Often times, it’s the little life lessons that have the biggest impact. A simple piece of advice from a friend or family member can have a stronger impact than ten self-help books combined. It’s a lot easier to apply a concept such as “treat others how you’d like to be treated,” than it is to memorize a book on ethics. In order for advice to be beneficial, it needs to be actionable and memorable. The same logic applies to day trading lessons.

Trading is complicated enough as is. You can read a stack of books on trading theory, watch countless YouTube videos, and enroll in premium courses only to find out that nothing is having an effect on your bottom line.

You’ll hear many successful traders attribute their success to a single “aha moment” or words of advice they received from other traders. It’s a lot easier to absorb and apply these “micro-lessons” than it is to take action on a book full of theory. In the spirit of keeping things simple, let’s get right to it.

This post is an ode to simplicity. Hopefully, a few of these ideas will stick!

Here are 25 simple trading lessons that all traders should commit to memory.

1. Learn First, Trade Second

New traders are always excited to jump into action. When you’re putting your hard earned money on the line, it’s important to make sure you’re equipped with a strong foundation. Learn the ins and outs of the market and test yourself with paper trading before entering the big leagues

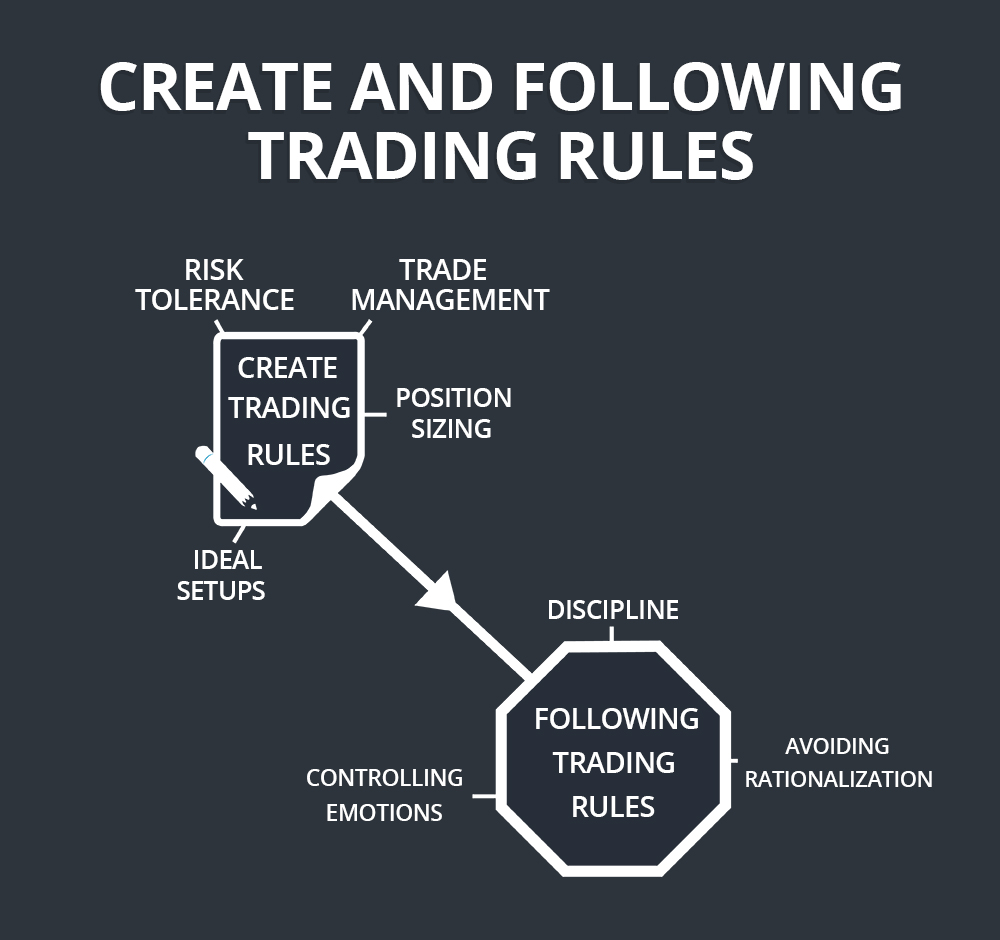

2. Create Trading Rules

Trading rules help you simplify your approach to trading and keep yourself inline. Create trading rules that help you decide which type of trades to pursue and which type of trades to avoid.

3. Follow Your Trading Rules

Creating your trading rules is the first step; following them is the second step. This seems obvious, but this is where many traders get in trouble. Create rules and follow them.

4. Become Self-Sufficient

Many new traders come to the market looking for mentorship and guidance. It’s okay to learn from others but your ultimate goal should be self-sufficiency. Make sure your daily actions are in line with this goal.

5. Keep it Simple

Simplification is a powerful tool for traders. Being able to take complex data and simplify is a skill that will pay dividends for years to come. Focus on keeping things simple in all aspects of trading. This may include your charts, the setups you look for, and the tools you use.

6. Focus on Efficiency

Efficiency and simplicity go hand in hand in the stock market. Efficiency means you are making the most of your time spent so you can be as productive as possible. If you’re staring at the screens eight hours a day to make $50 in profits, you may not be operating as efficiently as possible.

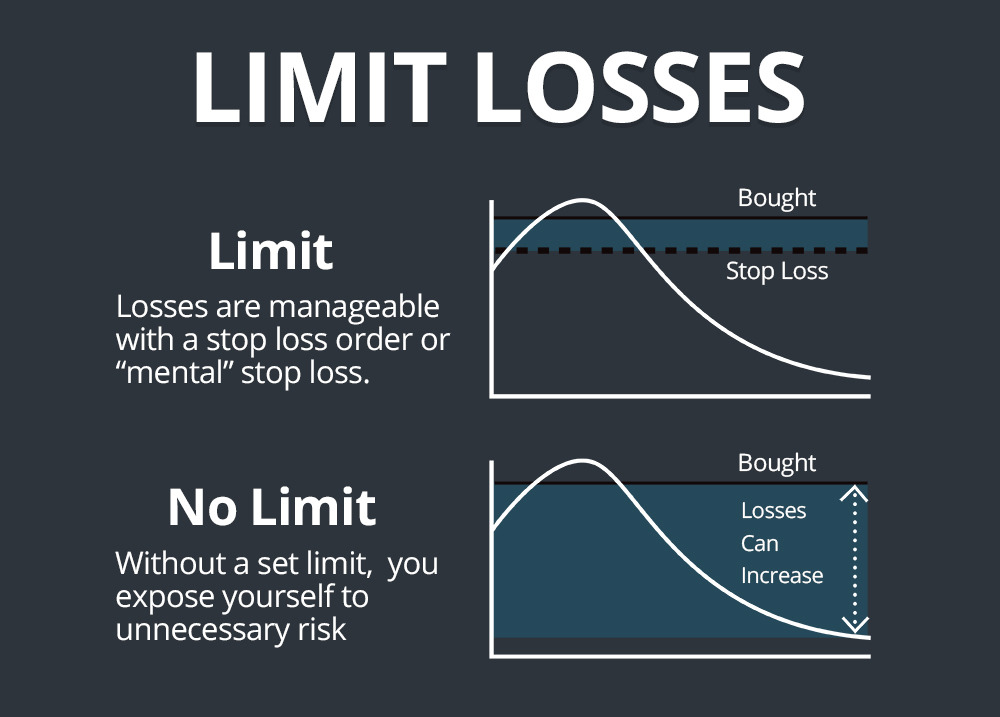

7. Limit Losses

Nobody likes losing. Unfortunately, losing is a part of life and a part of trading. The best traders take their losses and move on. If you keep your losses manageable, you can come away with lessons that will help you improve as a trader. If you let your losses grow, you risk taking yourself out of the game.

8. Learn from Losses

Losses are the cost of doing business as a trader. Fortunately, like any business expense, losses provide something in return. Use your losses as lessons to help you create new trading rules and improve your strategy.

9. Stick to a Niche

Here’s a little secret: no one has mastered the entire market. Successful traders find areas of strength and capitalize on them. Instead of trying to catch every trade, focus on developing a niche and honing in on it.

10. Don’t Get Greedy

Greed is one of the most detrimental emotions in trading (consider it a deadly sin). Like many emotions, greed can cause you to act irrationally. This may cause you to take inflated position sizes or turn a winning trade into a loser. Let your strategy and trade plan guide you and avoid getting greedy.

11. Get Used to Doing Nothing

“Do nothing? What kind of advice as this?”

As counterintuitive as it may seem, sometimes doing nothing is the most strategic move. Day traders are hunting for prime trading setups. If there the setups don’t show, there’s no reason to pull the trigger. Get comfortable with the fact that you may not trade for hours or days at a time.

12. Be Prepared

If you want to make it as a trader, get used to planning everything. You need to come to the market with a game plan every single day. While you cannot account for everything, a proactive approach beats a reactive approach in most cases.

13. Be Patient

Coming to the market prepared is the first step. The next step is remaining patient as you wait for your setups to pan out. Be patient when waiting for setups to form and planning your entries and exits. This will allow you to become a more disciplines (and, ultimately, profitable) trader.

14. Have Realistic Expectations

You’ve probably seen a variety of advertisements for gurus who claim you can make thousands of dollars trading a couple hours a day.

Spoiler alert: it’s not going to happen.

Trading requires hard work and practice. If you come to the market expecting to make millions, you’re going to be disappointed. Set realistic goals and focus on growing at your own pace.

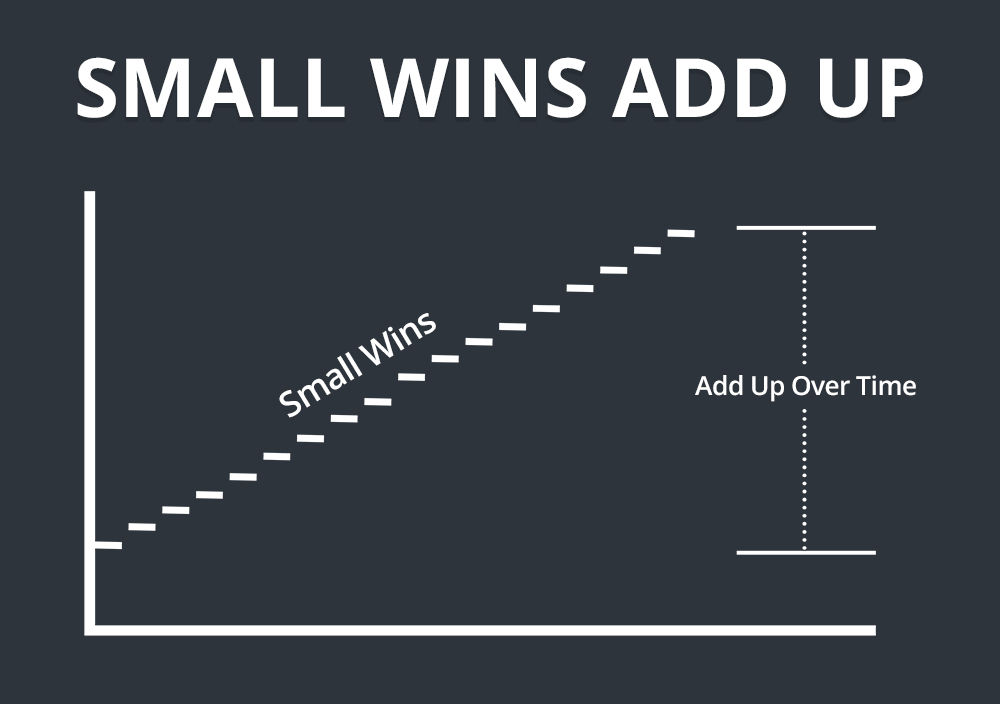

15. Small Wins Add Up

Trading is a strategic long-term game. Like most sports games, it’s the little wins that add up over time. The majority of points scored in most basketball come from 2-point shots. The same strategy should be applied to trading.

Let your wins add up instead of trying to sink a half-court shot.

16. Make Sure You’re Properly Equipped

There are “tools of the trade” in every profession. Make sure you show up to work properly equipped. Traders need access to the right brokers, platforms, and data if they want to be successful.

17. Don’t Trade Under Duress

The “mental game” is a big part of trading. If you’re not in the right frame of mind, consider avoiding the markets. Trading under periods of stress can cause you to make irrational decisions that can cost you in the long run.

18. Avoid Vengeance Trading

There is only one good reason to place a trade: you see a setup and you have a plan. You should never trade because you need money or want to avenge a loss. Many traders get into trouble because they try to make back what they lost on a previous trade. This can cause you to ignore your core strategy and make poor decisions.

19. Assess Your Own Behavior

You’re your own boss as a day trader. Consequently, you may need to play the role of the “boss” from time to time. Analyze your own behaviors and trading patterns and look for areas of improvement. If you’re honest with yourself, this type of introspection and self-awareness can take your trading to the next level.

20. Ignore Hype and Cynicism

Your trades should be based on your plan and your plan alone. It’s easy to get wrapped up in what other people are saying on Twitter, message boards, and CNBC. The fact is, no one has 100% certainty in the markets and if you plan properly, your hypothesis is as valid as any other.

21. Plan for Success

A trade doesn’t end up in the win column until the profits are realized. It’s important to have a game plan for how you will exit trades when they go in your favor. Know when you will take profits and why. This will help you avoid getting greedy and ruining an otherwise successful trade.

22. Plan for Failure

Losses happen. You can’t control a stock’s price action but you can control your own actions. Have a plan for how you will react if a trade goes against you. There are ways to take losses gracefully and there are ways to turn them into disasters. Strive for the former of the two.

23. Adapt

Trading is one of the few activities where you can never reach a pinnacle. There’s a theoretically infinite amount of money that can be made in the market, therefore there’s always room for improvement. Adapt and evolve. Focus on becoming a better trader every day. If market conditions change, adapt. If your strategy isn’t delivering the results you want, evolve.

24. Trading is Not Gambling

This should go without say, however there are still a lot of people out there who believe trading is gambling. They think the market is rigged against them and day traders are as fanatical as gamblers.

When done right, trading is not gambling. That said, it’s your role as a trader to differentiate the two. Do your research, create well-rounded plans, and identify setups with high probabilities for success.

25. Have Fun

As cheesy as it may sound, having fun is conducive to your success as a trader. The leaders in any field actually enjoy their work. You won’t become a top mathematician if you hate math, you won’t become a leading scientist if you despise science, and you won’t become a successful trader unless you enjoy yourself.

Enjoy the ups and downs of the journey, keep your eyes on the prize, and stay persistent.