scanner and load your watchlists. Click the Watchlist menu and select any watchlists you want to include in your scan.

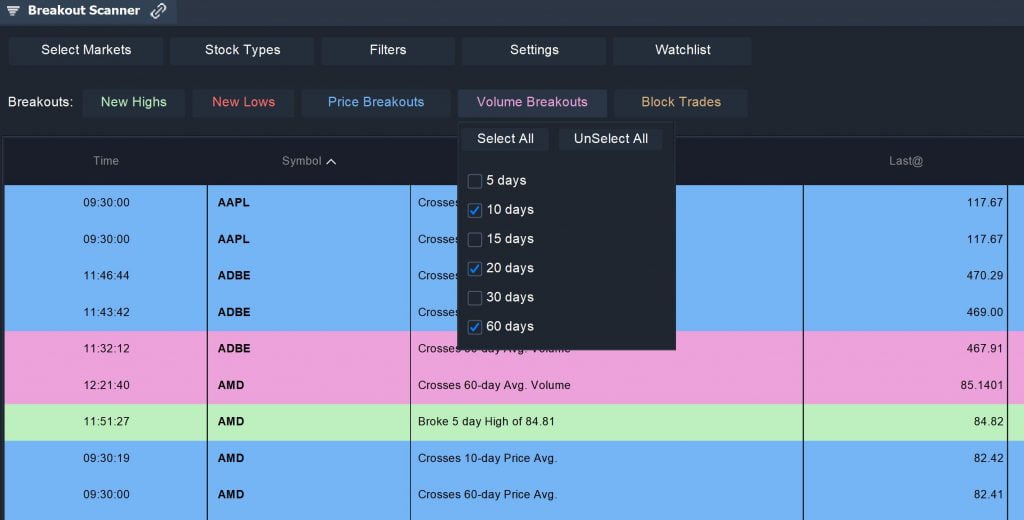

Finally, set the Breakouts Scanner parameters according to your strategy. For example, if your strategy is looking for price breakouts on strong volume, include a selection for New Highs and a selection for Volume Breakouts.

The Breakouts Scanner will now display scan results and update in real-time. Anytime a stock in one of your selected watchlist satisfies your scan parameters, it will appear in the results table.

Putting Your Watchlist Scanner to Work

There are a number of ways you can use a watchlist scanner in Scanz to improve your trading. Let’s take a look at some potential uses for day traders:

1. Scan for Big Moves

The first thing you can do with a watchlist scanner is to look through your watchlists for stocks that are making moves. For example, you can set up the Breakouts Scanner module to look for stocks in your watchlists that are experiencing price breakouts, higher than average trading volume, or both.

This is a great way to ensure that you don’t miss out on the very price movements that you set up a watchlist to monitor for in the first place.

2. Slim Down Your Daily Watchlists

You can also use your watchlist scanner to help you focus your trading efforts. You may have dozens of stocks across your watchlists, but only a handful of them are highly active on any given day. You can spot these active stocks by scanning across your watchlists, then focus just on those ticker symbols for the remainder of the trading day.

At the same time, keep the Breakouts Scanner running in the background. You can check it every so often to ensure you don’t miss out on any big movements in the other stocks in your watchlists that might happen over the course of the trading day.

3. Create Watchlists for Your Scans

Instead of starting with a watchlist and building a scan around it, you can also start with a scan idea and build a watchlist around it.

For example, say you want to trade penny stocks. Most penny stocks are illiquid, so they don’t need your attention most of the time. Instead of spending time monitoring the entire universe of penny stocks, you can create a watchlist of penny stocks and pull it up in the Breakouts Scanner. Then, you’ll be alerted in real-time whenever there is abnormal trading behavior like high volume or price breakouts.

4. Monitor Sector Performance

You can also create watchlist scans that allow you to keep an eye on individual market sectors. This is a great way to keep track of whether stocks across an industry, like tech or finance, are experiencing unusual trading activity.

To monitor sector performance, create individual watchlists for all the sectors you want to monitor. Then set up a watchlist scan in the Breakouts Scanner and toggle each sector on or off. If you turn one sector on and the results list lights up with a variety of alerts, that’s a signal that companies in that sector are riding a wave of trading activity.

Conclusion

Scanning your watchlists for price and volume breakouts can help you spot potential trading opportunities in real-time. Watchlist scanners also enable you to trade more effectively by allowing you to create smaller daily watchlists or to track active stocks by trading strategy or market sector. With the Breakouts Scanner, it only takes seconds to set up an effective watchlist scanner in Scanz.