One of the biggest hurdles many day traders face is finding stocks that are primed for quick, profitable trades. In this guide, we’ll show you how to find stocks to day trade in real-time using Scanz.

Factors to Look for When Day Trading Stocks

There are two main things to look for when day trading stocks: liquidity and volatility.

Liquidity is essential for day trading because you need to be able to enter and exit trades quickly. When there are many traders buying and selling shares of a stock and liquidity is high, then this getting in and out of trades is no problem. On the other hand, when liquidity is low, you could find yourself stuck holding shares or unable to enter a position at the price you need to turn a profit.

Volatility refers to the range of a stock’s price within a specified timeframe. Stocks with higher volatility tend to present more trading opportunities due to their broader price ranges. For example, if a stock trades within a 1% price range (i.e. between $10/share and $10.10/share), there are very few trading opportunities. The most you can expect to make from a trade is 1%. If a stock trades within a 10% price range, there are far more trading opportunities.

While there are hundreds of unique setups for traders to focus on every day, most active day traders consider liquidity and volatility to be critical components of any great trading setup.

How to Find Stocks to Day Trade

We’ll break down the process of finding stocks to day trade into three steps:

Step 1: Define Your Goal

The first step for every day trader should be defining your goal. That means getting into specifics like what types of stocks you want to trade, what types of setups you’re looking for, and what risk-reward ratio you’re willing to trade around.

Looking for “stocks to day trade” is too narrow of a goal. You need to start by defining the ideal setup for your personal trading style.

A good day trading goal might, for example, focus on large-cap stocks experiencing a breakout or breakdown. You could also have a goal built around scalping or intraday momentum trading.

Step 2: Identify Your Setups

Once you’ve defined your day trading goal, the next step is to categorize the ideal setups that will help you achieve your goal.

If your goal is to scan for breakout stocks, you’ll need to define the type of breakout you’re looking for: say, a 52-week breakout or a 1-hour volume breakout. If your goal is to find momentum stocks, you’ll need to decide whether momentum is defined based on MACD, moving average crossovers, or something else.

Step 3: Quantify Your Setups

Finally, you need to turn your ideal setups into quantifiable rules that you can use to create stock scans.

In the case of a 52-week breakout, for example, you might quantify the setup by looking for stocks with a last price that is greater than the 52-week high. In the case of intraday momentum trading, you might quantify your setup by looking for stocks with a 10-minute moving average above the 30-minute moving average.

Example: Scanning with the Pro Scanner

Let’s look at some examples of how you can use the Pro Scanner in Scanz to find stocks to day trade.

52-week Breakout

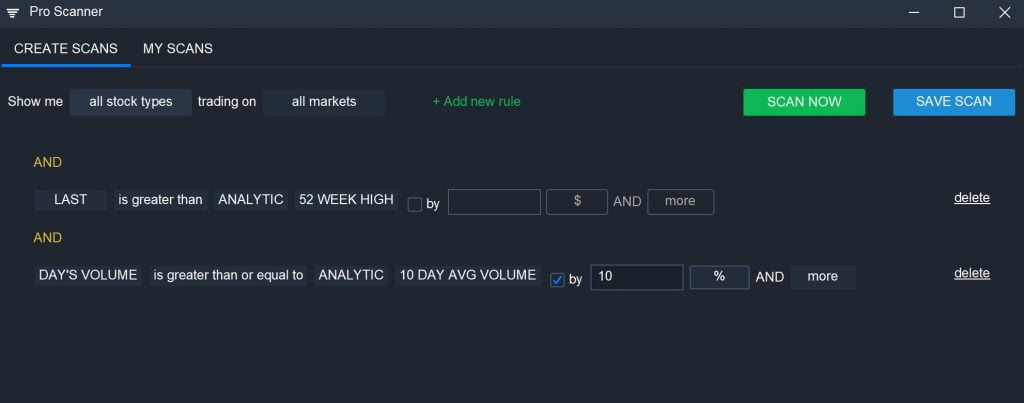

To find 52-week breakout stocks, you can start with a simple scan:

LAST is greater than ANALYTIC 52 WEEK HIGH

That single parameter will find all the stocks that have hit new highs during the current trading session. You can make your scan even more actionable by combining this with a rule to look for stocks trading with above-average volume:

DAY’S VOLUME is greater than 10 DAY AVG VOLUME by 10% AND MORE

Keep in mind that your initial scan doesn’t need to be perfect. Test out a scan, see what setups it returns, and then refine your scan to get closer to your ideal setup. You can also broaden or narrow your scan parameters based on market conditions.

Overbought/Oversold Trading

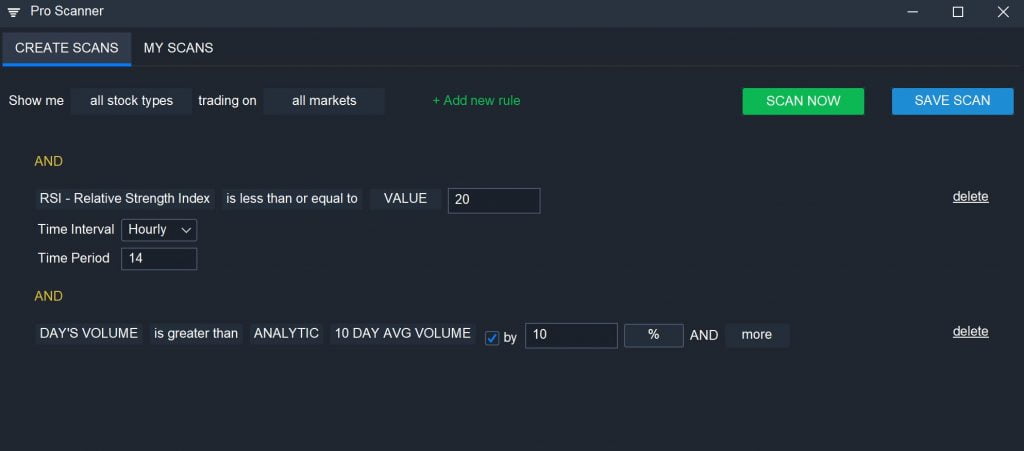

You can also create a simple RSI stock screener to look for stocks that are overbought or oversold on an intraday timeframe. For example:

RSI – Relative Strength Index (Hourly, 14) is less than or equal to VALUE 20

This will find stocks that are severely oversold based on their 1-hour RSI. Once again, you can combine this with a volume scan to find stocks that are oversold and trading with high liquidity.

If you are looking for more scan ideas, here are some guides worth checking out:

- How to Scan for Penny Stocks

- How to Use the Easy Scanner

- How to Build a Relative Volume Scanner

- How to Scan for Breakouts

Conclusion

Finding stocks to day trade is easy with the Scanz Pro Scanner. Simply define your goal, choose your setups, and then build a scan to find setups in real-time. Once you’ve got a scan, don’t be afraid to test and refine it to find even more actionable setups for day trading.