Although stock prices get a lot of attention, prices on their own aren’t all that informative. Investors need context about the number of shares and how they’re distributed in order to make trading decisions. This context is known as a stock’s share structure, and it includes a number of different components.

Today, we’ll take a closer look at share structure to show you how you can find it in Scanz and how you can put it to use when trading.

What is a Stock’s Share Structure?

Not every company has the same number of shares or distributes them to investors in the same way. That can have impacts for both a stock’s fundamental valuation and technical price movements.

So, a stock’s share structure is a set of metrics that, taken together, describes how a company’s shares are divvied up and issued to investors. There are several different components to share structure, and investors need to understand how these components work together to influence a stock’s trading patterns and value.

How to Identify a Stock’s Share Structure Using Scanz

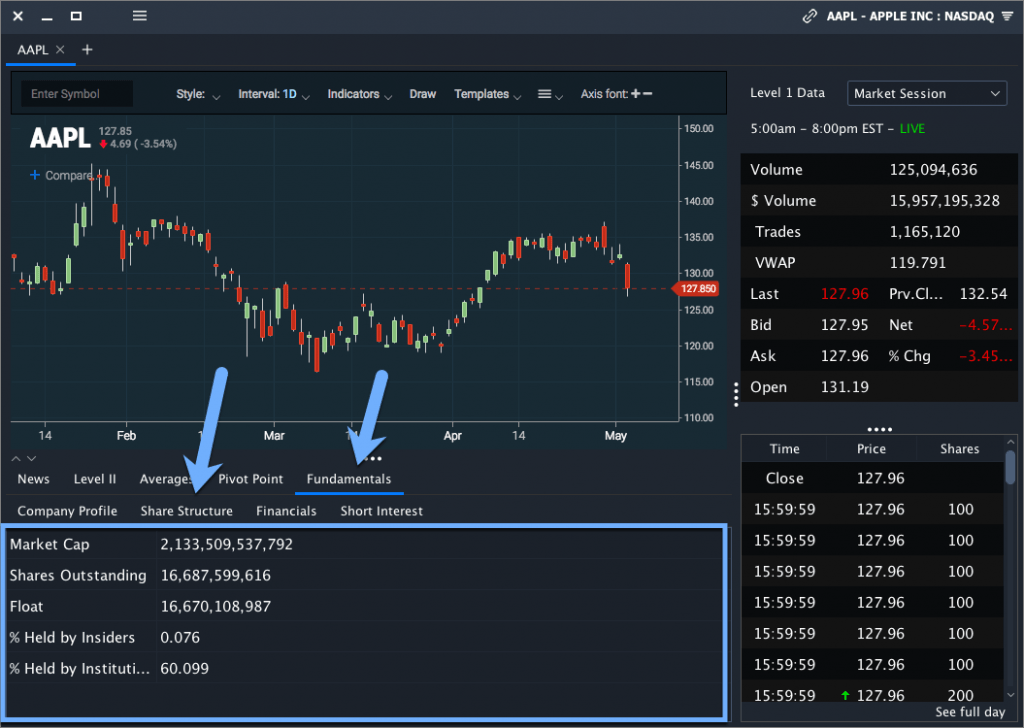

You can find information about a stock’s share structure in Scanz using the Montage module. Search for the stock you want information about, then select the Fundamentals tab and then the Share Structure tab.

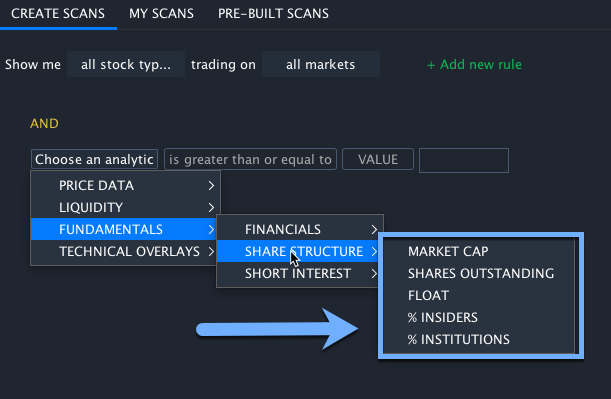

You can also scan for stocks with the Pro Scanner module using filters around share structure. These filters are available under Fundamentals > Share Structure.

If you are using the Easy Scanner, you can sort stocks by share structure components such as market cap and float.

Key Components of a Stock’s Share Structure

Let’s take a closer look at some of the metrics that are commonly used to define a stock’s share structure.

Authorized Shares

A company’s authorized shares is the total number of shares that it can ever issue, as laid out in the company’s articles of incorporation. Many large companies do not have a limit on the number of authorized shares that they can issue, since this could create problems for stock-based compensation or limit future funding options.

Outstanding Shares

The number of outstanding shares a company has is how many shares it has actually released to investors. Outstanding shares includes stock shares issued to early investors, shares released during an IPO or secondary offering, and vested shares that employees or insiders receive as part of stock-based compensation plans. The number of outstanding shares can change over time and is reduced when companies buy back their own stock.

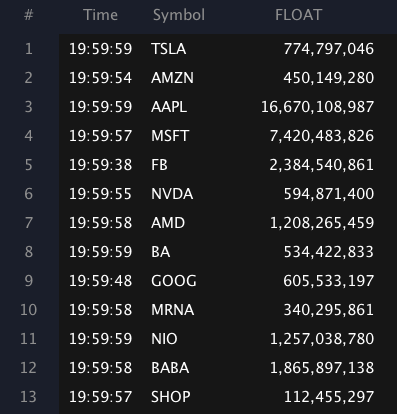

Float

Float is similar to outstanding shares, except it only counts shares that are currently available for investors to trade. A company’s float may be less than its number of outstanding shares if there are restrictions on trading some shares, for example because of a lock-up period after an IPO or because of restrictions on how many shares company insiders can trade.

Market Cap

A company’s market capitalization, or market cap, is the total combined value of all its stock shares. In effect, it’s the total valuation of a publicly traded company. Market cap is calculated simply by multiplying the current share price by the number of outstanding shares.

% Held by Insiders

The percentage of outstanding shares held by company insiders – typically executives and board members – isn’t necessarily part of a company’s share structure. However, shares held by insiders aren’t frequently traded. So, it can be helpful to know if a large portion of a company’s float is tied up in insider-held shares that are largely kept off the market.

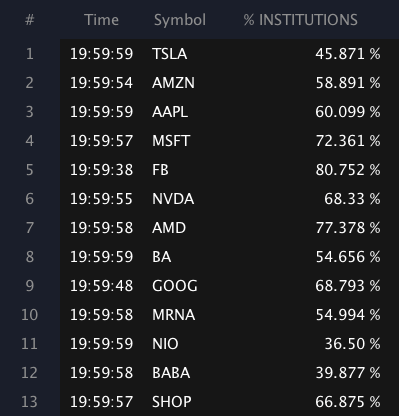

% Held by Institutions

The percentage of outstanding shares held by institutions is important to know about for the same reason as the percent of shares held by insiders. These shares are typically long-term holdings that are kept off the market. So, it the percent held by institutions is high, a stock’s effective float may be lower than its actual float.

What to Consider When Analyzing a Stock’s Share Structure

There are several ways that you can use information about a stock’s share structure to your advantage when trading.

Supply and Demand

First, knowing a stock’s float can be extremely useful. Stock prices fluctuate in response to supply and demand, and float provides information about share supply on the stock market.

If a stock has high float, it will take greater demand – in terms of trading volume – in order for that stock to appreciate in price. Low float stocks, on the other hand, can be very volatile because there are relatively few shares available to buy and sell.

Market Cap

Market cap is one of the most important metrics to look at when considering whether a stock is overvalued or undervalued. The stock price itself doesn’t tell you much, but market cap reflects the current public valuation of a company.

So, you can use market cap to decide whether a company’s current valuation is justified, and from there decide whether an individual share is overvalued or undervalued. Even technical traders should pay attention to market cap since highly overvalued or highly undervalued companies will eventually move back towards a more reasonable market cap.

Increases in Outstanding Shares

Companies can issue new outstanding shares, up to their number of authorized shares, through a secondary offering or employee stock compensation.

Traders should beware of companies that repeatedly issue new shares through secondary offerings. Every increase in the number of outstanding shares dilutes the value of existing shares since there are now more ownership shares of the same company. This kind of repeated dilution can hold a stock’s price back from appreciating.

Conclusion

Understanding a stock’s share structure is important to getting a holistic picture of a stock’s valuation and price movements. While share structure is often used by fundamental investors, it also has implications for technical traders. With Scanz, you can easily find a stock’s share structure and create stock screens using common share structure metrics.