Did you ever watch the scene in Wall Street where Bud Fox is in his Manhattan penthouse at 4 am looking at his trading monitors and think to yourself, “I could see myself doing that…”

Maybe you know a friend, of a friend, of a friend, who made it big trading stocks and the idea of quitting your job to buy and sell stocks at home in your pajamas just won’t get out of your head.

Whatever the case may be, you have the burning desire to dive into stock trading – and that’s great!

But before you get too carried away, there are some things you need to know. Make no mistake – trading is trench warfare. Success isn’t guaranteed, and there are people out there who will rip you off and bleed your accounts without even a hint of guilt.

The best way to protect yourself is with education. Start by familiarizing yourself with the basic principles that all successful stock traders need to live by.

Welcome to the Trenches

Don’t get me wrong. I’m not saying all of this because I want to scare you away from trading. I’m warning you because I know you’ve worked hard for the money you’ll be depositing (or have deposited) into your online brokerage account.

And believe me – I want you to keep as much of that money as possible.

Heck, I want you to double or triple that money with good, solid trades, but there are a few things you have to know before you put any of your money on the line.

The thing is, if you don’t know what you’re doing – and you dive in before taking the time to educate yourself – you could lose thousands of dollars (or more) on your first day out.

That education can’t just come from anywhere. Learn from real traders who are in the trenches, making plays each and every day. And learn from your own experiences as well.

Just don’t rely on internet gurus or paid newsletters promising you the world. Remember, if a so-called expert seems to make more money selling training courses and other educational products, they’re probably not somebody you should turn to for good advice!

I want you to stay in the game long enough to be successful, but doing so requires that you follow the rules of trading. Here are a few of the rules you need to learn, from a source you can trust:

Meet the “3 Pillars of Trading”

Before you even think about placing your first trade, think about the following three factors which I like to call the 3 Pillars of Trading. Getting crystal clear on these issues is one of the best things you can do to protect and preserve your trading capital.

“Whenever you catch yourself wading into unfamiliar trading waters, put these pillars into practice. They’ll guide you to the most successful trades you can make.”

1) Pick a Trading Method

It might surprise you to hear this, but not all trading styles are created equal. A daytrader has a very different process than a swing trader, who has a different set of goals and objectives than a long-term investor.

If you’re reading this blog and using the EquityFeed platform, it’s probably because you’ve already committed to a highly-active style of trading. So what I want to caution you about is something known as “shiny object syndrome.”

You’re learning to trade as either a daytrader or a swing trader, but it’s taking time and you’re making mistakes (totally normal). Stock trading isn’t rocket science, but there is a learning curve. You might not see results right away, and this can frustrate traders who aren’t truly committed for the long-term. They start looking around, see an article about somebody who made money as a dividend investor or growth investor and decide to shift their focus away to this new trading method. A few weeks later they decide that stocks altogether is not for them and jump into options or futures. I hear these stories almost every day.

So how do you think that person’s results will compare to somebody who commits to only daytrading and then immerses themselves into studying everything they can about that method day in and day out? At the end of a few weeks, months or years, who do you think will come out ahead – the dabbler who keeps jumping around, or the person who’s invested the time needed to become a true expert?

I know it’s tempting to dip your toes in every possible trading pool, but your results will suffer if you do. When you’re constantly shifting your method, you aren’t able to properly focus, get deeply educated and learn from the big players in your trading style. You won’t have the time to learn the setups and patterns you feel most comfortable trading.

Ultimately, you’re going to wind up all over the place and out of capital.

The bottom line is this – you’ve committed to active trading, so don’t change your style! Don’t risk your valuable capital and future profits chasing a quick payout. They rarely, if ever, happen. Dedicate yourself to your chosen method, make the necessary mistakes, learn from those priceless lessons, and your returns will come in time.

2) Understand Risk Management

I hate to break it to you, but stock market success is not highly probable. In fact, it’s estimated that a s many as 90% of new traders lose more than they’ll ever make.

One of the reasons losses like these exist is that these aspiring traders don’t put any thought into theirrisk management tolerance. All they see is the upside, so they do nothing to protect themselves from potential losses. Big mistake.

To determine your own risk tolerance, ask yourself the following questions:

If I never earned a single penny as a trader, how much money am I comfortable losing? Think of money you invest in stocks like money you’d be willing to walk away from at a casino. If you’re depending on the money you want to trade with to cover your daily living expenses, it shouldn’t make it into your brokerage account in the first place.

How much am I willing to risk on a single trade? Even that “100% sure, guaranteed” stock tip you received could turn out to be a bust. That’s why it’s always a good idea to scale into a trade. Make a small first trade that’s akin to sending out a probe. If the stock acts the way you expect it to, scale up your position size to the level you’re comfortable with.

How long will it take me to make up potential losses? The more you lose, the longer it’ll take to get back to where you once were. Consider that each and every time you go to execute an order – especially if you’re planning to take a large enough position that potential losses would set you back significantly.

Before you start trading, it’s a smart idea to familiarize yourself with the concept of the risk-reward ratio, as you can use this tool to protect yourself from losses. Here’s how it works…

Suppose you buy 500 shares of XYZ Company at $4 a share, making your total investment $2,000. You expect that the stock price will go up to $6 a share, giving you a potential profit of $1,000. But since you know that things can go south at any moment, you immediately put in a stop-loss order at $3.50 a share, limiting your potential losses to a maximum of $250.

Essentially, you’re willing to risk a loss of $250 for a potential profit of $1,000. This makes your risk-reward ratio 1:4 on that particular trade.

The most important component in the above example was the stop-loss order which is a sell order that’s set in advance to execute automatically when a stock reaches a certain price. In the example, your stop-loss is set to $3.50 a share so that, as long as buy orders exist to execute your trade, you’re able to get out before your losses get too big.

You could certainly have aggressively set your stop-loss at $3.90 for a maximum loss of $50. Different traders feel comfortable with different risk-reward ratios, but it’s something you want to have in place on every single trade you place. No exceptions. Knowing all of your possible P&L scenarios in advance, before entering the trade, is arguably one of the most important things you can do. This is when trading goes from “gambling” to making smart, calculated risks and prevents the kinds of losses that can take you out of the game for good.

3) Develop Your Trading Psychology

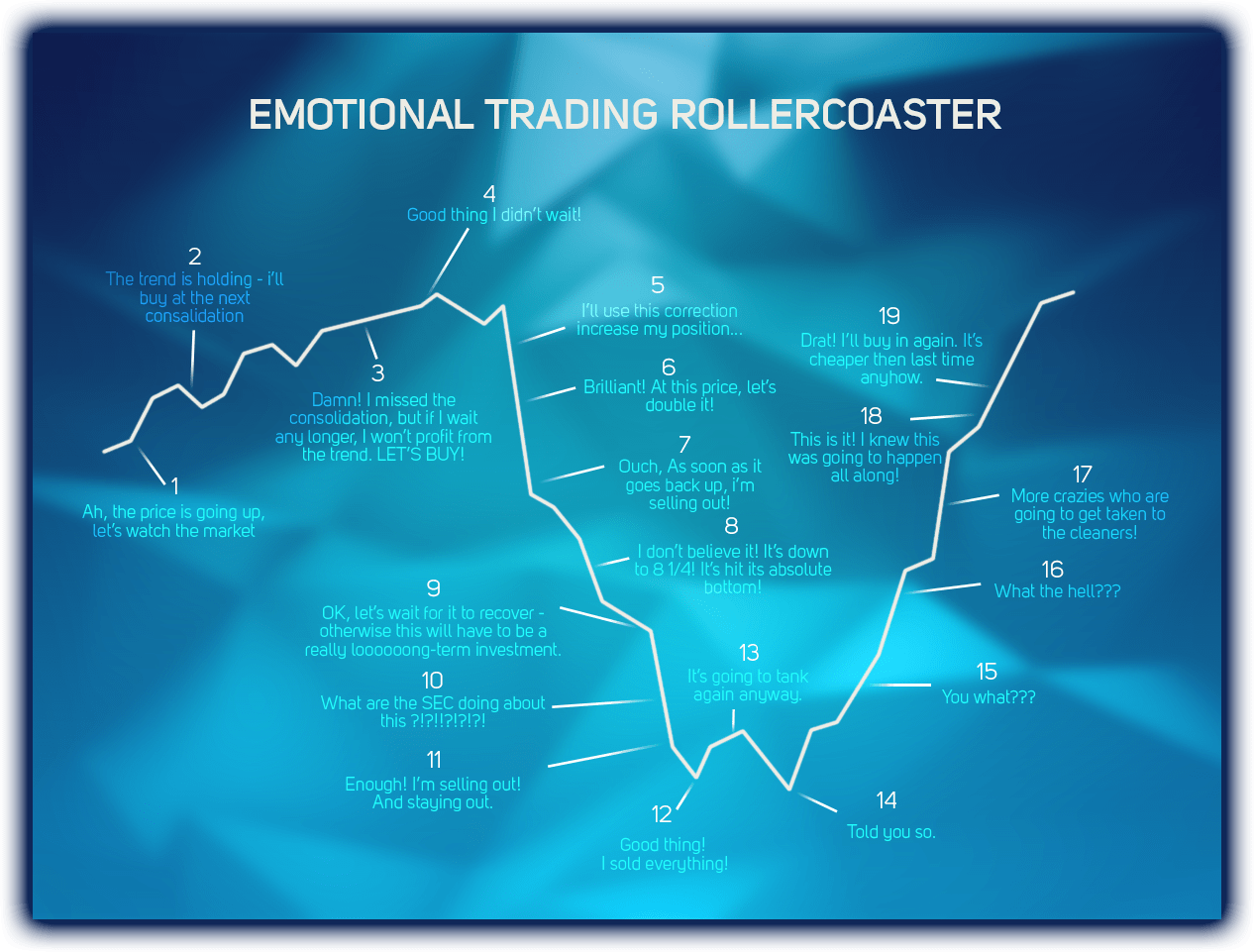

Stock trading might seem strictly like a numbers game, but it’s as much about controlling your thoughts and emotions as it is making decisions based on price action.

In particular, there are two emotions you need to pay special attention to: greed and fear. If you aren’t disciplined in controlling these negative thought patterns, you’re almost certainly going to wind up facing significant losses as a trader.

If you book a few profits, it’s easy to let greed take over. You’ve done well a couple times – and now you want more. The problem is that, if left unchecked, greed can manifest itself as overtrading. You force setups just to give yourself the chance of success – even if the numbers just aren’t there.

To protect yourself from greed, ask yourself regularly if you’re making a play because the setup is right or because you’re being swayed by the profit potential. Only trade when all your factors come together.

Fear, on the other hand, comes from being afraid of the risk involved in stock trading and not pulling the trigger when conditions are optimal. I can’t even tell you how many times I’ve had to snap myself out of being frozen in a trade because I let fear take over!

If you fall victim to these emotions, remember that it’s ok – you’re only human. It’s natural to experience these intense emotions – especially when your hard-earned money is at stake. Nothing makes the head and heart ride an emotional rollercoaster quite like having your own money on the line. In fact, I’d be pretty worried about you if you never felt anything when executing trades.

Don’t expect to get rid of them entirely. Instead, focus on being aware of the emotions you’re experiencing and using this awareness to practice developing the emotional control needed to trade successfully.

How to Apply This to Your Trading

I wish I could tell you that I came to these realizations before I lost money making bad trades, but that’s just not the case. These are hard-fought lessons, hard-earned from the mistakes made in the past as a beginning trader.

I’m sharing them with you because I truly want you to be successful, and because these lessons that I and many others had to learn the hard way may help prevent you from making the same mistakes.

So what I want you to do is to print them out, paste them on your wall and read through them every day. Repeat these words over and over again: PATIENCE. DISCIPLINE. STICK TO THE PLAN. GREED. FEAR. MANAGE MY RISK. Whenever you catch yourself wading into unfamiliar or choppy trading waters, lean on these pillars and they’ll guide you to the most successful trades you can make.

Have a question about the 3 Pillars of Trading? Let us hear your thoughts in the comments below!