About Fibonacci Retracements Fibonacci retracements are a set of ratios, defined by the mathematically important Fibonacci sequence, that allow traders to identify key levels of support and resistance for stocks. Unlike moving averages, Fibonacci retracements are...

Month: December 2018

A Comprehensive Guide to Bollinger Bands

Bollinger Bands Bollinger Bands, developed by financial analyst John Bollinger, are a technical indicator that account for volatility to indicate when a stock is overbought or oversold. Bollinger Bands describe lines corresponding to twice the standard deviation of...

A Comprehensive Guide to Moving Averages

Moving Averages Moving averages are among the most commonly used indicators in technical analysis and one of the primary indicators that nearly every trader has overlaid when studying a stock’s chart. Moving averages smooth price action to make it easier to visualize...

A Comprehensive Guide to the MACD Indicator

What Is MACD The moving average convergence divergence (MACD) was developed in the 1960s by Gerald Appel and has since become one of the most commonly used indicators thanks to its simple application and interpretation. The MACD compares the differences in two moving...

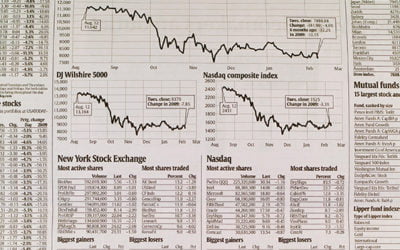

Stock Market News: What to Pay Attention To

Stock Market News Every seasoned investor knows that media news can have an outsized impact on stock prices. The headline effect, as it is known, can affect a single company receiving media attention, an entire sector, or even the entire market in the case of national...