Efficiency is one of the most important traits of a successful day trader. The word “efficient” is defined as, “achieving maximum productivity with minimum wasted effort or expense.” Time is money, and you want to make the most of it. You want to make sure your trading activity makes the most of both your time and your money.

In trading, efficiency can entail a variety of ranging from a shift in focus to a change in behavior. Your goal is to make the most money with the least amount of work (and stress). Here are some tips to get you started.

1. Scan at Night

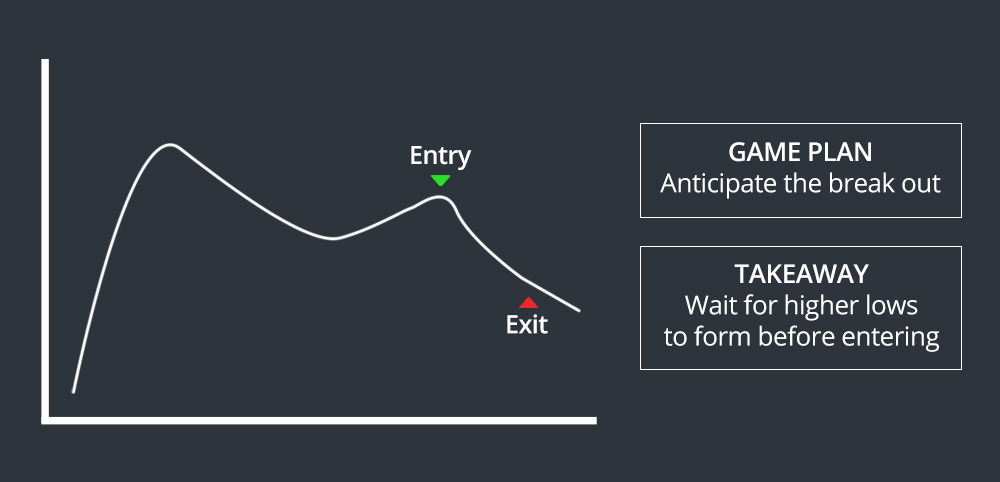

You should come to market every day with a game plan. Don’t expect to flip on your computer screens at 9:30AM and have the trades come to you. You need to scan the night before, create a watch list, and prepare to execute your trading plan the next day.

2. Wake Up Early and Check Pre-Market Data

Waking up early serves two purposes. First, it gives you time to wake up and take care of your morning routine before you start trading. Second, it allows you to analyze pre-market trading activity. You can see how broader markets are performing, check for company news, and analyze pre-market trades. This will help you solidify and/or reformulate the plan you created the night before.

3. Keep your Watch Lists Short

If you’re watching 20+ stocks, you’re going to get overwhelmed. Even the best multi-taskers can’t devote the proper attention to a large watch list. Focus on creating smaller watch lists of 5-10 stocks. As you analyze early morning trading activity, you may be able to narrow this list down to less than 5. This allows you to stay focused and give each trade the attention it deserves.

4. Use Multiple Watch Lists

Many traders create big watch lists because they don’t want to miss out on a trade. If this is the case, you can create multiple watch lists and flip through them. Better yet, you can create watch list scans to alert you of any significant activity from these stocks. You may create separate watch lists based on timeframe, stock price, sector, etc.

5. Limit Your Indicators

Relying on too many indicators will lead to information overload and, ultimately, decision fatigue. You should only be using the indicators that help you make decisions. For example, you may find that the VWAP indicator is helpful for gauging risk, but the 5, 10, and 20-period moving averages are not.

6. Create a Positive Environment

Your physical environment will have an impact on your mindset and, consequently, your trading. While you may not pay much attention to your environment, it can still have subconscious effects. Keep your desk clean, eliminate distractions, and do whatever is necessary to facilitate an environment that is conducive to your trading success.

7. Avoid Distractions

Trading is difficult enough as-is. The last thing you need is to be distracted. Do your best to eliminate distractions. For example, if you know that browsing social media distracts you, stay off of social media sites during trading hours. If you know you have an appointment during the middle of the trading day, consider avoiding trades that you’d need to hold through the appointment.

8. Don’t Overthink Your Trades

It’s important to remember that there is a big difference between planning and overthinking. Planning represents diligence whereas overthinking represents indecision.

Create a plan and do what you said you were going to do. Don’t question your judgment after the fact and don’t try to account for every scenario. Any time you find yourself hesitating, it can usually be attributed to a lack of planning.

9. Take Away Lessons, Not Regrets

Here’s a little trading secret – NO trader has a 100% win rate. Every trader takes losses, regardless of their experience. It’s impossible to be right all of the time. Perfection is an aspiration, not a destination. Allow yourself room for failure.

Instead of regretting your losses, learn to take away a lesson. Regret gets you nowhere, whereas lessons will help you improve your trading.

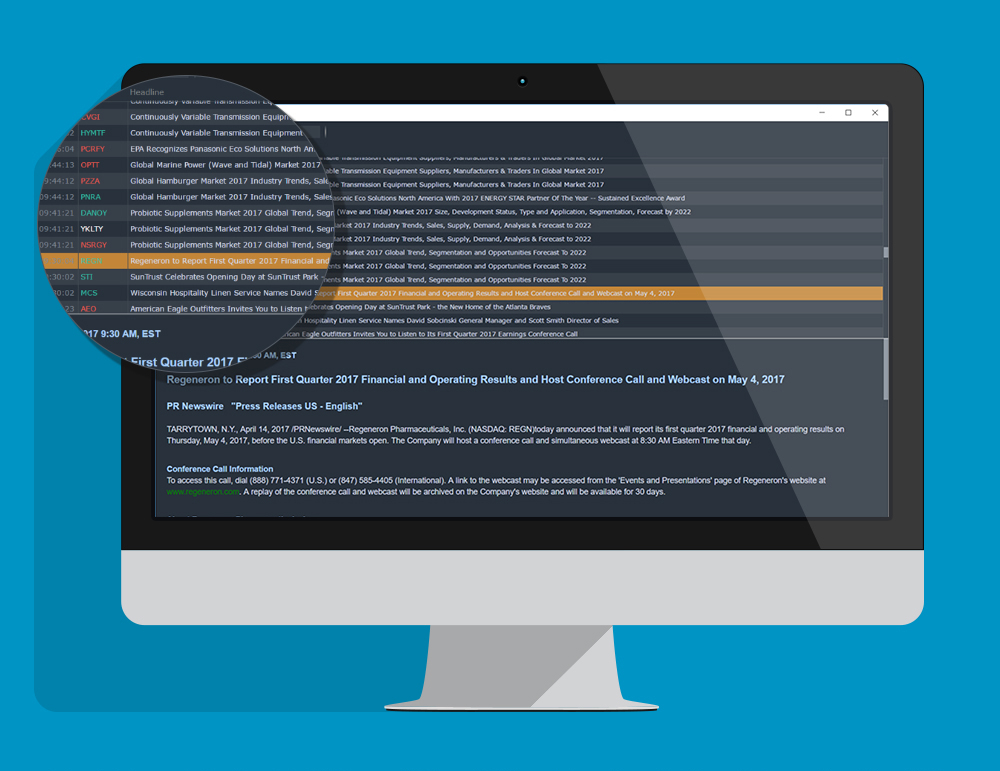

10. Get The Right Tools

Most traders can’t even imagine the thought of trading without their charts and level 2 screens. If you want to give yourself the best shot at trading success, you need to be equipped with the proper tools. Luckily, in this new-age of technology, almost every tool you need is available.

Make sure you have access to quality scanners, charting tools, level 2 platforms, etc.

11. Know Your Limits

When possible, trade within your comfort zone. Leaving your your comfort zone causes you to trade emotionally and irrationally. This isn’t to say you shouldn’t challenge yourself BUT if you constantly find yourself in uncomfortable positions, you need to learn your limits.

Your limits may include certain position sizes, certain sectors, certain trade setups, etc. For example, if you’re not comfortable short selling, focus on long trades. If you are trying to expand your horizons, ease your way in so you can learn a new skillset.

12. Let the Trades Come to You

When you’re staring at a screen for 8+ hours a day, it can be tempting to place a trade just for the sake of remaining active. Considering every trade has the potential for losses, this isn’t your best move. Let the trades come to you. If there are no good setups on a given day, wait for the next day. It’s better to end the day flat than negative.

13. Avoid Averaging Down

One of the worst ways to try to rectify a situation is by repeating the exact behavior that got you into the mess. You can’t fight fire with fire.

Traders often see “averaging down” as a way of hedging their risk and increasing their potential upside. In reality, this is a great way to stack your losses and cause unnecessary damage to your trading account. If a trade goes against you, take the loss and move on.

14. Disconnect from Your Capital

If you want to stand a chance in the world of trading, you need to disconnect from your capital. Think of your capital as numbers instead of money. This helps you make intelligent, rational decisions instead of emotional ones. For example, if you realize that loss you just took was about the price of your rent, you might mishandle your position.

Of course, you also shouldn’t trade with money you can’t afford to lose.

15. Get in the Habit of Doing Research

We live in one of the best eras to be a day trader. The answers to 99% of your questions are at your fingertips. Don’ t know what the MACD indicator is? Google it. Don’t know what a trailing stop loss order is? Google it.

Get in the habit of doing research whenever you are faced with the unknown. Over time, this habit will help you become a more educated and knowledgeable trader. If you learn five new things every week, imagine where you’ll be at the end of the year.

16. Stick to a Niche

Sticking to a niche in the stock market helps you find consistency and improve your profitability. Let’s use a sports analogy to illustrate this concept. Assume you had to take 100 shots on a basketball court. Do you think you would make more shots if you took them all from the same spot or random spots across the court? Clearly, you would make more if you took them all from the same spot. Repetition and focus help you improve your skillset. This same logic applies to day trading.

When you stick to a niche, you narrow your focus, become more familiar with your setups, and learn much faster. Ultimately, this will lead to higher consistency and profitability.