High of day scanners can be extremely useful for finding stocks that are poised for an intraday move. These scanners identify momentum stocks that are readying for a breakout, allowing day traders to quickly home in on promising positions.

In this article, we’ll cover what high of day scanners are and how you can create your own using the Breakout Scanner and Pro Scanner in Scanz.

What is a High of Day Scanner?

A high of day scanner is a simple stock scan that looks for stocks that are setting new intraday price highs. But, price alone isn’t enough to signal a sustained move that’s worth trading. So, the best high of day scans also look at trading volume around the new intraday high relative to trading volume for earlier in the day or for the same period on a daily average.

Importantly, it’s easy to customize high of day scanners. For example, you can look only at specific market sectors or at stocks with a certain market capitalization range. More helpfully, you can also limit your scan to stocks that have already made a significant price move on the day and may be trading with some momentum.

The Significance of High of Day Scan Alerts

The reason that day traders like high of day scans is that they indicate a potential intraday breakout. Stocks that are hitting new intraday highs on higher than average trading volume are often able to successfully move through resistance levels if the trading pattern continues. This is particularly true if the stock has already seen a bullish move of several percent on the day so far and is trading with strong momentum.

Thus, creating a high of day scan and setting alerts is a good way to catch short-term momentum breakouts before they take off.

How to Trade High of Day Scan Alerts

Trading stocks that trigger a high of day scan alert is a lot like trading any other momentum breakout. It’s important to look for other technical signals that might signify a bullish breakout, such as a positive MACD signal or a high ADX that indicates the stock is strongly trending.

Of course, it’s important to check the chart for previous failed breakouts as well. These can help identify band of resistance that the stock will need to break above in order for the price to continue rising, thus providing context for entry and exit points for a trade. Alternatively, failed breakouts can serve as a warning to ensure that the breakout is successful before opening a position.

One other way you can identify whether a high of day alert coincides with a resistance break is to look at daily charts. A sustained break above a multi-day moving average that coincides with the high of day is a strong sign that a breakout is in progress, as the moving average itself may have served as a resistance level. You can also identify other medium- and long-term resistance levels from a daily chart, which give insight into whether the high of day truly represents a price breakout.

Setting Up High of Day Scanners in Scanz

With Scanz, you have two options for creating high of day scanners: the Breakout Scanner and the Pro Scanner.

Setting Up High of Day Scans with the Breakout Scanner

The Breakout Scanner is a great place to start for finding stocks hitting new intraday highs with Scanz. At the most basic, just scan for new day highs (under “New Highs”).

But, it’s a good idea to add some additional filters to your scan to make sure you’re only getting quality momentum movers. You can limit your scan to only stocks that have seen at least a 4% positive price movement on the day and only to stocks that are above a specific market cap. You may also want to limit your scan to stocks with a minimum trading volume of several hundred thousand shares (or use $ Volume to set a limit by total trade value).

Unfortunately, while you can also scan for volume breakouts with the Breakout Scanner, you can’t look at volume around the price high relative to the rest of the day or the previous day. So, the Breakout Scanner is best for getting a quick overview of stocks to further investigate.

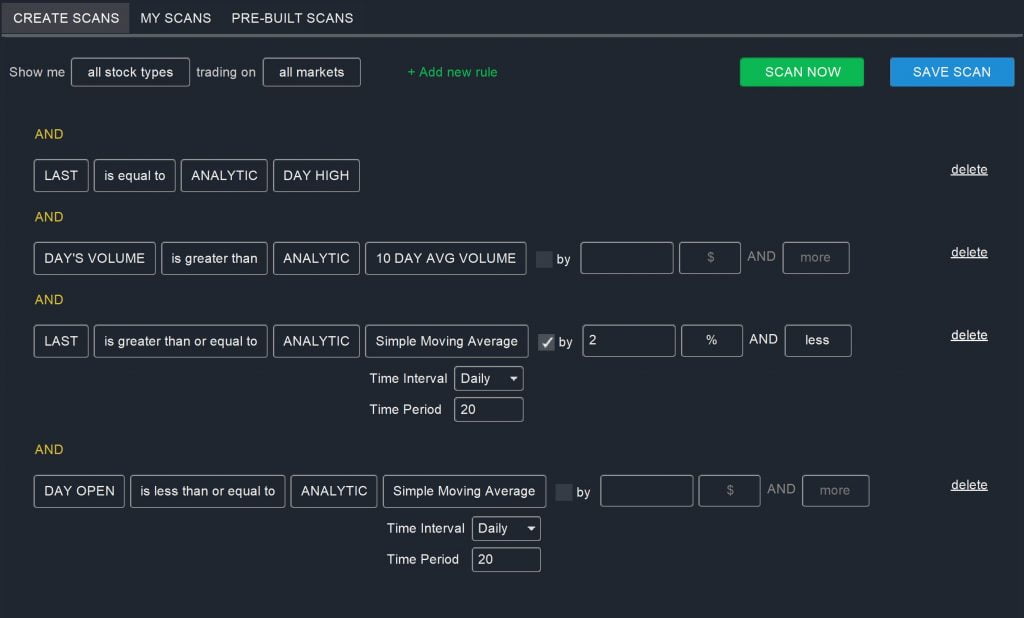

Setting Up High of Day Scans with the Pro Scanner

The Pro Scanner in Scanz gives you more precise control over your high of day scan. It’s still easy to search for new intraday highs – simply set a rule that “LAST is equal to ANALYTIC DAY HIGH” – but you can also introduce a number of more complex parameters. For example, you can look only for stocks that are trading on higher trading volume than average while also trading at or just above their 20-day moving averages:

LAST is equal to ANALYTIC DAY HIGH

AND

DAY’S VOLUME is greater than ANALYTIC 10-DAY VOLUME

AND

LAST is greater than or equal to ANALYTIC Simple Moving Average (Daily, 20) by 2% AND Less

AND

DAY OPEN is less than or equal to ANALYTIC Simple Moving Average (Daily, 20)

This scan more specifically finds stocks that are at or have just broken above a potential resistance level on strong volume, which offers a prime opportunity for day traders.

Conclusion

A high of day scanner is an extremely useful tool for quickly identifying stocks that can breakout with strong momentum. The beauty of these scanners is that they can be endlessly customized to fit your existing day trading strategy. Of course, as when trading any breakout, it’s important to use a variety of technical signals to confirm the move and to identify appropriate entry and exit points.