Anyone can build a basic stock screen, but building high-quality scans that surface actionable stock ideas takes practice along with trial and error. Given the entire library of parameters and tools that Scanz offers, you need to know how to put different components together in order to make stock screeners that work for you.

So, let’s take a look at 8 tips you can use to start building better scans.

1. Define Your Setup

Stock screeners are designed to help you find stocks with a specific setup. In order for you to get anywhere with you scans, the setup you’re looking for needs to be well-defined.

The more specific you can get, the better. For example, “hot stocks” isn’t an actionable setup, but “breakout stocks” or “moving average crossovers” are. Focus on attaching measurable indicators or price movements to the setups you have in mind. “Breakout stocks” may be defined as stocks experienced a 5% gain on above-average volume, for instance. Once you have that level of specificity, it’s much easier to define a scan that will actually return the setups you have in mind.

2. Choose Your Stock Targets

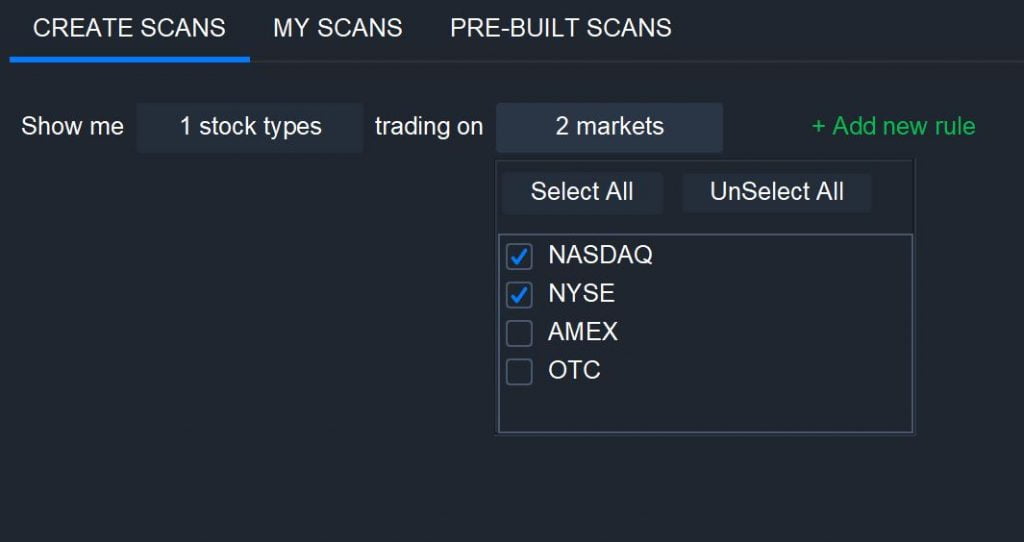

Scanz gives you the power to filter your results based on factors like what exchange a stock is trading on, what price range it’s trading in, and what its market cap is. Put these filters to work!

If you’re only interested in trading large-cap stocks on the NYSE or NASDAQ, for example, you can limit your results to only companies that fit these criteria. That way, when you look through your scan results, you know that you will only be looking at stocks that fit your broad target categories.

3. Try Reverse Engineering

One of the best ways to go about developing actionable scans is to look for setups you like and then try to target them with a scanner by reverse engineering. Start by finding a few examples of the setup and then see what characteristics they have in common. Look at factors like price, volume, price change, and technical indicators.

Remember to keep your scan somewhat broad, rather than tailoring it tightly to your setup examples. Even if the setups you evaluated were perfect examples of the situation you’re looking for, there might be edge cases that you still want your stock scan to pick up.

4. Keep It Simple

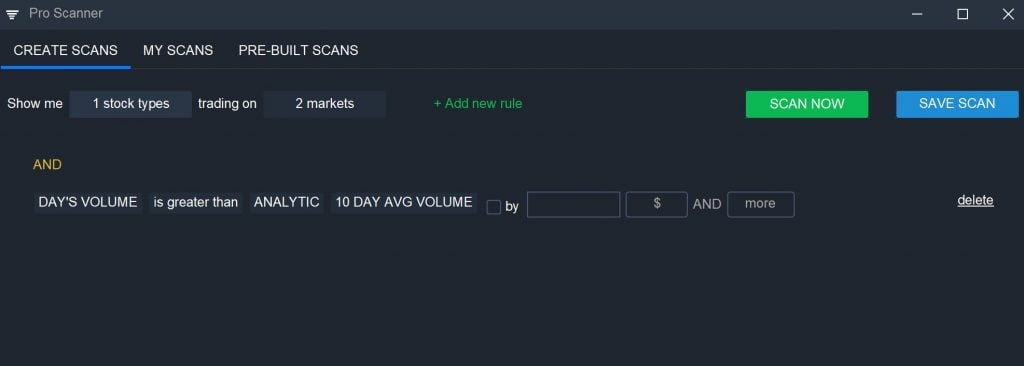

Simpler scans are almost always better than complex scans. By using only the filters you need – not every filter that could possibly define a setup – you leave your scan open to finding variations on your target setup that you may not have expected. Simpler scans with fewer parameters also tend to work better when market conditions change suddenly, such as after a pullback.

5. Use Comparative Metrics

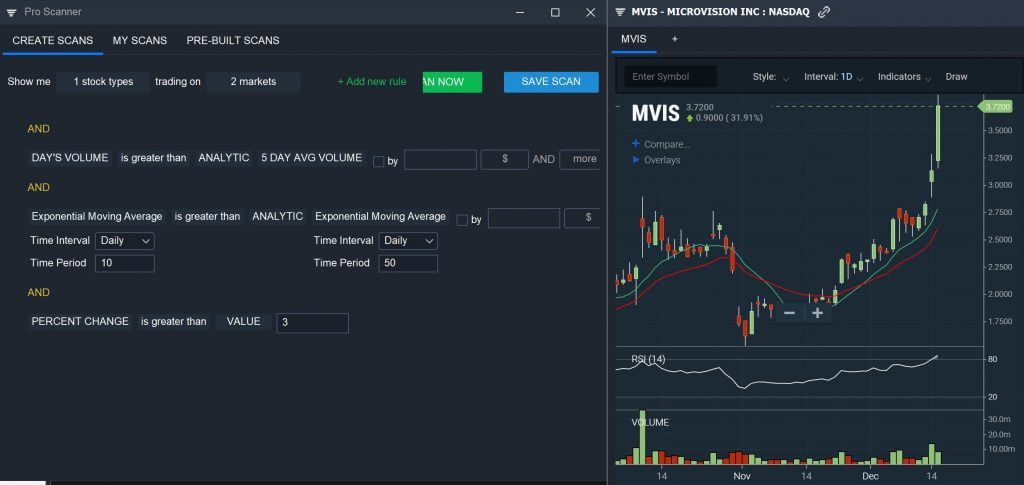

Using comparative filters can also help to keep your scans more flexible in the face of changing market conditions. For example, if you set an absolute volume cutoff, you may miss potential setups on stocks that generally trade with low volume or on days when market activity as a whole is low. On the other hand, if you use a comparative parameter for volume filtering – such as, day volume is greater than the 5-day average volume – your scan will work as intended even for stocks that don’t meet a specific threshold.

This type of comparative approach also works well when looking for price momentum or other changes over time. It’s especially helpful when the overall market drops or rises sharply.

6. Get Creative

Don’t be afraid to try out new ideas and parameters when building a scan. Figuring out exactly what parameters can be tricky, even when using reverse engineering. By being willing to try out different approaches to a scan, you increase your chances of getting the right combination of parameters to find the setup you have in mind.

In practice, being creative can simply mean trying out different parameters that describe the same quantitative idea. For example, you could try to find price momentum by scanning based on price relative to a moving average. Or you could identity momentum by scanning for stocks that are more than a specific percentage off their lows and within a percentage of their highs.

7. Recognize That Less is More

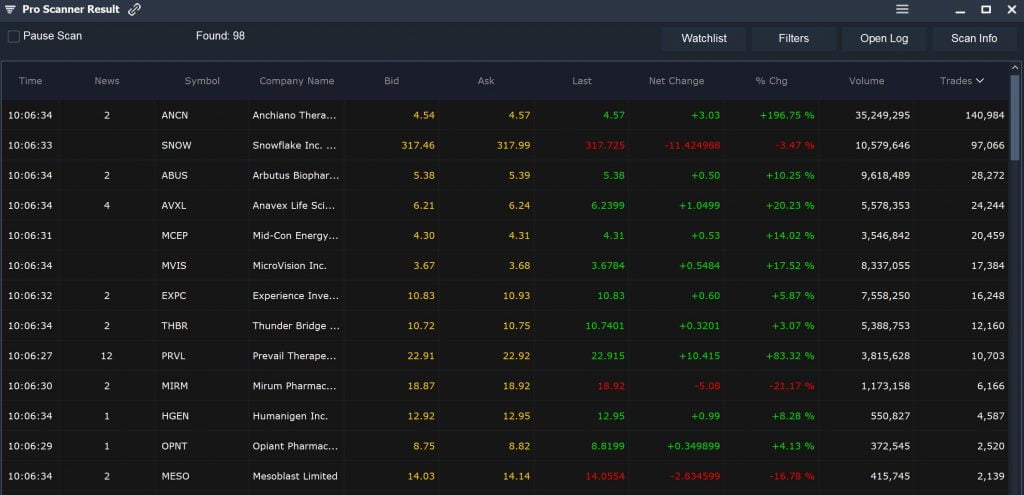

It’s easy to get disheartened if your scan only returns a few potential trading opportunities. But keep in mind that a scan that returns a handful of actionable, profitable trading setups is far superior to a scan that returns dozens of mediocre setups. Focus on the quality of your scan results, not the quantity.

8. Build, Test, Refine, Repeat

Building high-quality scans is an iterative process. After you build an initial scan, test it out to see if it returns the trading setups you’re targeting under the market conditions you want. Think carefully about what results are appearing that you don’t want and what results that you do want aren’t appearing, and modify your scan accordingly. Then repeat the process until your scan reliably returns the setups that you want to identify.

Building high-quality scans is an iterative process. After you build an initial scan, test it out to see if it returns the trading setups you’re targeting under the market conditions you want. Think carefully about what results are appearing that you don’t want and what results that you do want aren’t appearing, and modify your scan accordingly. Then repeat the process until your scan reliably returns the setups that you want to identify.

Conclusion

Building robust, actionable stock screeners takes practice, patience, and careful analysis. Use these 8 tips to improve the quality of your scans and find better potential trading opportunities.