Screening stocks based on fundamental metrics can be a good way to improve the quality of your scans and complement an existing technical trading strategy. With fundamentals, traders look not just at how a company’s stock is performing, but also how the company itself is performing. That can provide important information about where a company may be headed financially in the future, which has major implications for the future stock price.

Today, we’ll take a look at what fundamental screeners are and the key parameters you should know about. Then we’ll explore some simple fundamental stock screeners using the Scanz Pro Scanner.

What is a Fundamental Stock Screener?

A fundamental stock screen filters stocks based on company data as opposed to stock price data or technical indicators. Fundamentals include things like annual or quarterly revenue, market capitalization, and cash flow. These metrics provide insight into a company’s financial health and its future earnings, which in large part form the basis for a stock’s price.

Key Fundamental Parameters

It’s easy to get into the weeds thinking about company’s cash flow and revenue across specific product lines. But when you zoom out, there are a few essential fundamental parameters that all companies share and that form the basis of a good fundamental screener:

- Market Capitalization – This is the total market value of a company based on all of its outstanding stock. In general, companies with a high market cap are seen to be more stable, while small cap stocks may be more volatile.

- Revenue – Revenue is the total amount of money that a company brings in before expenses. Revenue minus expenses equals profit.

- Cash – The amount of cash that a company has on hand. This cash can be used as a safety net, to pay off liabilities, or to fund a new development or product line.

- Debt – The amount of debt that a company has accrued. Debt is important to many fundamental investors because it is an outstanding liability on a company’s future financial health.

- % Institutions – The percentage of a company’s shares that are owned by institutional investors like banks and large funds. Institutional investors typically invest in ‘safe’ companies, but their money is also less liquid because they need to move such large quantities of shares at a time.

- Shares Short – The number of shares of a company that have been shorted by investors. A higher proportion of shares shorted means that investors believe that the company’s stock price will fall in the near future.

Creating Fundamental Screeners in Scanz

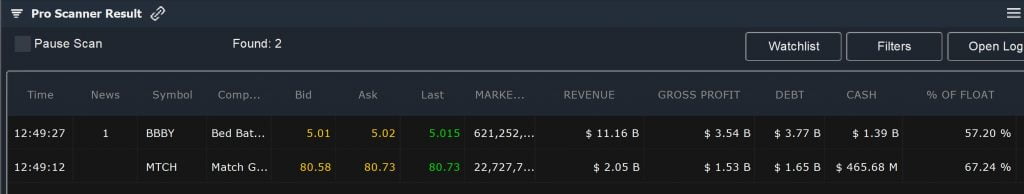

The Pro Scanner in Scanz has a handful of fundamental parameters that you can use to build a custom screen. As examples, let’s look at how you can build a scan for high-performing mid-cap companies and a scan for companies that may be poised for decline in stock price.

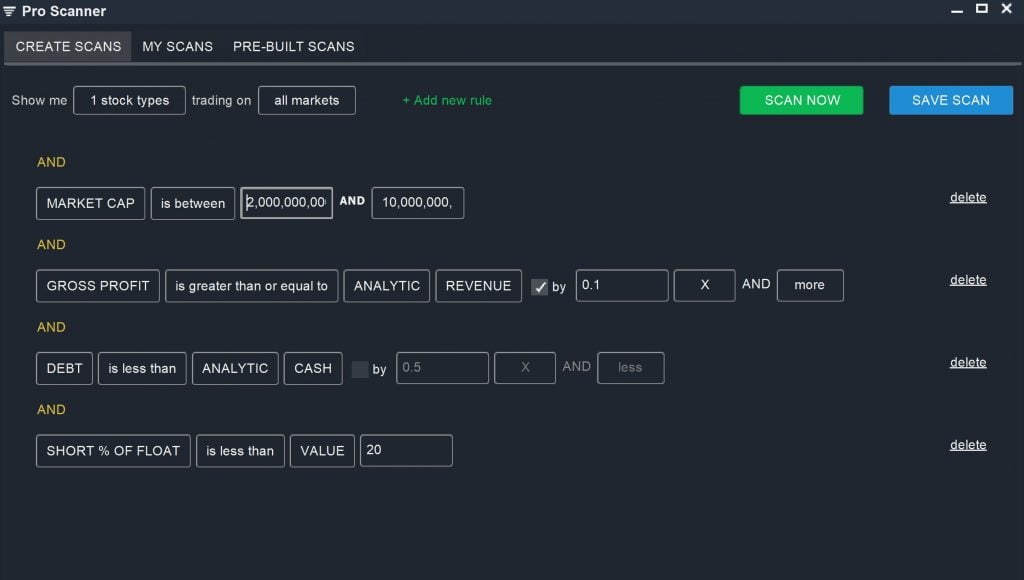

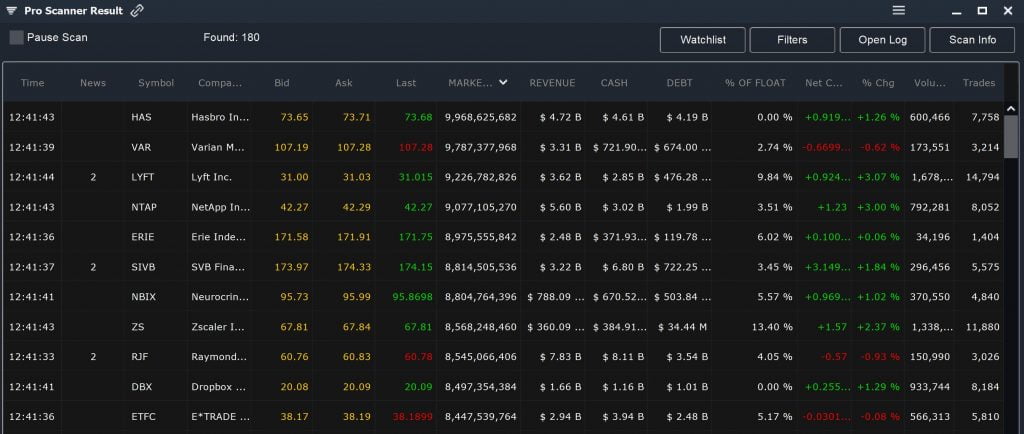

High-performing Mid-caps

To create a scan for high-performing mid-caps, you’ll need to make a few assumptions about what constitutes performance from a fundamental perspective. In this case, we’ll look for companies with profits that are greater than 10% of revenue and with manageable debt that is less than their amount of cash on hand. We’ll also eliminate companies that are being heavily shorted by investors.

MARKET CAP is between 2 Billion AND 10 Billion

AND

GROSS PROFIT is greater than or equal to ANALYTIC REVENUE by 0.1 X AND More

AND

DEBT is less than ANALYTIC CASH

AND

SHORT % OF FLOAT is less than VALUE 20

Poor Performers

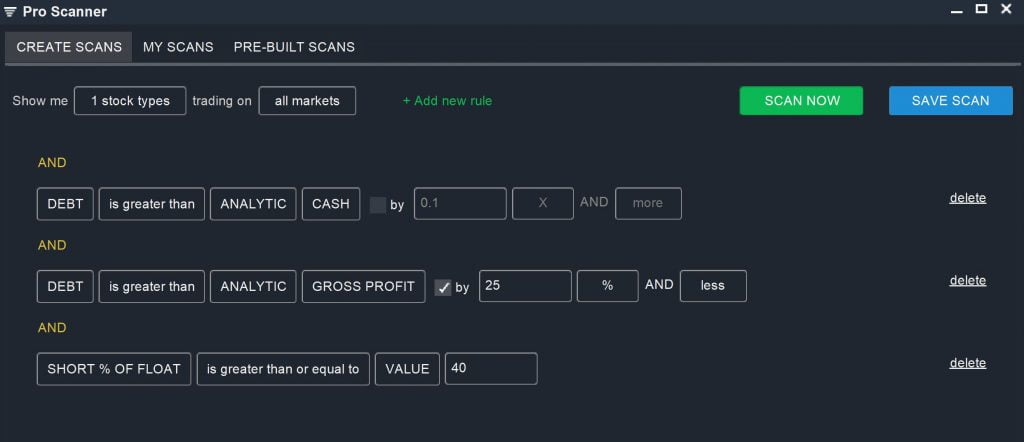

You can also use fundamental screeners to scan for companies whose stock prices don’t accurately reflect their financial hardships. These companies may have mounting debt that is higher than either cash on hand or annual profits. They also likely have high short interest. You can scan for these troubled companies with a few parameters:

DEBT is greater than ANALYTIC CASH

AND

DEBT is greater than ANALYTIC GROSS PROFIT by 25 % AND More

AND

SHORT % OF FLOAT is greater than or equal to VALUE 40

Conclusion

Fundamental screeners are powerful tools in a trader’s arsenal for finding companies that are poised for financial success or trouble. Since a company’s financials have such a significant impact on its stock price, it’s important to always keep one eye on these fundamental metrics.

With the Scanz Pro Scanner, you’re not limited to searching for stocks based on fundamental data. You can integrate fundamental screens with technical screens to get the fullest picture of a stock’s future and eliminate troubled companies from your watchlists.