Stock moving averages can be calculated across a wide range of intervals, making them applicable to both long and short-term investment strategies. When navigating the financial markets, traders can choose from a number of tried-and-true strategies. One of the most...

Technical Analysis

4 Key Market Internal Indicators for Day Traders

What are market internals? Market internals give us a peek “under the hood” of the market, if you will. From them we gleam insights into the market’s breadth. The S&P may be up on the day, but the market internals may tell a different story. It may be one sector...

A Comprehensive Guide to the RSI Indicator

What is the Relative Strength Index (RSI)? The relative strength index (RSI) is a straightforward indicator for identifying when an equity has been overbought or oversold following recent price actions. The RSI is widely used by traders for its ease of interpretation...

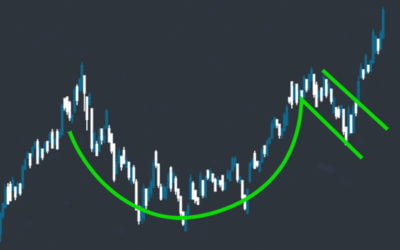

A Comprehensive Guide to Cup and Handle Patterns

The cup and handle pattern was first introduced in 1988 by analyst William O’Neill and has since become a favored chart pattern among traders because it is relatively straightforward to recognize and trade on. The pattern forms during as a result of consolidation a...

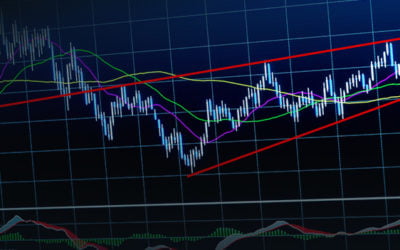

A Comprehensive Guide to Wedge Patterns

Wedge patterns are chart patterns similar to symmetrical triangle patterns in that they feature trading that initially takes place over a wide price range and then narrows in range as trading continues. However, unlike symmetrical triangles, wedge patterns are...

A Comprehensive Guide to Triangle Patterns

Triangle patterns are a chart pattern commonly identified by traders when a stock price’s trading range narrows following an uptrend or downtrend. Unlike other chart patterns, which signal a clear directionality to the forthcoming price movement, triangle patterns can...

A Comprehensive Guide to Stochastics

Stochastics Oscillator The stochastics oscillator, developed by analyst George Lane in the 1950’s, is a momentum indicator used widely by traders to predict reversals in trending stocks. While the stochastics oscillator can be used similarly to MACD, the stochastics...

A Comprehensive Guide to PSAR

PSAR The Parabolic Stop-and-Reverse (PSAR) indicator places a set of dots on a chart in order to highlight whether a stock is trending up or down and to indicate when a price trend breaks ahead of a potential reversal. PSAR was developed by Welles Wilder in 1978 and...

A Comprehensive Guide to Fibonacci Retracements

About Fibonacci Retracements Fibonacci retracements are a set of ratios, defined by the mathematically important Fibonacci sequence, that allow traders to identify key levels of support and resistance for stocks. Unlike moving averages, Fibonacci retracements are...

A Comprehensive Guide to Bollinger Bands

Bollinger Bands Bollinger Bands, developed by financial analyst John Bollinger, are a technical indicator that account for volatility to indicate when a stock is overbought or oversold. Bollinger Bands describe lines corresponding to twice the standard deviation of...