If you want to be a successful day trader, you need to trade the right stocks at the right time. Every day, there are thousands of stocks being traded, but only a few that are worth your attention. Your goal is to follow the action and find stocks that are exceptionally volatile. Day traders and swing traders aim to spot momentum before it happens. One of the best ways to do this is by using stock scanners to find specific chart patterns that will lead to the best trading opportunities.

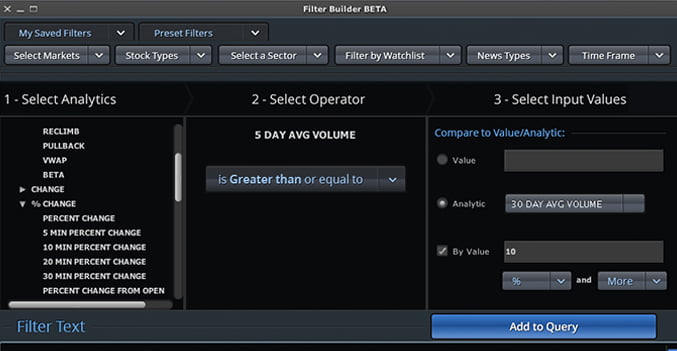

In EquityFeed, you can use the “Filter Builder” module to input a variety of criteria, including price, volume, and technical data. These inputs can be used to filter through thousands of stocks so you can focus on the best trading opportunities.

We’ll be discussing a few Filter Builder settings to get you started. Keep in mind that scanning is just the first step – you still need to review each stock before formulating a game plan.

If you want to follow along, feel free to start your 14-day free trial of EquityFeed.

52-Week High Breakouts

A 52-week high breakout occurs when a stock breaks above its yearly high. This price breakout represents a strong positive sentiment surrounding the stock, which can continue to push the stock price even higher. Naturally, a move likes this attracts the attention of traders and investors who are looking to take advantage of the momentum.

Filters

- Last Price > $10

- $ Volume > $1mm

- Last Price > 52-Week High

Filters Explained

We start with a price filter to remove cheaper stocks that may not attract the same interest as higher priced stocks. Next, we add a volume filter to ensure there is enough interest and liquidity in the stock. Lastly, we add the filter to make sure the price is higher than the 52-week high so we can catch the breakout.

Chart Examples (Click to Enlarge)

Golden Cross Formations

A golden cross is formed when the 50-day simple moving average crosses above the 200-day simple moving average. This signifies an increase in short-term momentum (or a potential trend reversal), which can be ideal for swing traders.

Filters

- Last Price > 200-Day Simple Moving Average

- Last Price > 50-Day Simple Moving Average

- 50-Day Simple Moving Average > 200-Day Simple Moving Average by 1% or Less

Filters Explained

We start by making sure the stock is trading above both the 200-day simple moving average and the 50-day simple moving average. We’re looking for bullish momentum so the golden cross is less significant if the stock is trading below its moving averages. Next, we add a filter to ensure the 50-day moving average is above the 200-day simple moving average by 1% or less. We add the “1% or less” restriction to make sure we aren’t finding the golden cross months after its formation.

Chart Examples (Click to Enlarge)

Active Penny Stocks

Penny stocks can be appealing due to their volatility. Although penny stocks are infamously risky, they can also experience higher volatility than blue chip stocks. For example, it’s generally easier for a $1 stock to run to $1.50 than it is for a $100 stock to run to $150. Of course, many penny stocks are illiquid, meaning they trade on very low volume. Your goal is to find volatile penny stocks with higher volume.

Filters

- Last Price > $0.50

- Last Price < $5.00

- % Change > 5%

- $ Volume > $500k

Filters Explained

We start by setting price filters so we can find cheaper stocks (often referred to as “penny stocks”). We also add a filter to avoid stocks that may be too cheap, however you can remove this if you are familiar with trading these types of stocks. Next, we add the “% Change” filter to ensure there is significant trading activity. We follow that with a “$ Volume” filter to make sure there is enough liquidity to trade the stock.

Chart Examples (Click to Enlarge)

Bottom Bouncers

When a stock is in a longer term downtrend, it will occasionally provide short-term bounces that make for great trading opportunities. These bounces can happen for a variety of reasons ranging from press releases to short squeezes. If you can spot these “bottom bouncers” early on, they can provide great trading opportunities.

Filters

- Day Volume > 10 Day Avg volume by 20% or more

- Last price < 50-Day SMA

- Last Price < 40 Day High

- Last Price > 5 Day High

- Last Price > Day Open

Filters Explained

We start with a volume filter because we are looking for a significant bounce. We want to make sure the stock is trading well above its average trading volume. We add filters to ensure the stock is trading below its “50-Day SMA” and “40-day high,” signifying a downtrend. That said, we are looking for stocks that are bouncing, so we want to make sure the stock is above its 5-day high. Lastly, we want to make sure the stock closed green on the day because we are looking for short-term strength. We accomplish this by adding the “Last Price > Day Open” filter.

Chart Examples (Click to Enlarge)

Gappers

When a stock “gaps up,” it opens above its previous closing price (creating a gap on a candlestick chart). These gaps are generally caused by significant catalysts, such as a press release or earnings release.

Filters

- Last Price > Previous close

- Day Open > Prev. Close by 5% or More

- $ Volume > 1,000,000

Filters Explained

A “gapper” is defined as a stock that opens above its previous close, so we start with that basic filter. We want to make sure the gap is significant so we add filters to make sure the day’s open is at least 5% higher than the previous day’s close. Lastly, we add a filter for dollar volume to make sure the stock is liquid.

Chart Examples (Click to Enlarge)

Overextended Reversals

As you’ve probably learned, not all trading activity is rational. Stocks can experience irrational moves, however the market will usually correct itself over time. For example, when there was an Ebola scare in The United States, many loosely related companies experienced exponential price gains. It was assumed that these companies would profit from an Ebola outbreak, even though there were less than 10 reported cases of the disease. These stocks became overextended and, when the market returned to reason, they lost their gains.

These types of setups can provide great short selling opportunities, but it’s important to wait until the move is over. As mentioned above, the market isn’t always rational.

Filters

- Last Price > 10 Day Low by 40% or More

- 5 Day Average Volume > 30 Day Avg Volume by 20% or More

- Percent Change < -10%

Filters Explained

First things first, we want to find a stock that has experienced a considerable short-term price increase. We do this by adding a filter that finds stocks that are up 40% off their short-term lows. We also want to make sure the recent price increase was fueled by higher volume so we add a filter to find stocks where the 5-day average volume is 20% higher than the 30-day average volume. Lastly, we want to add filters to find stocks that are reversing off of their highs. We do this by adding a filter to find stocks that are down 10% or more.

Chart Examples (Click to Enlarge)

Additional Tips

These 6 scanner setting should help you find better trading opportunities and build better watch lists. Here are a few extra tips you can apply as you start building your scanners:

- Adjust the settings to match your trading style. You can add price and volume filters to find stocks that meet your requirements.

- No scan is going to deliver 100% accurate results. You will need to analyze the results to make sure the scans are delivering the results you want. You can refine your scans by adding new filters to eliminate some of the subpar stocks.

- If you use multiple scans, don’t expect every scan to return ideal trading setups every day. For example, there may not be overextended reversal trades available every day. Use a variety of scans to help you find better trading opportunities.