It’s universally true that, as the markets evolve, so must our trading. Lately, one trend in particular that you’ll want to take note of is the near elimination of any liquidity in the OTC and Pink Sheets markets.

Liquidity is the friend of the trader – and a lack of it is the enemy.

If you’re trading penny stocks, you’re working with stocks that may not allow you to get in and out at will. Being able to make a profit buying at $0.75 and selling at $0.80 requires the ability to flip the stock quickly. And if the trading volume just isn’t there, you may find yourself stuck holding shares long after your ideal price target has passed (or never arrived!).

Penny stocks were never the most liquid investments to begin with, but recent trends suggest that even the trading volume that was there is tanking. The huge lack of liquidity in the OTC and Pink Sheets markets means that savvy traders need to start looking for the next opportunity – and I’ve got just the thing…

More Stable Trading Opportunities

The potential rewards of penny stocks have always drawn investors who aren’t afraid of a little risk – those who are willing to forego secure fundamentals and SEC filings for the chance of catching a stock’s major runup (or shorting it on the way back down).

And can you blame them? If you’ve got 5,000 shares in a stock trading for $0.75 a share and it suddenly runs to $1.00 on positive news (or hype) with strong volume , you’ve just pocketed a 34% profit ($1250) – something that’s incredibly difficult or even impossible to do when working with larger cap companies on the “real” exchanges.

“Liquidity is the friend of the trader – and a lack of it is the enemy.”

But what if I told you that there’s a way to enjoy these same benefits of these low-priced stocks, while also minimizing the risk of getting caught in a position with low liquidity?

The answer is as simple as how you set the filtering options on your trading platform.

Here’s how to do it in EquityFeed (though you can apply this same process to any other platform, if if offers the necessary options) :

1. First, limit your searches to the NASDAQ, NYSE and AMEX exchanges. Contrary to popular belief, there are plenty of “penny stocks” that can be found trading for less than $5 a share on these more-legitimate exchanges. If you can find them, you’ll take advantage of the added liquidity, tighter spreads and price stability they offer.

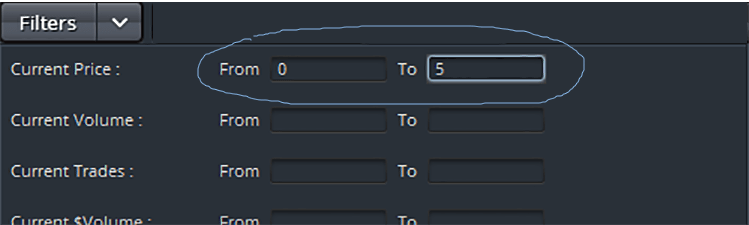

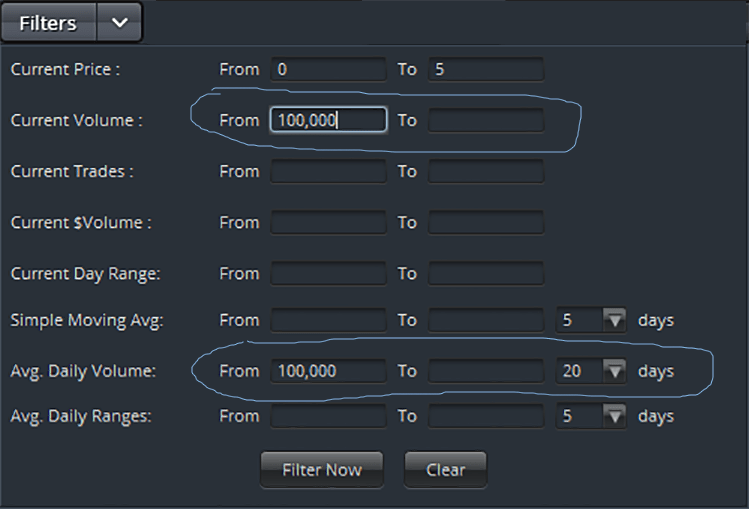

2. Next, search for stocks that trade between $0 and $5.00 a share. If you’re going after the huge returns that come with timing penny stock setups correctly, this threshold will give you the best balance between the size of the position you can take on and the company’s potential for appreciation.

3. Set your liquidity parameters. The specific liqudity range you choose should be informed by your personal trading rules, but for a starting point, consider looking for stocks that have traded at least 100,000 on the current day and at least 100,000 on average per day over the last 20 days (20 ADV).

4. Use your platform’s filtering tools to find stocks with more stable price action. If you’re using EquityFeed, use the “Change” filters to set “Net Change”, “5 Min. Net Change”, “Change from Open” or other parameters to something that’s in-line with your trading rules and preferred risk-reward ratios.

A Sweet Example

Let’s take a look at an example of a stock that these filters would have found. The company ticker symbol is XCO traded on the NYSE, and the chart pictured below comes from Wednesday, March 25th, 2015.

As you can see, the company had really nice, stable price appreciation throughout the last 2 days from about $1.60 to $1.96.

In the image below, you can also see the kind of unmatched volume (offered by the NYSE on such low-priced stocks) that would have allowed you to get into and out of your position with very little liquidity risk:

Overall, the dollar volume and number of trades for this indicate a great pick. Not only would you have been able to enjoy the volatility of a penny stock, but you’d be protected from potential losses due to its exceptional trading volume.

Obviously, I have to include a caveat here… You can’t rely on a trading platform to make all your stock picks for you. A stock could meet all the criteria you’ve set and still not be a good choice, but you’ll only know that if you do your own homework before deciding to take a position. Remember, if a trading platform could map out your trades for you with a 100% success rate, there’d be a lot more millionaire traders in the world.

“There’s a way to enjoy the benefits of penny stocks, while also minimizing the risk of getting caught in a position with low liquidity.”

That said, if you’re tired of the risk that comes along with traditional penny stocks – or if you’ve seen the writing on the wall in terms of vastly decreased liquidity in the OTC and Pink Sheets markets – you don’t have to give up their volatility (and the profit potential that comes along with it) altogether.

Instead, learning to better control the filters used on your trading platform gives you the opportunity to trade up to a better, more stable marketplace, all while maintaining the growth and returns potential you enjoyed as a OTC penny stock trader.

Are you seeing evidence of liquidity changes in the penny stock markets? Share how you’re adjusting to or handling these changes by leaving me a comment below!