Stocks that trade on over-the-counter (OTC) exchanges are a prime target for risk-tolerant investors. The penny stocks that trade OTC can be highly volatile, and it’s not uncommon for them to see double-digit gains in a single day.

One of the key elements of trading OTC stocks is volume. Penny stocks can have low liquidity at times, and a flood of investor interest at others. Being able to spot high volume OTC stocks in real time is critical to successfully trading these shares.

In this guide, we’ll take a closer look at why liquidity is essential for trading OTC markets and show you how to find high volume OTC stocks with Scanz.

What are OTC Markets?

Over-the-counter (OTC) markets are electronic stock markets where traders can buy or sell shares without a centralized exchange. Prices are agreed upon directly between two parties, and there isn’t necessarily a lot of transparency about the prices at which transactions are completed.

OTC markets also aren’t subject to many of the strict regulations as major stock exchanges. It’s not uncommon for companies that have shares on OTC markets to limit how much information they share with investors. As a result, stocks trading on OTC markets are considered to be riskier than those trading on the major exchanges.

The Cyclical Nature of OTC Markets

When OTC markets are hot, investors are enticed to move in and buy or sell shares since there’s plenty of liquidity to go around. Once the market starts to cool down, however, investors are incentivized to wait for liquidity to rise again rather than to buy or sell shares at enormous spreads.

This creates a cycle of inactivity punctuated by periods of high trading volume in the penny stock market. It’s not uncommon to see penny stocks trade well above their 10-day average volume for a day or two, only for the volume to fall below its 10-day average for another week immediately afterwards.

The cyclical nature of the OTC markets can be compared to the cyclical nature of hot sectors in bigger markets. For example, green energy stocks may trade at a premium during political discussions of sustainable environmental policies. It’s important to understand broader market themes as they will impact how individual stocks will trade.

Before trading OTC stocks, you should have a good understanding of your trading environment. How is the liquidity? Are individual stocks making big moves? Are stocks breaking out for multiple days or spiking and dropping off? Which sectors are hot?

Importance of Liquidity in Penny Stock Markets

Liquidity is so important in the penny stock market because it plays a huge role in controlling the price of a stock.

As an example, let’s say liquidity is low. In that case, the bid-ask spread for a stock will be quite large. Traders may be forced to pay a premium to buy shares since there aren’t many being sold. At the same time, traders with shares to sell may be forced to sell at a discount since there aren’t many buyers available.

When liquidity is high, on the other hand, the market operates much more efficiently. When there are plenty of buyers and sellers for a stock, the bid-ask spread shrinks – if one seller is asking for an exorbitant price, there are plenty of other sellers that you can buy from to get a better price.

So, the best time to trade OTC markets is when trading volume and liquidity are high. That ensures that you will be able to buy and sell shares relatively smoothly, instead of potentially getting stuck in a position or being forced to sell shares at a discount.

How to Find High Volume OTC Stocks

Finding high volume OTC stocks with Scanz is relatively easy. Let’s take a look at how you can spot hot penny stocks using the Easy Scanner, Breakout Scanner, and Pro Scanner.

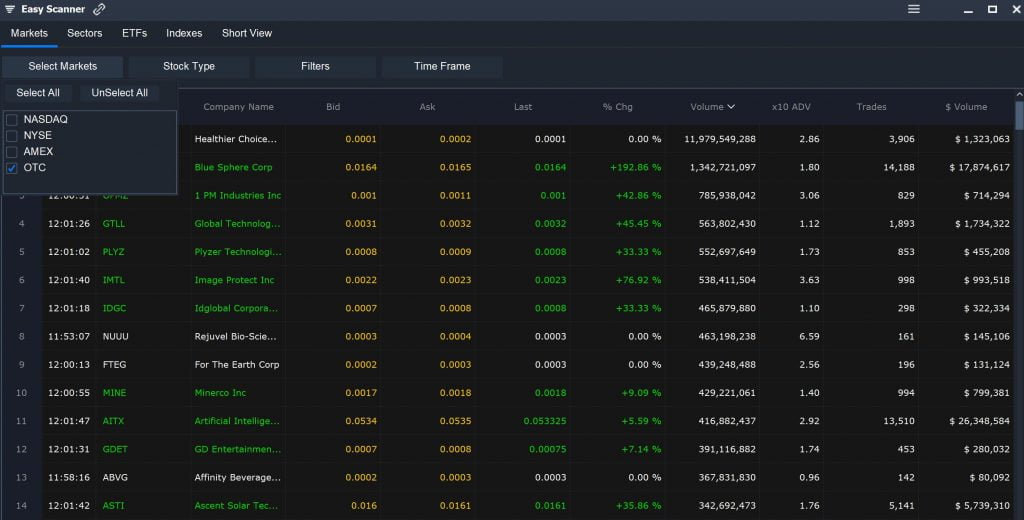

Easy Scanner

The Easy Scanner is a great place to start your search for OTC stocks that are trading with high volume. To get started, filter for OTC stocks using the ‘Select Markets’ menu. Then simply sort the scanner table by Volume, Trades, or $Volume to find the stocks experiencing the most trading activity. You can also add a column showing the average volume to get a sense of how extreme the current trading volume is.

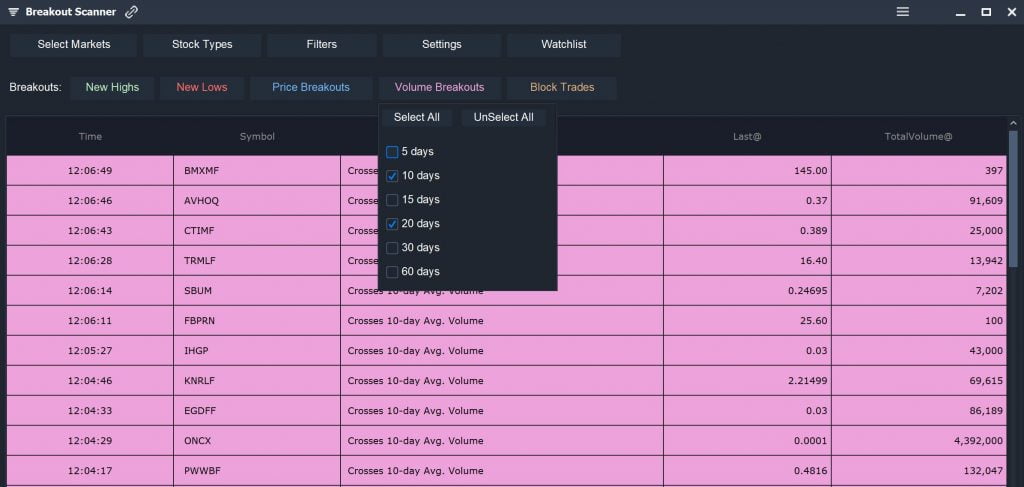

Breakout Scanner

You can also use the Breakout Scanner to quickly spot penny stocks experiencing higher than average trading volume. Choose OTC as your market to scan, then add a volume filter to find stocks that are crossing above a moving average of their daily trading volume. You may also want to add a filter for Current Trades or Current $Volume to eliminate stocks that typically trade with low liquidity.

One nice thing about the Breakout Scanner is that you can also screen for stocks that are crossing above a price moving average. Penny stocks that are experiencing a bullish crossover on above average volume may be particularly good targets for momentum or breakout trading strategies.

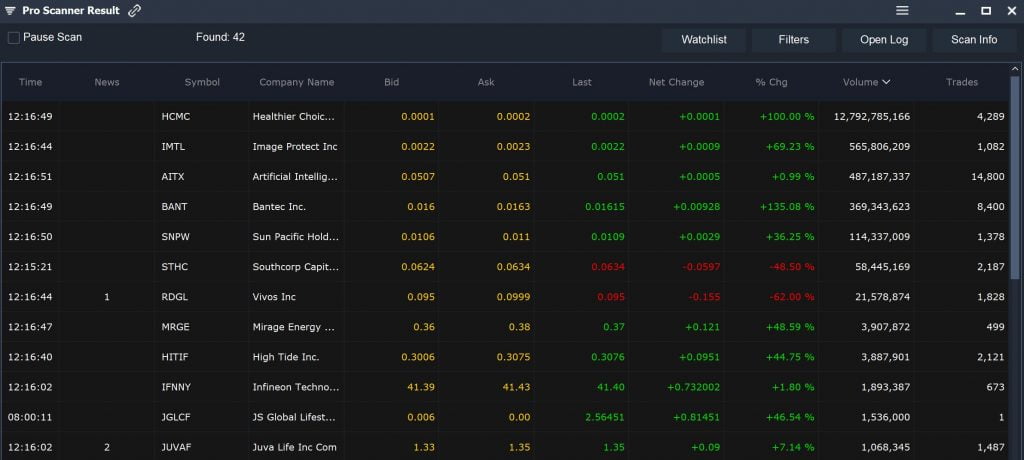

Pro Scanner

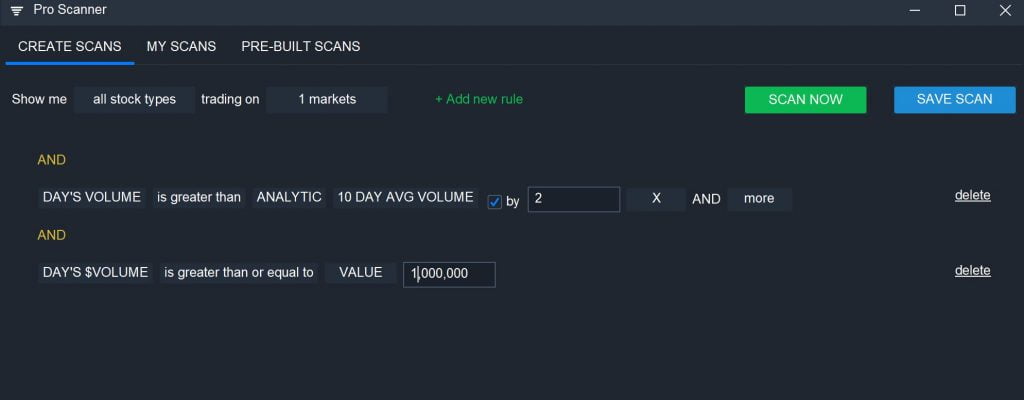

The Pro Scanner offers a way to find high volume OTC stocks with specific trading setups. No matter what setup you’re planning to trade, you can start setting up the Pro Scanner by setting the markets filter to OTC. Then create parameters to find stocks with above average volume. For example:

DAY’S VOLUME is greater than ANALYTIC 10 DAY AVG VOLUME by 2X AND More

AND

DAY’S $VOLUME is greater than or equal to VALUE 1,000,000

The first filter searches for stocks that have volume more than twice their 10-day average volume, while the second eliminates stocks that have less than $1 million in trading activity. You can easily customize these filters to make them more or less stringent, or to prioritize the number of trades over share volume.

These volume parameters can easily be combined with any existing scans you’ve built for the Pro Scanner. For example, if you have saved a momentum stock screener, load it into the Pro Scanner, set the markets filter to OCT, and add volume filters to find high volume, high momentum OTC stocks.

Conclusion

OTC markets are highly volatile and offer a lot of opportunities for traders. Liquidity plays a much larger role in trading stocks on these markets than it does for trading stocks on major exchanges. So, the first step to finding trading opportunities is to screen for volume.

With Scanz, you can use the Easy Scanner, Breakout Scanner, or Pro Scanner to easily find high volume OTC stocks.