The first step towards any successful trade is finding the RIGHT stock to trade. Your goal is to focus solely on the stocks that provide the best trading opportunities. In order to do this, you need to wade your way through a sea of thousands of stocks. While this may seem like a substantial task, it’s actually quite simple if you’re familiar with the process. That’s where we come in.

Tools like EquityFeed are designed to help you find the right stocks at the right times. Managing your trades is still up to you, but we’re here to give you a head start on other traders.

So, how exactly do you find the best stocks to trade? First things first, you need to define your goals.

What are you looking for?

Defining your trading strategy is another topic for another day. That said, before you find the best stocks to trade, you need to know what you are looking for. This will ensure that your trading tools are customized to your personal needs. Your goal is to find trading setups that fit your trading style. For example, if you swing trade breakouts, you may want to find stocks setting new 30-day highs. If you trade momentum, you may want to find the most active stocks.

A few considerations include:

- What price stocks are you looking to trade?

- Are you looking for bullish or bearish setups?

- Are you planning to swing trade or day trade?

The list goes on and on. For now, create some broad specifications. You can always return later to narrow your focus.

EquityFeed Market View

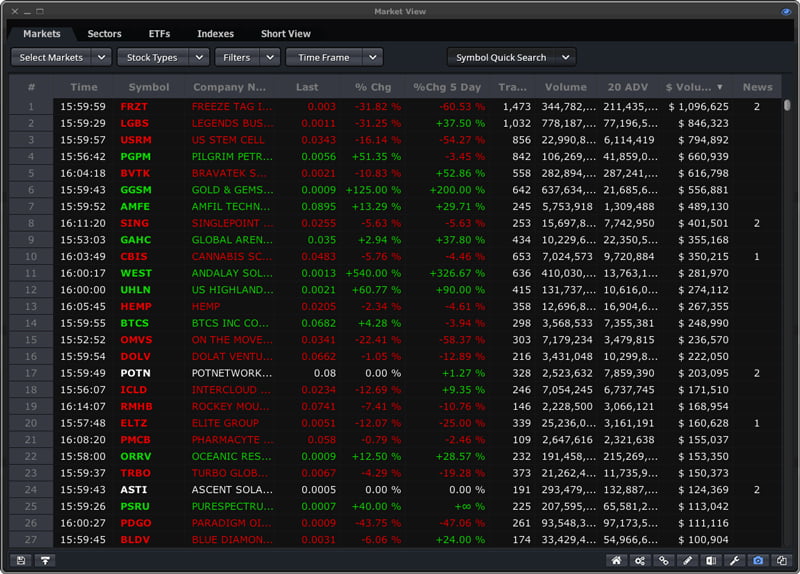

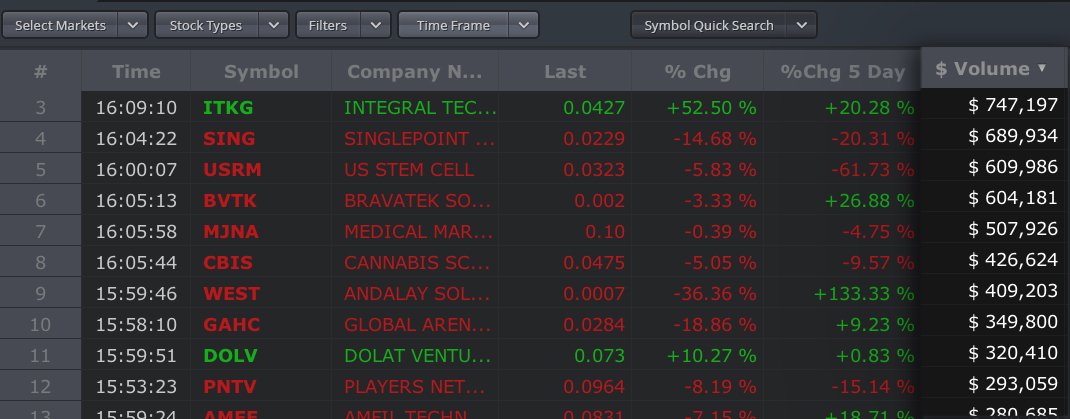

EquityFeed Market View is an incredibly powerful tool that gives you a bird’s eye view of the entire stock market. You can choose which markets you’d like to analyze and filter the stocks using a variety of criteria.

Market View is best for generating broad trading ideas and getting a better understanding of the day’s trading environment. You can see which stocks have the most volume, the most trades, the biggest percent changes, etc. This is particularly beneficial for intraday traders who want to be where the action is.

For example, on June 20, 2017, there were only 6 OTC stocks priced under $0.10/share with over $500,000 trading volume. If you were interested in these types of stocks, you could narrow your focus from an entire market down to 6 stocks.

Here are a few ways to make the most of the Market View module.

Market View Pro Tips

Sorting Penny Stocks – When searching for penny stocks (or cheaper stocks), sort the Market View module by “$ Volume.”

Sorting Momentum Stocks – When looking for momentum plays, sort the Market View module by “Trades.”

News – Pay attention to stocks with news. News catalysts can help fuel a stock’s volatility.

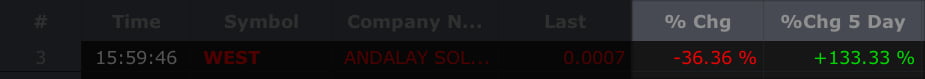

Understand the Phase of the Move – Compare the “% Chg 5 Day” column to the “% Chg” column to see which phase of the move a stock is in. For example, if the “% Chg 5 Day” is +300% and the “% Chg” is -30%, the stock is probably in the backside of the move.

Use Filters Sparingly – In the Market View module, you are better off sorting stocks by column than filtering them. For example, you don’t need to filter stocks based on volume if you are going to use the “$ Volume” column to sort the stocks.

Market View Video Guide

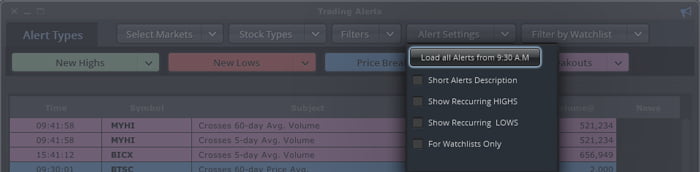

Trading Alerts

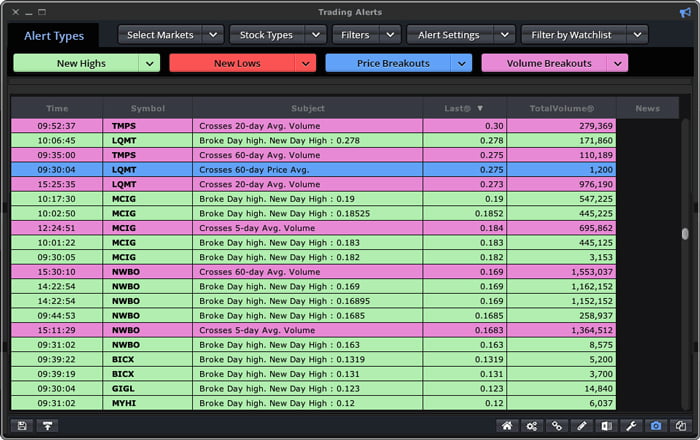

The Trading Alerts module is one of the most powerful tools for intraday traders. This tool gives traders intraday alerts when stocks are making significant moves. Unlike other intraday scanners, EquityFeed’s Trading Alerts module is incredibly easy to set up and focuses solely on actionable trading alerts.

To get started, select a few stock filters (i.e. price, # of trades, etc.) and choose which types of alerts you’d like to receive. Alerts are color-coded so they are easily recognizable during the trading day. Here are some of the alerts you can set up:

- New Highs (Intraday, 5 Day, 10 Day, 20 Day, 40 Days, 26, Days, 52 Weeks)

- New Lows (Intraday, 5 Day, 10 Day, 20 Day, 40 Days, 26, Days, 52 Weeks)

- Price Breakouts (5, 10, 15, 20, 30, or 60 days)

- Volume Breakouts (5, 10, 15, 20, 30, or 60 days)

- Block Trades

These alerts will be streamed in real-time during the trading day. You can also run the scanner after hours to tweak your filters or find stocks to trade the next day.

Trading Alerts Pro Tips

Balance Your Filters – You want to be alerted to significant moves, but you don’t want to overwhelm yourself with alerts.

Avoid Redundant Alerts – Clean up your alerts feed by eliminating similar alerts. For example, a 5-Day Avg. volume breakout and 10-Day Avg. volume breakout may be similar. Eliminate whichever one is delivering lower quality alerts.

Eliminate Irrelevant Alerts – You only want alerts that actually help you generate trade ideas. For example, if block trades don’t affect your trading style, there’s no need to be alerted about them. Keep your alerts relevant to your personal trading style.

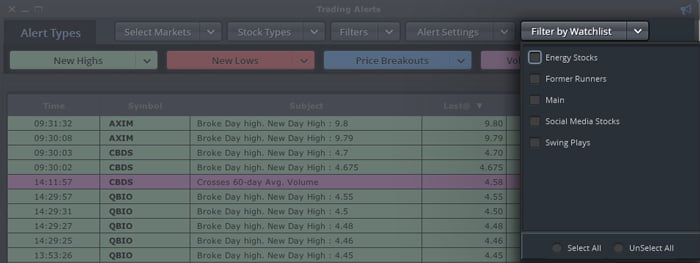

Scan Your Watch Lists – Use the Trading Alerts module to scan your watch lists. This can help you keep identify significant moves in stocks that you follow. You can take this a step further by creating special watch lists just for the Trading Alerts window. You can sort these watch lists by sector, stock type, etc.

Use Multiple Windows – You can have multiple trading alerts windows open at once. Consider segmenting your alerts by market, stock price, trading style, etc.

Keep Track of Stocks with Multiple Alerts – Add the “Count” column. This will tell you how many alerts a stock has triggered. Pay close attention to stocks with a higher amount of alerts.

Trading Alerts Video

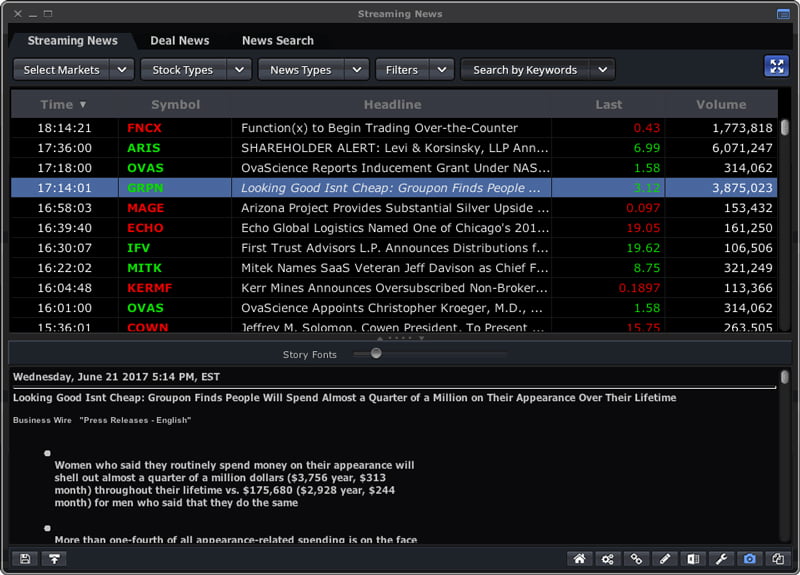

News Streamer

Stocks can experience higher volatility when there is a catalyst in the mix. Often times, this catalyst comes in the form of a press release, SEC filing, or promotion. The EquityFeed News Streamer will alert you to these potential catalysts in real-time.

You can filter news results by markets, stock prices, stock volume, and more. This allows you to find news from stocks that are relevant to your trading style.

The News Streamer is straightforward and easy to use. Simply specify a few filters and the scanner will do the rest for you.

News Streamer Pro Tips:

Use Filters Sparingly – Avoid “over-filtering” stocks. For example, if you filter out stocks with less than 100 trades, you may filter out news that can bring in more volume. Remember, the right catalyst can bring more volume to a stock.

Keep it Relevant – Only stream news types that are relevant to your trading style. If you don’t read through filings, you don’t need real-time alerts for them. Similarly, if you don’t understand the implications of NASDAQ news, avoid scanning that market.

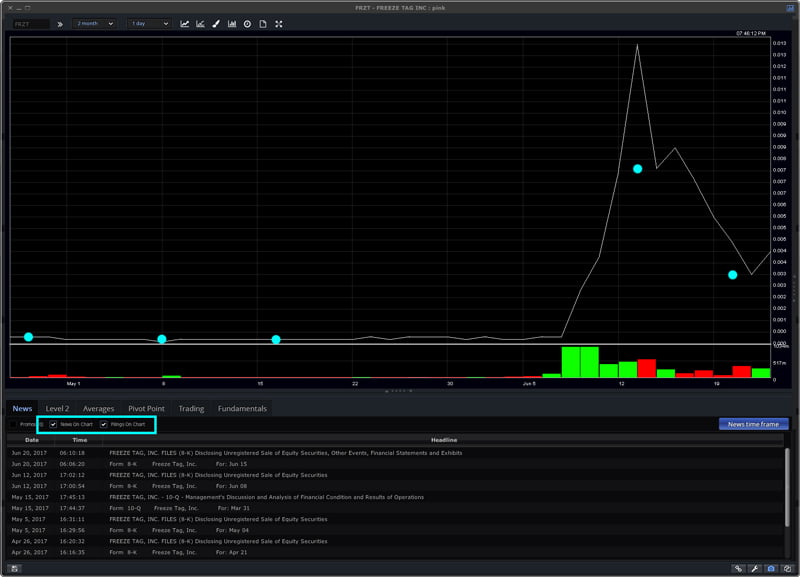

Check a Company’s History – See how a stock reacts to previous news. Here’s how:

- Click on the ticker to open the Chart Montage window.

- Load the news for the past month and select “News on Chart.”

First, it will show you how a stock reacts to news. You may find that the market shows no interest in news surrounding a particular stock. Secondly, it helps you gauge the significance of the news. For example, you may get a news alert for a company that is expecting to close a $100 million deal, yet the stock isn’t moving. If you check on the stock’s previous news, you may find that the company has been talking about this deal for months without any follow through.

News Streamer Video

Filter Builder

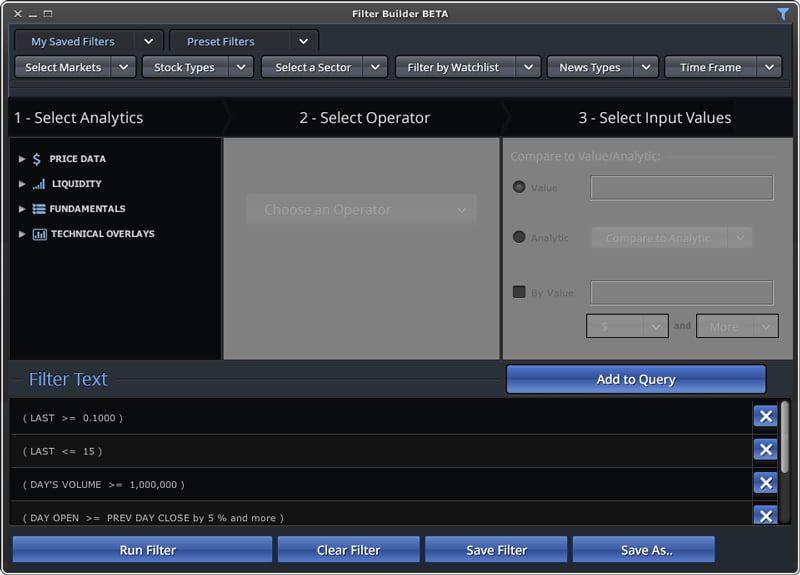

Filter Builder is by far the most powerful scanning tool within the EquityFeed platform. Filter Builder allows you to create scans using almost any filter you can think of. You can include price data, volume data, technical indicators, fundamentals, and more.

The Filter Builder can be used both intraday and after market hours. Intraday scans help you find momentum trading candidates, whereas after hours scans help you build a watch list.

The main benefit of the Filter Builder is that it allows you to find stocks that fit your own personal trading strategy.

Here are some examples of scans you can set up using the Filter Builder:

- Stock breaking out above their 52-week highs

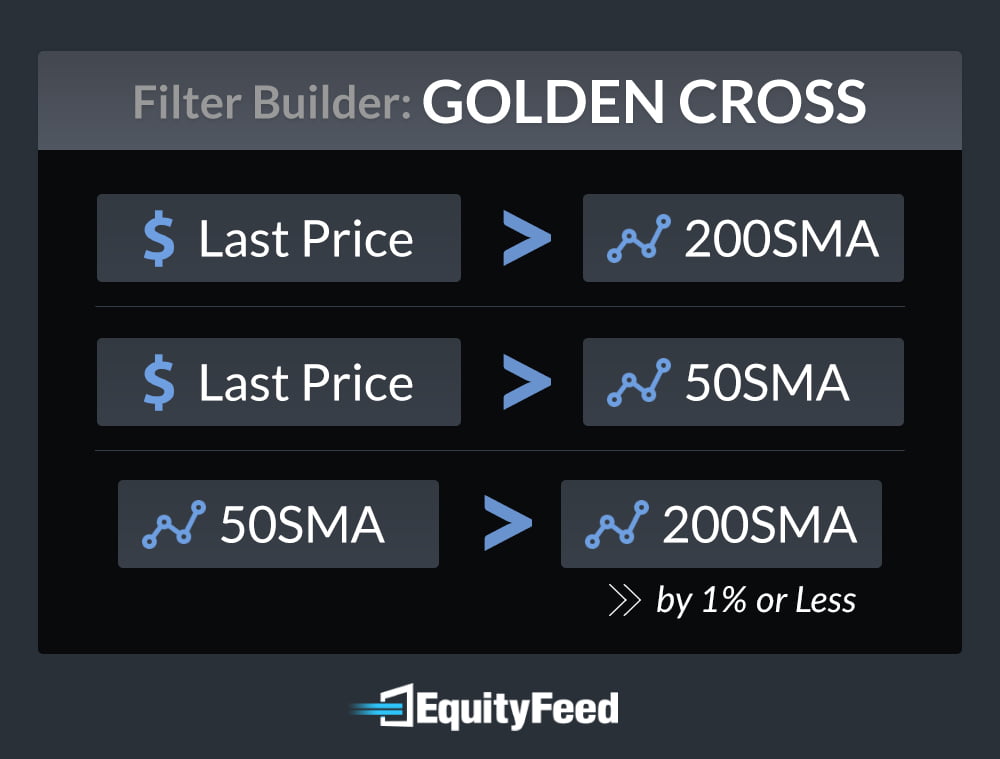

- Stocks crossing over their 200-Day moving averages

- Stocks trading above VWAP with above average volume

- Stocks up over 10% on the day with over 1000 trades

- Stocks reversing out of a long-term downtrend

- Stocks going red after a multi-day price run

The list is endless. Decide what types of stocks you are looking to trade and start building your filter! You can get some tips on building a great scan with the Filter Builder over here.

Filter Builder Pro Tips

Focus on Relevant Filters – Don’t add filters for the sake of adding filters. Focus on filters that are actually relevant to your scan. For example, if a stock’s 5-day avg. volume isn’t important, don’t include it. This seems like a simple concept, but many traders muddy up their scanning criteria by getting too specific.

Get Creative – Certain scans are easy to build while others require some creative thinking. For example, if you wanted to find a stock that is coming out of a short term downtrend, there’s not a simple “reversal” criteria you can use. Instead, you may look for stock’s breaking above their 5-day high with a 10-day moving average that is higher than the 50-day moving average.

Create Multiple Scans – One scan isn’t enough to find all of the top trading setups. If you value simplicity, you may prefer using the Trading Alerts module. If you want to find different types of hidden gems in the stock market, you may need to create multiple scans. Each scan should have a basic goal. For example, one scan may be used to find 52-week price breakouts while another may be used to find parabolic moves.

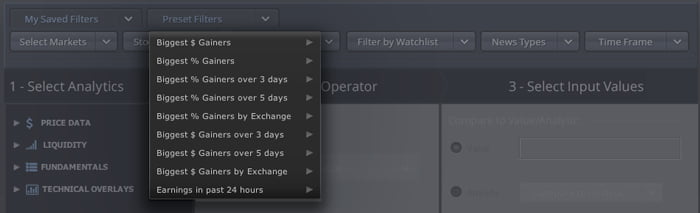

Use Preset Filters – If you are looking for a quick scanning option, consider using the preset filters available in the Filter Builder.

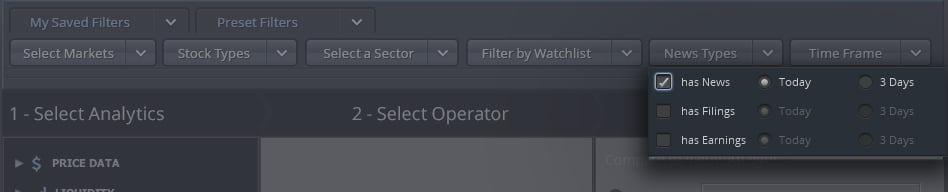

Incorporate News Into Your Scans – We mentioned above that news can act as a catalyst that fuels higher volatility. Why not incorporate this into your scans? The Filter Builder allows you to scan for stocks that had news during the day or during the past 3 days. For example, you could look for stocks that are up over 10% on the day with news.