Day trading is one of the few jobs that provides infinite profit potential. There is no cap on the amount of money you can make if you continue to grow your account. Making $50,000 per year? Take it to $100,000. Making $1 million per year? Step it up and hit $10 million!

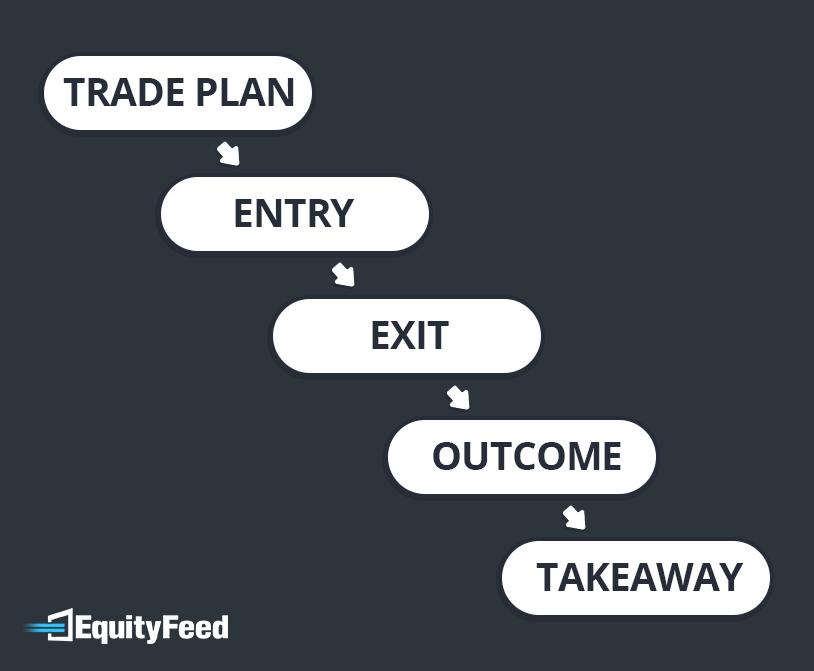

Mastery is a myth. Regardless of how skilled or profitable you are, there is always a next level. If you want to reach new levels and set new milestones, you need to record and analyze your progress. The best way to do this is by logging your trading activity in a trading journal.

What is a Trading Journal?

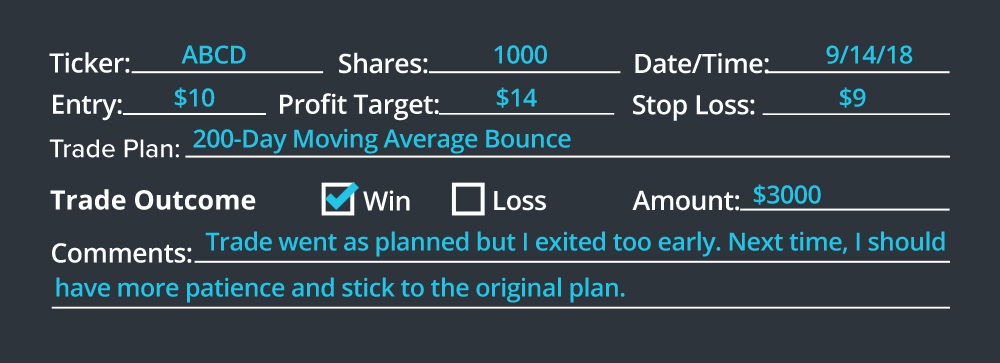

A trading journal is a log of all of your recent trades. Generally, a trading journal will include relevant data such as entries, exits, position sizing, trade rationale, etc. For example, a journal entry may look like:

There is no universal format for a trading journal. You can keep a physical journal, a Word Document or Excel Spreadsheet, or utilize an online trade analysis software. Choose whichever option fits your needs.

Why You Should be Keeping a Trading Journal

Many traders want to focus solely on the exciting parts of trading. Sniping trade setups is far more appealing than introspection and trade analysis. That said, analyzing your trading behavior provides a variety of benefits.

Collect Data

Having access to the right data puts you in an advantageous position. When you keep a trading journal, you are building a database full of valuable information. This data can be applied in a variety of ways as you advance in your trading career.

Pinpoint Strengths and Weaknesses

Often times, we’re blind to our own strengths and weaknesses. We may discount our strengths and ignore our weaknesses. This is a hindrance in our day-to-day lives, and even more so in trading when real money is on the line.

While we may be blind to our own strengths and weaknesses, data doesn’t lie. For example, if you notice that 80% of your short trades result in a loss and 70% of your long trades result in a profit, it would be hard to refute the fact that you’re better at long trades. This type of information can help you reshape your trading strategy to play off your strengths.

Hold Yourself Accountable

All traders are susceptible to emotional influence. Traders should aim to replace emotional influence with reason and logic. Keeping a trading journal can often be the key to this robotic trading approach. When you record a trading journal, you are holding yourself responsible. You have to explain all of your trades to yourself, so you better have good rationale. For example, you may not want to log a trade that you entered because “everyone on Twitter was talking about it,” whereas you may feel comfortable entering a trade based on a news catalyst.

Avoid Future Mistakes

The ultimate goal of logging your trades is to help you improve your results. This includes profit maximization and loss minimization. Small changes can have profound impacts on your net profitability. For example, lf you have $1000 in losses every month and you minimize the losses by only 10%, you will save $1200 over the year.

Keeping a trading journal helps you identify what NOT to do in the future. Over time, this will help you minimize your losses and shift your attention to the most profitable areas of your trading strategy.

Track Your Growth as a Trader

As mentioned earlier, we often discount our strengths. Similarly, we often minimize our progress as we work towards a big goal. While it’s good to stay focused on your end goal, its important to appreciate the milestones along the way. Keeping a trading journal allows you to track your growth and analyze your progress. This allows you to stay motivated and recognize the positive changes you’ve made to your trading strategy.

Components of a Good Trading Journal

Hopefully you’re sold on the idea of keeping a trading journal by now. The next step is getting started. So, what should you include?

There are two parts to the answer. First, you should include some key information that we will discuss below. Second, you should feel free to include any information that is relevant to you.

It’s also important to note that you can choose to create journal entries in real-time or after the trade. When possible, real-time entries are preferred as they will generally be more insightful than a future analysis.

Let’s get started with the key components.

Order Entry Information

Start by recording the basic order entry information such as the ticker, position size, date & time, and entry price.

Order Exit Plan

Next, record your plan for trade management. What happens after you’ve entered your position? When will you exit if your profitable and what is your stop loss? If you can answer these questions, trade management will be a breeze. You know exactly when you plan to sell regardless of how the trade pans out.

Trade Plan

The trade plan is one of the most important parts of a trading journal. It’s also the only qualitative piece of data you will be recording, so you can record as much or as little as you’d like. Your goal is to answer the question, “Why did I enter this trade?” Remember, you have to answer to yourself later so make sure to record a good response. Here are some examples of good and bad trade plans:

- GOOD: Stock was reacting to a news catalyst. I was able to initiate a position with a 4:1 risk/reward ratio and momentum was in my favor.

- BAD: I saw the stock running and I wanted to make sure I got in before it was too late.

Trade Outcome

How did the trade play out? Mark whether it was a win or a loss and enter the total profit or loss.

Additional Comments

Most of us tend to avoid “additional comments” fields. That said, your trading journal isn’t an online survey – it’s a personal tool. Adding additional comments can be insightful in the future. For example, you may mention that you had to be at an appointment 30 minutes after entering the trade so you mismanaged your position. In the future, you would know its better to avoid trading when you have other obligations.

Other Considerations

Your trading journal is your own personal tool; you make the rules. Consider logging any information that is relevant to you. Trading during work vs. trading at-home may be irrelevant to some traders and highly influential to others.

Of course, like any data set, you want to keep it relevant. If wearing a red shirt didn’t impact your trading, keep it out of the journal. Here are some possible considerations:

- Trading Environment (i.e. work, home, laptop, desktop, etc.)

- Type of Stock (i.e. penny stock, NASDAQ,, biotech, etc.)

- Timeframe (i.e. scalp trade, day trade, swing trade, etc.)

- Broker Used (If your commissions are adding up)

- Chart Pattern (i.e. bull flag, wedge, triangle pattern, etc.)

- Mood (i.e. tired, frustrated, energized, etc.)

Free Trading Journal

You’re officially ready to start your first trading journal! We’ve included this free trading journal to help you out along the way. Fill them out on the computer or print them out to keep on your desk.

If you have any trading journal tips, share them in the comments!